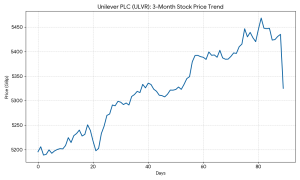

Unilever PLC Shares Rise as This fall and Full-Yr 2025 Outcomes Are Launched

Unilever PLC (UL) shares closed at 5,325.00p on Thursday, marking an intraday improve of 1.45 p.c from the earlier shut.

The corporate’s market capitalization reached £116.24 billion ($150.1 billion) on the conclusion of at present’s buying and selling on the London Inventory Trade.

Newest Quarterly and Full-Yr Outcomes

For the fourth quarter and full 12 months ended December 31, 2025, Unilever reported underlying gross sales progress of 3.9 p.c for the quarter and 3.5 p.c for the complete 12 months. Annual turnover for 2025 was recorded at €60.1 billion, in comparison with €60.8 billion in 2024, reflecting the affect of enterprise disposals. Underlying working revenue for the complete 12 months stood at €12.1 billion, with an underlying working margin of 20.0 p.c, representing a 65-basis level enchancment over the prior 12 months.

Section efficiency (Underlying Gross sales Development) for the ultimate quarter is as follows:

- Magnificence & Wellbeing: 5.1 p.c

- Private Care: 4.1 p.c

- Dwelling Care: 3.1 p.c

- Vitamin (previously Meals): 3.4 p.c

- Ice Cream: 3.7 p.c (reported as a separate group previous to demerger completion)

FINANCIAL TRENDS

Full-Yr 2025 Outcomes Context

Unilever’s full-year 2025 outcomes present a directional development towards margin growth and volume-led progress. Underlying quantity progress for the 12 months was 1.5 p.c, whereas value progress accounted for 2.0 p.c. The corporate accomplished its €1.5 billion share buyback program throughout the first half of the 12 months. The transition to a extra targeted portfolio is evidenced by the expansion of “Power Brands,” which now account for about 78 p.c of group turnover.

Enterprise & Operations Replace

Unilever has accomplished the formal demerger of its Ice Cream enterprise, which has begun buying and selling as a separate entity. The corporate additionally introduced the sale of its Dwelling Care enterprise in Colombia and Ecuador to Alicorp and the divestment of the Graze model to Katjes Worldwide. To reinforce inner capabilities, Unilever invested £80 million in a brand new perfume facility within the UK. Moreover, the corporate appointed Srinivas Phatak as the brand new Chief Monetary Officer.

M&A or Strategic Strikes

The corporate confirmed an annual M&A finances of roughly €1.5 billion, with a main strategic deal with the US market. Current transactions embrace the acquisition of the lads’s private care model Dr. Squatch. Moreover, the subsidiary Hindustan Unilever Restricted (HUL) introduced the complete acquisition of the wellness model OZiva, whereas concurrently exiting its three way partnership in Nutritionalab (Wellbeing Vitamin).

Steering & Outlook

For the fiscal 12 months 2026, Unilever administration expects underlying gross sales progress to be throughout the multi-year goal vary of 4 p.c to six p.c. Components to observe embrace the combination of current acquisitions within the Magnificence and Wellbeing phase and the affect of continued portfolio rationalization. The corporate anticipates a modest enchancment in underlying working margin as productiveness packages proceed to ship value financial savings.

Efficiency Abstract

Unilever PLC shares rose 1.45 p.c following the announcement of full-year 2025 outcomes. Underlying gross sales grew by 3.5 p.c for the 12 months, supported by a 20.0 p.c working margin. Strategic strikes in 2025 included the Ice Cream demerger and a deal with premium Energy Manufacturers, whereas 2026 steering factors to sustained gross sales progress throughout the 4-6 p.c vary.