Mercer Worldwide (NASDAQ: MERC) Mercer This fall 2025 earnings present the corporate going through pulp market headwinds. The corporate posted This fall revenues of $449.5 million. Additionally, administration made progress on its value financial savings plan. This system goals to chop $100 million in prices by late 2026.

Mercer This fall 2025 Earnings: Income Outcomes

This fall 2025 revenues got here in at $449.5 million. This marks an 8% drop from $488.4 million in This fall 2024. Additionally, the pulp phase introduced in $371.2 million. In the meantime, stable wooden merchandise added $82.7 million. Plus, company actions gave $1.9 million extra.

For full-year 2025, revenues hit $1.868 billion. So, this was 9% under the $2.043 billion in 2024. Nonetheless, administration famous features on a quarter-to-quarter foundation.

Chart: Mercer This fall 2025 Earnings – Quarterly Income Pattern

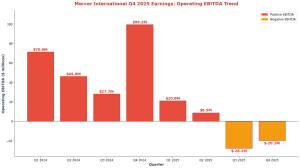

Mercer This fall 2025 Earnings: Working EBITDA Assessment

Working EBITDA in This fall 2025 was unfavorable $20.1 million. However, this beat the unfavorable $28.1 million in Q3 2025. So, the $8 million acquire exhibits progress. For 2025, Working EBITDA was unfavorable $22.0 million. In distinction, 2024 posted optimistic $243.7 million.

The pulp phase had EBITDA of unfavorable $11.3 million. Additionally, stable wooden posted unfavorable $10.8 million. Actually, the hardwood pulp downcycle harm outcomes. Plus, excessive fiber prices in Germany weighed on margins.

Chart: Mercer This fall 2025 Earnings – Working EBITDA Pattern

Price Financial savings Plan On Observe

The “One Goal One Hundred” plan retains shifting. To date, the corporate saved about $30 million in 2025. Thus, the $100 million goal by finish of 2026 stays on observe. Additionally, these financial savings will assist in future market cycles. Plus, extra value cuts are being discovered.

Mass Timber Features Momentum

The mass timber enterprise retains rising. Actually, the order e-book reached $163 million. This consists of initiatives in Germany and North America. Now, the Spokane plant goals to open within the first half of 2026. So, capability will rise as soon as it begins up.

In the meantime, mass timber gives a progress path. Additionally, inexperienced constructing traits enhance long-term demand. Thus, this enterprise provides range.

Money Place Stays Stable

Money stood at $186.8 million at year-end. Additionally, complete money readily available was about $430 million. Actually, money movement rose by $76 million from Q3. So, the corporate has room to function. Plus, debt funds are unfold out nicely.

Non-Money Prices Recorded

This fall 2025 had $238.7 million in non-cash prices. Of this, $174.0 million was for Peace River pulp. Additionally, $64.7 million was for Celgar pulp mill property. So, these prices mirror market circumstances. However, they don’t have an effect on money.

Internet loss for This fall 2025 was $308.7 million. With out prices, the loss was a lot smaller. For 2025, web loss totaled $497.9 million.

Market Outlook

Hardwood pulp markets are in a down cycle. However, provide traits trace at stability forward. Additionally, packaging demand stays intact. Plus, tissue markets present endurance. So, a market upturn helps future outcomes.

In Germany, fiber prices keep excessive attributable to guidelines. Nonetheless, value cuts tackle these headwinds. General, the cycle place ought to enhance.

For extra particulars, see the Mercer Worldwide This fall 2025 earnings press launch on the corporate’s investor relations web page. Additionally go to Yahoo Finance MERC for inventory information.

Click on Right here to go to the AlphaStreet web site.