The Solana value stays underneath heavy strain in early February, with the token down practically 30% over the previous 30 days and buying and selling inside a weakening descending channel. Value continues to grind towards the decrease boundary of this construction as long-term conviction fades.

On the similar time, internet staking exercise has collapsed, trade shopping for has slowed, and short-term merchants are constructing positions once more. Collectively, these indicators counsel that extra SOL is changing into out there for potential promoting simply as technical assist weakens.

Sponsored

Sponsored

Staking Collapse Meets Descending Channel Breakdown Danger

Solana’s newest weak spot is being bolstered by a pointy drop in staking exercise. The Solana staking distinction metric tracks the weekly internet change in SOL locked in native staking accounts. Constructive values present new staking, whereas unfavorable readings point out internet unstaking.

In late November, long-term conviction was robust. In the course of the week ending November 24, staking accounts recorded internet inflows of over 6.34 million SOL, marking a significant accumulation section.

That development has now absolutely reversed. By mid-January, weekly staking flows had turned unfavorable. The week ending January 19 confirmed internet unstaking of round –449,819 SOL. By February 2, this had worsened to –1,155,788 SOL, a surge of roughly 150% in unstaking inside two weeks.

Staking Collapses: Dune

This implies a rising quantity of SOL is being unlocked from staking and returned to liquid circulation. As soon as unstaked, these tokens might be moved to exchanges and offered instantly, growing draw back threat.

This collapse is going on as value trades close to the decrease fringe of its descending channel with a 30% breakdown chance in play.

Sponsored

With SOL hovering close to $96, the mix of technical weak spot and rising liquid provide creates a harmful setup. If promoting accelerates, the channel assist could not maintain.

Trade Shopping for Slows as Speculators Improve Publicity

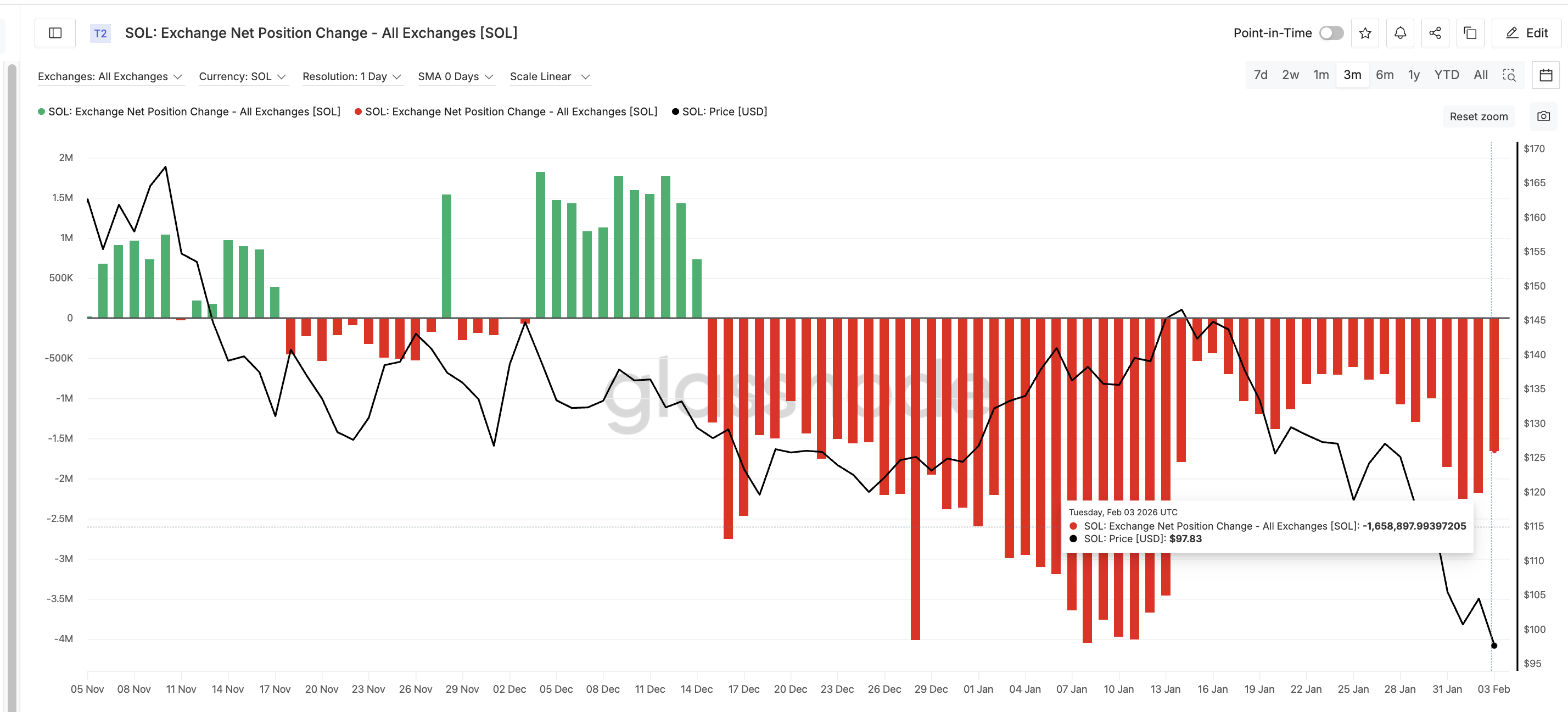

Falling staking exercise is now being mirrored in trade flows. Trade Internet Place Change tracks how a lot SOL strikes onto or off exchanges over a rolling 30-day interval. Adverse values point out internet outflows and accumulation, whereas rising readings sign slowing demand.

