World markets staged a broad rebound on February 6 after a pointy sell-off the day prior to this pushed shares, crypto, and commodities into deeply oversold territory. Bitcoin recovered to round $70,000, whereas US equities, gold, and silver additionally superior, pushed by technical shopping for and easing near-term macro fears.

The restoration adopted a violent deleveraging part slightly than a shift in fundamentals.

Sponsored

Sponsored

Technical Ranges Sparked The Preliminary Bounce

The rebound started after key technical ranges held throughout asset courses. The S&P 500 touched its 100-day shifting common, a degree carefully watched by systematic and discretionary merchants.

That triggered mechanical shopping for from funds rebalancing threat publicity after a number of periods of heavy promoting.

S&P 500 Chart. Supply: Google Finance

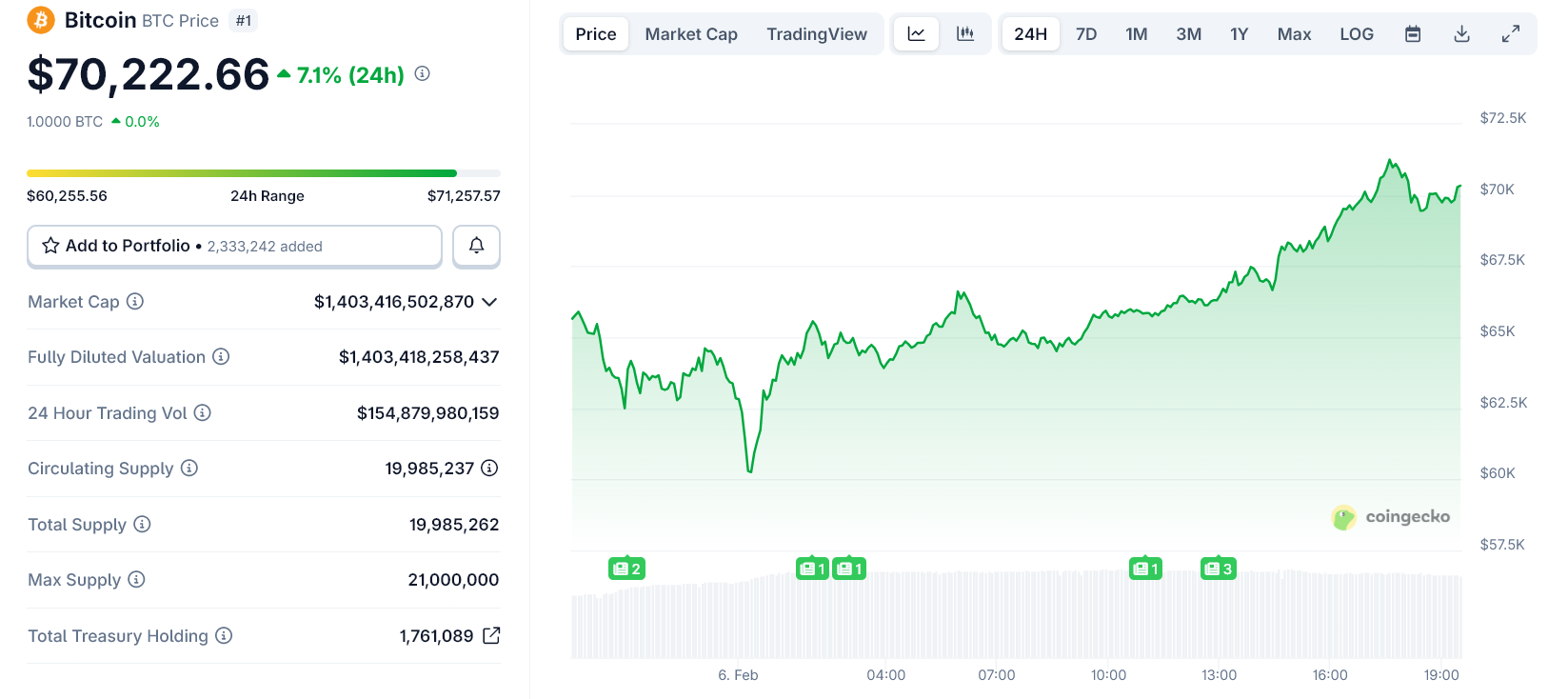

Bitcoin adopted an analogous sample. After briefly falling to $60,000, the asset rebounded sharply as pressured liquidations slowed and funding charges stabilized.

