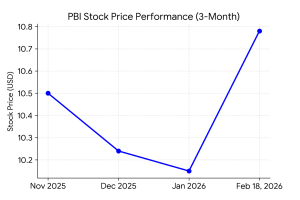

Pitney Bowes Inc. (NYSE: PBI) shares rose 1.89% in Wednesday buying and selling following the discharge of monetary outcomes for the fourth quarter and full yr 2025. Pitney Bowes has a market capitalization of $1.65 billion as of February 18, 2026.

Fourth Quarter Outcomes

Income for the fourth quarter was $478 million, representing a 7% lower in comparison with $516 million within the prior yr interval. GAAP web earnings for the quarter reached $27 million, an enchancment from a web lack of $37 million within the fourth quarter of 2024. Adjusted earnings per share have been $0.45, in comparison with $0.32 in the identical interval a yr earlier.

Section Highlights:

- SendTech Options (Core Mailing): Income for this section was $289.5 million, a lower of seven.4% year-over-year. The decline was attributed to structural shifts within the mailing set up base and product migration.

- Presort Companies: Income on this division was influenced by quantity fluctuations within the third and fourth quarters, with a give attention to labor and transportation productiveness.

- Pitney Bowes Financial institution (Monetary Companies): The section maintained secure finance receivables and credit score high quality, contributing to the general money circulation profile of the group.

Monetary Traits

Full Yr Outcomes Context

For the complete fiscal yr 2025, Pitney Bowes reported income of roughly $1.9 billion. The corporate achieved a web earnings turnaround for the complete yr, a reversal from the web lack of $204 million recorded in fiscal yr 2024. Operational outcomes point out a development towards elevated profitability and streamlined bills following the exit of non-core enterprise traces.

Enterprise & Operations Replace

Pitney Bowes accomplished the wind-down of its World Ecommerce (GEC) reporting section in early 2025. The corporate eliminated roughly $120 million in annualized prices by the tip of 2024 and has elevated its web annualized financial savings goal to a spread of $170 million to $190 million. These initiatives contain workforce rationalization and the simplification of the company organizational construction.

M&A or Strategic Strikes

On August 8, 2024, the corporate initiated a sequence of transactions to facilitate the exit of the World Ecommerce enterprise. This included the sale of a majority curiosity in GEC entities to an affiliate of Hilco Business Industrial, adopted by a Chapter 11 chapter submitting for these entities. The corporate additionally accomplished the sale of its success companies enterprise to Stord in the course of the restructuring interval.

Fairness Analyst Commentary

Institutional protection of Pitney Bowes stays different. Financial institution of America initiated protection on the corporate with an underperform ranking. Residents initiated protection with a market outperform ranking, whereas Goldman Sachs maintains a impartial place. Analysis experiences from these establishments spotlight the corporate’s money circulation era and the continuing influence of cost-reduction applications.

Steering & Outlook

Administration has issued monetary steering for fiscal yr 2026, projecting income between $1.8 billion and $1.9 billion. Adjusted earnings per share are anticipated to vary from $1.40 to $1.60. Components to look at embody the continued stabilization of the SendTech section and the execution of the remaining cost-rationalization targets.

Efficiency Abstract

Pitney Bowes shares moved larger following the fourth-quarter earnings disclosure. The corporate reported a 40% enhance in adjusted earnings per share and a return to constructive GAAP web earnings. Section efficiency stays focused on core mailing and presort companies as the corporate strikes ahead with its restructured steadiness sheet and revised price base.