Picture supply: Getty Photographs

The inventory market generally is a risky place, the place share costs can transfer increased or decrease in dramatic vogue. However it’s extraordinarily uncommon for them to do each in a single day.

That, nonetheless, is what occurred with Gamma Communications (LSE:GAMA) shares yesterday (9 September). That’s fascinating by itself, however the inventory is fascinating for plenty of different causes.

What occurred?

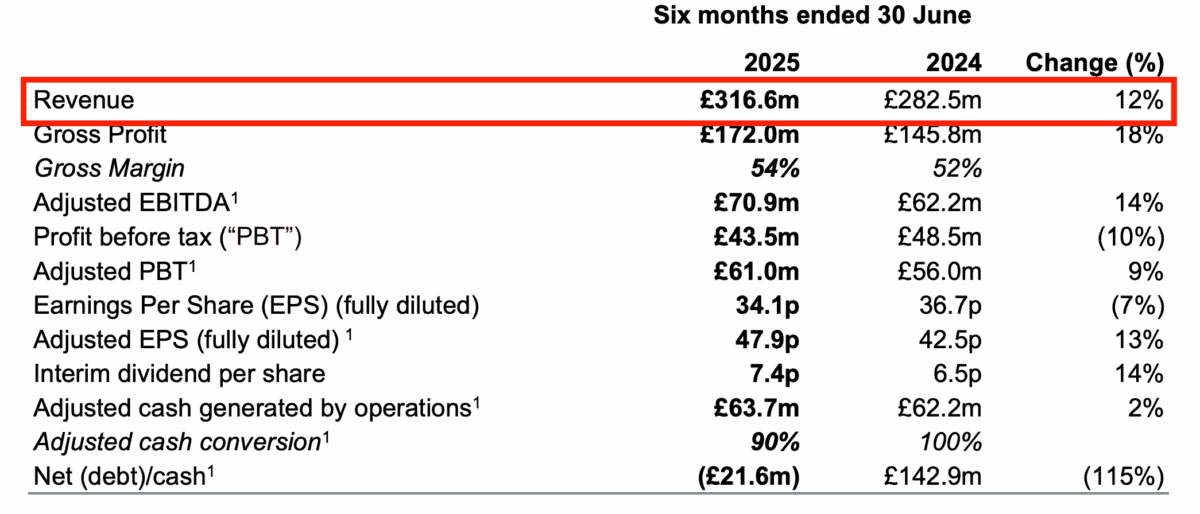

Gamma’s headline numbers definitely look spectacular – revenues have been up 12% and earnings per share grew 13% on an adjusted foundation. However beneath the floor, issues aren’t fairly what they appear.

In each instances, a variety of this was the results of one-off acquisitions within the UK and Germany. These are unlikely to contribute to ongoing development and the image seems very completely different with out them.

Gross sales development from current operations got here in at 1%, pushed solely by will increase in Germany. And revenue development was up 3% on the identical foundation.

Each of those are considerably beneath their headline counterparts they usually arguably give a greater thought of the place development may go from right here. And I believe this explains the inventory market’s response.

Acquisitions

There’s nothing flawed with rising by means of acquisitions. However you’ll be able to solely purchase any enterprise as soon as, which is why it’s necessary to tell apart natural from inorganic development.

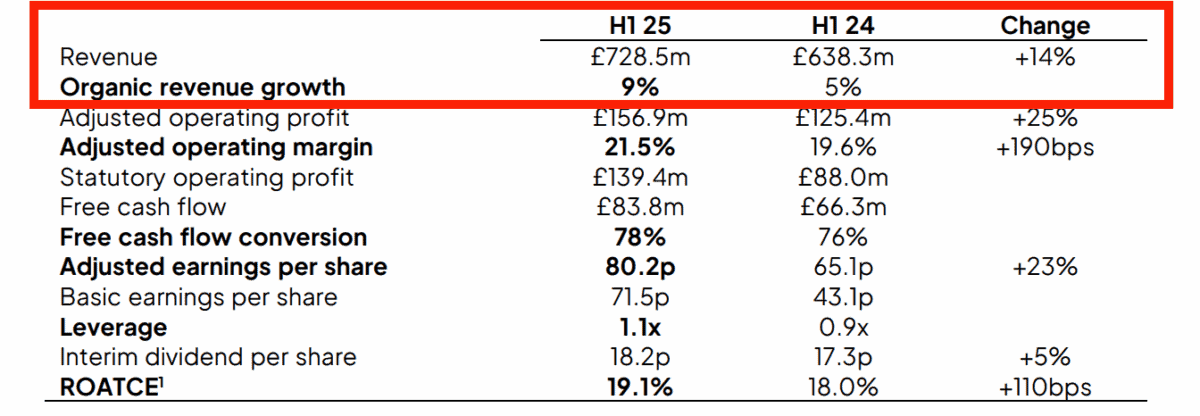

Consequently, serial acquirers like Diploma report complete development and natural development individually on the prime of their stories. That lets buyers see extra clearly how the corporate is doing.

Supply: Diploma Half-12 months Outcomes 2025

Gamma isn’t actually in the identical class, so it didn’t do that in its newest replace. As an alternative, it reported gross sales and earnings (on each a statutory and adjusted foundation) earlier than breaking it down afterward.

Supply: Gamma Communications Half-12 months Outcomes 2025

I think for this reason the inventory jumped then fell. Traders have been initially impressed by the sturdy development earlier than realising it was largely as a result of acquisitions and subsequently one-off in nature.

The place are we now?

Earlier than the newest replace, I used to be taking a look at Gamma as a possible purchase. And after seeing the market’s preliminary response, I believed my probability had gone, so I took my eye off the inventory.

The report is way much less spectacular than its headline numbers counsel. However I believe a great quantity of this is because of a tough buying and selling atmosphere, particularly within the UK.

Gamma’s core product – its cloud-based communications system – is genuinely spectacular. And the agency’s growth into Germany seems prefer it’s progressing fairly nicely.

Primarily based on the agency’s adjusted earnings, the inventory trades at a price-to-earnings (P/E) ratio of 12. I don’t suppose development must be spectacular to generate a great return, so it’s again on my purchase listing.

Ultimate Silly takeaway

There’s a lot buyers can be taught from Gamma’s newest outcomes and the inventory market’s response to them. However there are two issues that basically stand out.

The primary is that understanding companies is essential for buyers interested by shopping for shares. Having the ability to distinguish one-off acquisitions from natural development is significant.

The second is that the inventory market doesn’t at all times get issues proper — at the very least, not at first. And when it doesn’t, there will be alternatives for buyers to reap the benefits of.