The BitMine inventory worth has began exhibiting early indicators of restoration. BMNR rose 6% on Feb. 13 earlier than closing and is up 7.32% over the previous 5 days. This rebound comes whilst Ethereum, which BitMine intently tracks as a result of its ETH treasury publicity, has fallen 3.3% over the previous week. This divergence suggests BitMine’s inventory worth could also be attempting to catch up.

- Bear Flag Construction Exhibits Restoration Try — However Breakdown Threat Stays

- Hidden Bearish Divergence Exhibits BMNR Sellers Nonetheless Preserve Management

- Capital Circulation Stays Weak Regardless of Institutional Shopping for

- Value Ranges Now Determine Whether or not BitMine Inventory Value Recovers or Breaks Down

BMNR charts additionally present that this rebound could also be weak regardless of large gamers like Citigroup rising BMNR holdings quarter-on-quarter. The bearish construction remains to be lively, and the following few buying and selling periods might determine whether or not BitMine continues recovering or enters one other main drop.

Bear Flag Construction Exhibits Restoration Try — However Breakdown Threat Stays

The BitMine inventory worth has been buying and selling inside a bear flag sample since early February. A bear flag kinds after a pointy decline, adopted by a brief upward consolidation. This sample typically results in one other drop if patrons fail to completely regain management.

Sponsored

Sponsored

Between Dec. 10, 2025, and Feb. 5, 2026, BitMine’s inventory worth fell almost 60%. This steep drop created the “pole” part of the sample. Since Feb. 5, the inventory has rebounded about 26%, forming a bear “flag” sample, which represents a restoration try.

BitMine’s Bearish Sample: TradingView

Nevertheless, this restoration stays contained in the bearish construction. Until the inventory breaks above key resistance ranges, this rebound might merely be a brief pause earlier than one other decline.

If the bear flag confirms, BitMine’s inventory worth might fall by almost a 60% drop from the decrease trendline breach level. This raises a essential query. If the BitMine inventory worth is recovering, why does the breakdown threat nonetheless stay excessive?

The reply turns into clearer when taking a look at momentum indicators.

Hidden Bearish Divergence Exhibits BMNR Sellers Nonetheless Preserve Management

Momentum evaluation utilizing the Relative Power Index (RSI) exhibits indicators of underlying weak spot. RSI is an indicator that measures shopping for and promoting energy on a scale from 0 to 100. When RSI rises whereas worth struggles, it could possibly sign weakening purchaser energy.

Sponsored

Sponsored

The BitMine inventory worth shaped a hidden bearish divergence between Nov. 18, 2025, and Feb. 9, 2026. Throughout this era, the value created a decrease excessive, whereas RSI shaped the next excessive. This sample usually alerts that sellers stay in management and additional draw back might comply with.

After this divergence appeared, BitMine’s inventory worth dropped by over 14%.

Now, an identical setup seems to be forming once more. RSI has began rising, however the worth nonetheless stays under key resistance close to $21.57. If the inventory fails to interrupt above this degree, one other bearish divergence might verify.

This is able to improve the likelihood of a breakdown from the bear flag sample. Nevertheless, momentum alone doesn’t totally clarify worth path. Capital move information supplies one other vital clue.

Capital Circulation Stays Weak Regardless of Institutional Shopping for

Institutional curiosity in BitMine has elevated considerably. Citigroup raised its possession stake by over 540%, whereas companies like BlackRock and BNY Mellon additionally expanded their publicity. Usually, such shopping for would assist worth development.

Sponsored

Sponsored

🚨 TOM LEE WAS RIGHT

WALL STREET IS BUYING BITMINE

In the identical quarter, a number of Tier-1 establishments materially elevated publicity to BITMINE.

