The time period “SaaSpocalypse” is trending throughout monetary markets, tech media, and investor circles. It refers to a sudden lack of confidence in software-as-a-service (SaaS) corporations after the launch of superior AI brokers able to automating duties historically dealt with by enterprise software program.

Cowork is now accessible on Home windows.

We’re bringing full function parity with MacOS: file entry, multi-step process execution, plugins, and MCP connectors. pic.twitter.com/329DqJz5q5

— Claude (@claudeai) February 10, 2026

Sponsored

Sponsored

AI Brokers Set off Market Panic

The core worry driving the SaaSpocalypse is straightforward: AI brokers can now carry out whole workflows autonomously.

Instruments like Claude Cowork can evaluate contracts, analyze gross sales information, generate studies, and execute multi-step duties throughout a number of functions.

As an alternative of workers utilizing 5 separate SaaS instruments, a single AI agent can full the identical work.

Investing alongside the capital cycle is a structural funding tenet for us, and the message on software program remains to be not nice.

The “SaaSpocalypse” has triggered loads of tactical promoting exhaustion indicators, however the greater image remains to be difficult. Software program’s capital cycle… pic.twitter.com/pA9rTvExTO

— Variant Notion (@VrntPerception) February 17, 2026

This immediately threatens the SaaS pricing mannequin, which usually expenses corporations per person or “seat.” If AI reduces the necessity for human customers, corporations might have fewer licenses. Traders reacted shortly to this threat.

The S&P 500 Software program and Companies Index fell practically 19% in early February, marking its worst dropping streak in years.

Sponsored

Sponsored

On the similar time, capital rotated towards AI infrastructure suppliers reminiscent of Nvidia, Microsoft, and Amazon, which provide the compute energy behind AI brokers.

S&P 500 Software program and Companies Index Worth Chart. Supply: Yahoo Finance

Why the SaaSpocalypse Issues Past Software program

The SaaSpocalypse displays a deeper shift in how software program creates worth. As an alternative of promoting instruments that people function, corporations are starting to promote outcomes delivered by AI.

Analysts now describe this as a transition from software-as-a-service to “AI-as-a-service.” This shift challenges decades-old enterprise fashions and forces software program corporations to rethink pricing, licensing, and product technique.

Sponsored

Sponsored

Nonetheless, this isn’t essentially the tip of SaaS. Many enterprises will nonetheless depend on established platforms for safety, compliance, and information administration.

As an alternative, the disruption will seemingly reshape the business, forcing software program corporations to combine AI deeply into their merchandise.

What a Carnage!

Most of those names are down 50-70% from ATH, with unfavorable 5 yr returns

Wall Road Calls it the “SaaSpocalypse” pic.twitter.com/MwSj5IToni

— Fairness Insights Elite (@EquityInsightss) February 6, 2026

How the SaaSpocalypse Might Influence Crypto Markets

The SaaSpocalypse is already affecting crypto markets not directly. Each crypto and SaaS are thought-about high-growth, risk-sensitive sectors.

Sponsored

Sponsored

When buyers promote software program shares, they usually cut back publicity to crypto as effectively. In early February 2026, Bitcoin fell sharply as software program shares additionally posted heavy losses.

Extra importantly, capital is shifting towards AI. Enterprise capital invested over $200 billion into AI startups in 2025—excess of crypto obtained.

This implies fewer sources could move into new crypto tasks, slowing innovation in some areas.

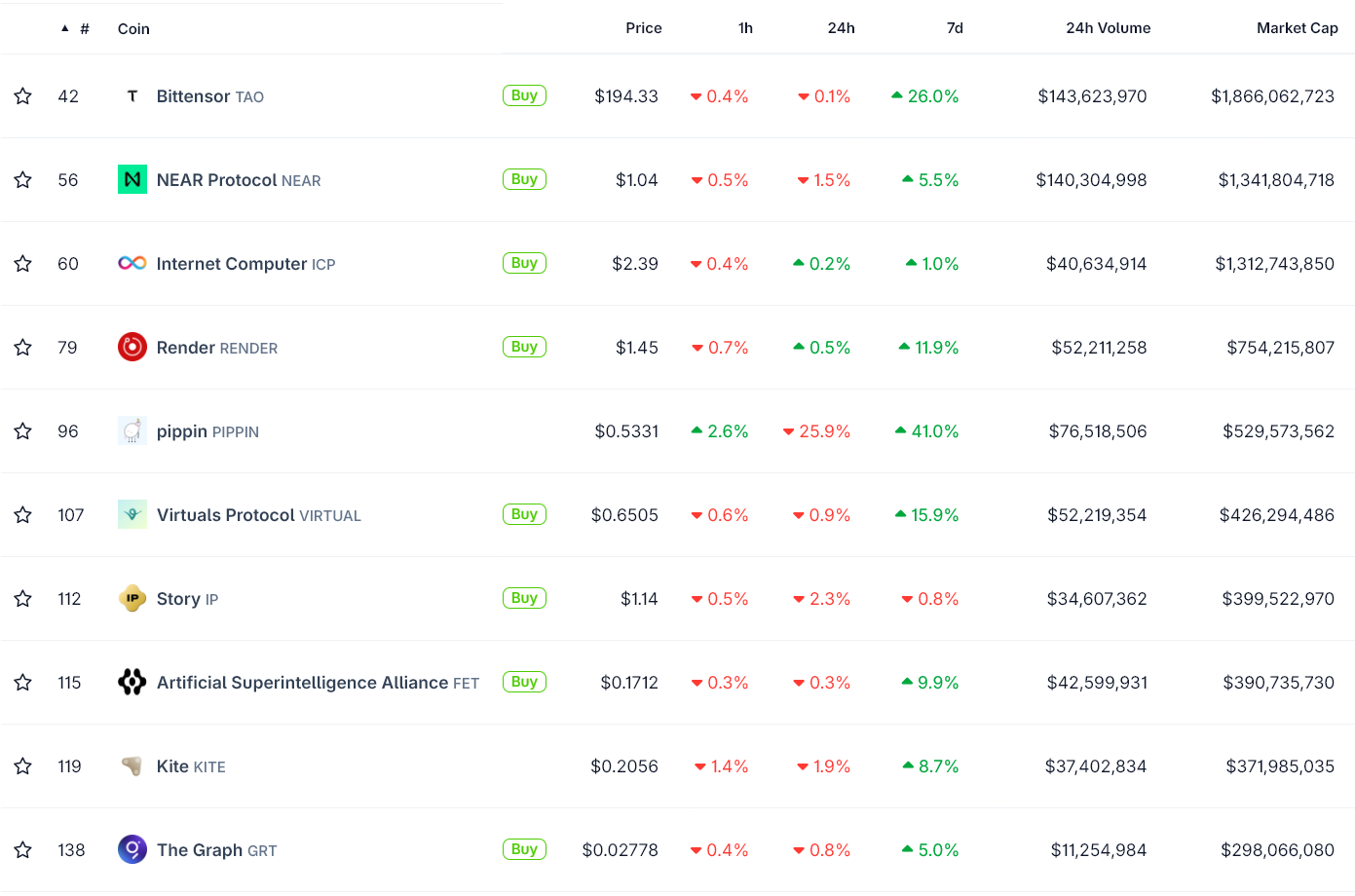

On the similar time, crypto may gain advantage in particular niches reminiscent of decentralized computing and AI infrastructure.

However total, the SaaSpocalypse indicators a significant capital rotation. AI is turning into the dominant funding theme, and crypto markets might want to compete for investor consideration on this new setting.