The absence of recent liquidation stress allowed spot patrons to step in, supporting a short-term restoration.

Positioning Reset Diminished Promoting Strain

The earlier sell-off had flushed leverage throughout markets.

Sponsored

Sponsored

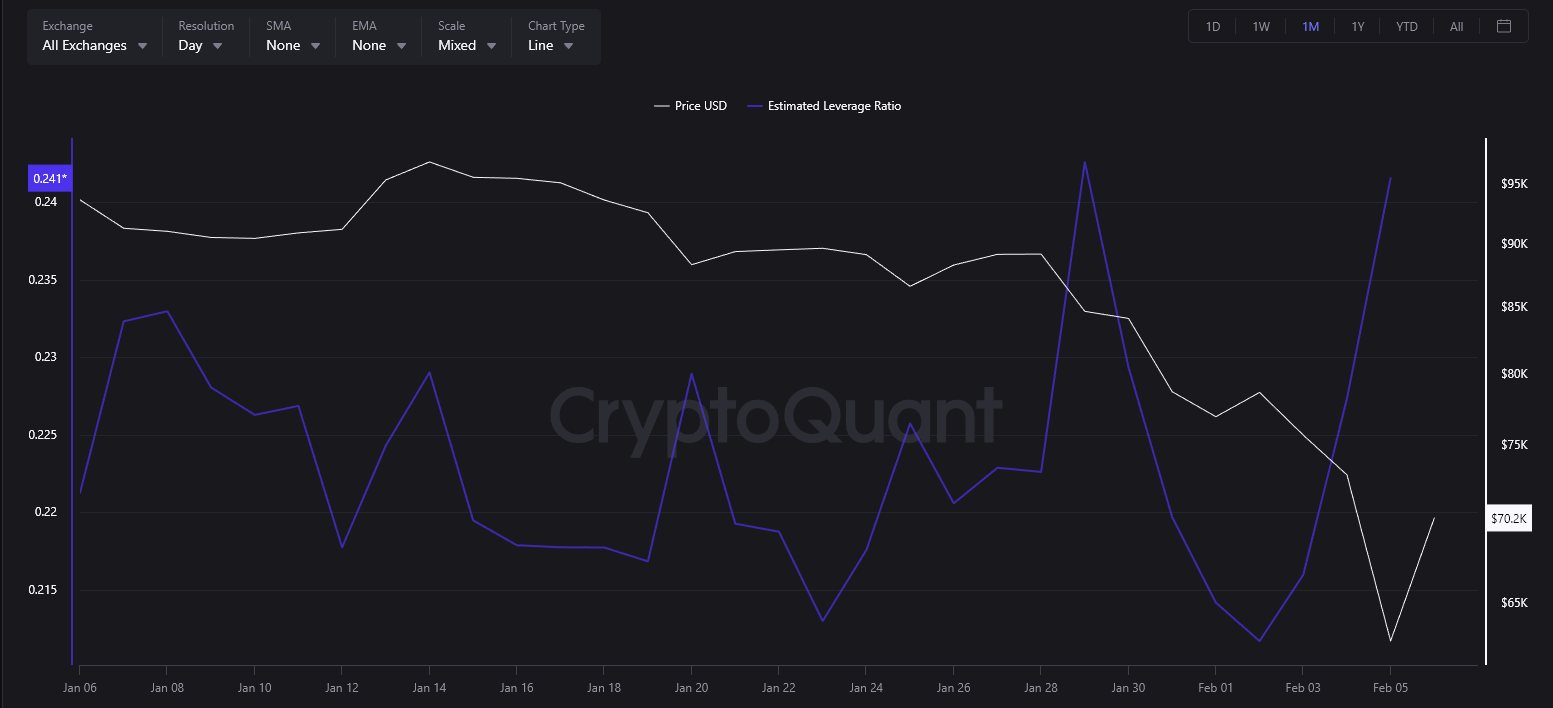

In crypto, derivatives positioning had develop into closely skewed towards longs, amplifying draw back as soon as costs broke assist. By February 6, a lot of that extra leverage had already been cleared.

Because of this, marginal promoting stress eased. With fewer margin calls and decreased pressured promoting, costs had been capable of rebound even with out new bullish catalysts.

The chart reveals leverage constructing via January earlier than being sharply flushed as value broke assist in early February.

After that reset, pressured promoting stress eased, permitting value to rebound regardless of the absence of latest bullish catalysts.