🔹 STIFEL +39%

🔹 CITIGROUP +542%

🔹 BLACKROCK +165%

🔹 BNY MELLON +497%

🔹 MORGAN STANLEY +25%

🔹 CHARLES SCHWAB +59%

🔹 ARK (CATHIE… pic.twitter.com/ThXuo7bxD6

— BMNR Bullz (@BMNRBullz) February 14, 2026

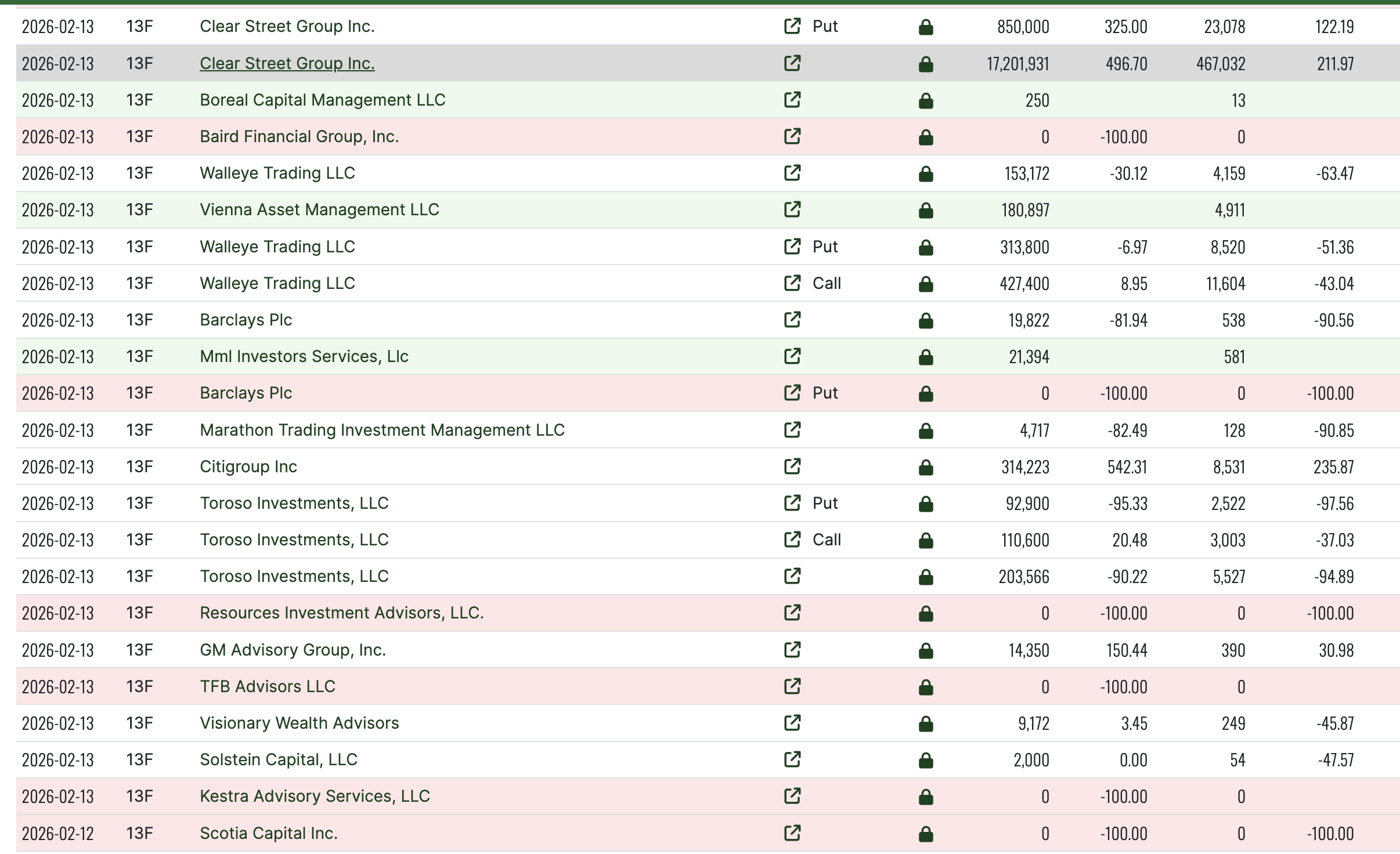

The Fintel snapshot exhibits Citigroup’s addition but additionally highlights a number of BMNR dumps by companies like Baird Monetary, Assets Funding Advisors, and extra, which will be alarming to the value.

The Chaikin Cash Circulation (CMF) indicator exhibits an identical image. CMF measures whether or not giant buyers are placing cash into or taking cash out of an asset. When CMF stays under zero, it alerts that total capital remains to be leaving the asset.

BitMine’s CMF has began rising progressively, exhibiting that promoting stress is slowing. However the indicator stays under the zero line. This implies complete institutional shopping for has not but totally reversed the broader promoting pattern. This creates a battle. Whereas some main companies are rising publicity, total, large-scale cash move stays cautious, as highlighted by the sooner snapshot.

Sponsored

Sponsored

This explains why BitMine’s inventory worth restoration nonetheless seems weak.

Value Ranges Now Determine Whether or not BitMine Inventory Value Recovers or Breaks Down

The BitMine inventory worth now sits at a essential degree. If BMNR breaks above resistance between $21.57 and $21.74, the bearish construction would weaken for now. This might permit the inventory to rise towards $29.60 and probably $34.03, offered ETH additionally positive factors energy.

Such a transfer would verify that patrons have regained management. Nevertheless, draw back threat stays vital.

If the BMNR inventory worth falls under the $20.02 assist degree, the bear flag breakdown might start. This may occasionally push the inventory towards decrease assist ranges at $15.05 and $11.22. A full breakdown might finally ship the inventory towards $8.36.

For now, BitMine’s inventory worth sits at a turning level. Citigroup’s aggressive accumulation exhibits institutional confidence. However bearish momentum and weak capital inflows nonetheless restrict restoration energy.

The subsequent few buying and selling periods will possible determine whether or not Tom Lee’s BMNR follows institutional optimism greater or confirms the bearish breakdown sample.