Sponsored

Sponsored

Macro Alerts Eased Close to-Time period Stress

US macro knowledge additionally helped stabilize sentiment. Shopper sentiment knowledge launched on February 6 got here in stronger than anticipated, marking a six-month excessive.

Whereas not signaling sturdy development, the information decreased speedy fears of a sudden financial deterioration.

Bond markets reacted by pricing a barely greater chance of a near-term fee reduce from the Federal Reserve, pushing short-term yields decrease earlier than stabilizing. That shift eased monetary situations on the margin, supporting threat property.

Shopper sentiment elevated this month to its highest degree since August, an indication that the financial unhappiness that has dragged down the political prospects of the Trump administration could possibly be turning round. https://t.co/TRiB2RzMIg

— Washington Examiner (@dcexaminer) February 6, 2026

Sponsored

Sponsored

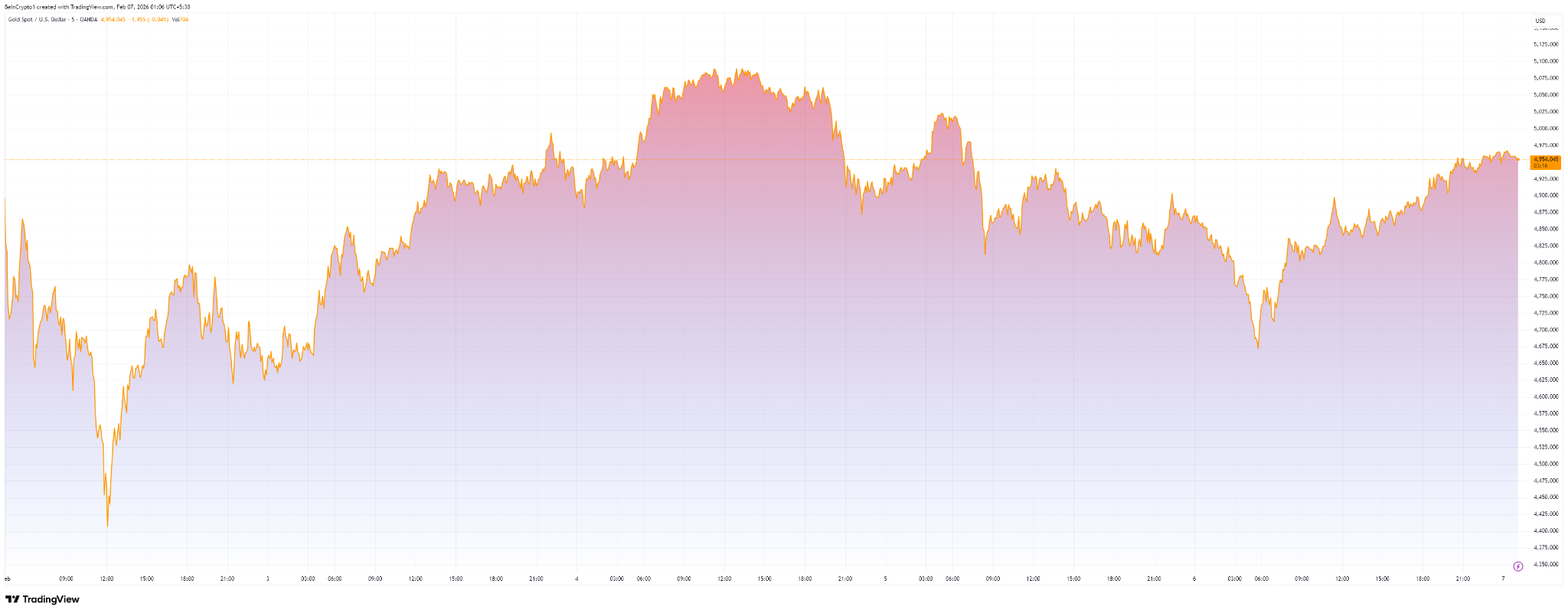

Gold and silver additionally recovered sharply, reinforcing the view that the prior session’s decline mirrored liquidity stress slightly than a elementary rejection of safe-haven property.

A softer US greenback and bargain-hunting contributed to the transfer.

Reduction Rally, Not A Development Reversal

The February 6 rebound displays a technical aid rally pushed by oversold situations, positioning resets, and short-term macro aid. It doesn’t but affirm a sturdy pattern reversal.

Markets stay delicate to liquidity situations, interest-rate expectations, and capital flows. Volatility is prone to persist as traders reassess threat in a tighter monetary atmosphere.