On February 1, this metric stood close to –2.25 million SOL, exhibiting robust shopping for strain. By February 3, it had weakened to round –1.66 million SOL. In simply two days, trade outflows dropped by practically 26%, signaling that accumulation has slowed.

Sponsored

This decline in shopping for is happening as unstaking accelerates, growing the quantity of SOL out there for buying and selling. When provide rises whereas demand weakens, the worth turns into extra susceptible to sharp declines.

On the similar time, speculative exercise is rising.

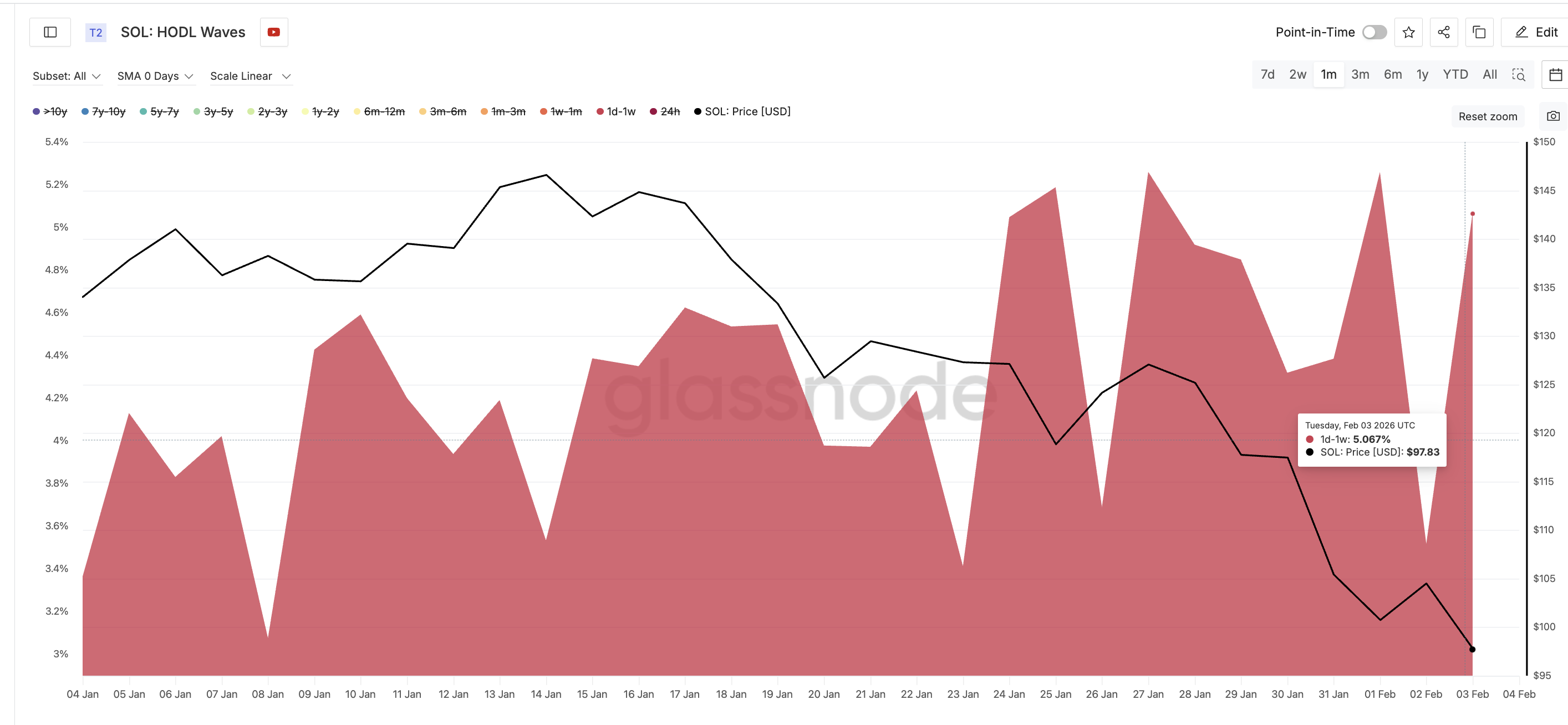

HODL Waves information, which separates wallets primarily based on holding time, reveals that the one-day to one-week cohort elevated its share from 3.51% to five.06% between February 2 and February 3. This group represents short-term Solana holders who usually enter throughout volatility and exit rapidly.

Related habits appeared in late January. On January 27, this cohort held 5.26% of the availability when SOL traded close to $127. By January 30, their share dropped to 4.31% as the worth fell to $117, a decline of practically 8%.

This sample means that speculative cash is positioning for short-term bounces quite than long-term holding, growing the danger that bounces will fade.

Sponsored

Sponsored

Key Solana Value Ranges Nonetheless Level to $65 Danger

Technical construction continues to reflect the weak spot seen in on-chain information. SOL stays locked inside a descending channel that has guided value decrease since November. After dropping the essential $98 assist zone, the worth is now buying and selling close to $96, near the channel’s decrease boundary.

If this assist fails, the subsequent main draw back goal lies close to $67, primarily based on Fibonacci projections. A deeper transfer may lengthen towards $65, aligning with the complete measured 30% breakdown of the channel.

On the upside, restoration stays tough. The primary stage that Solana should reclaim is $98, adopted by stronger resistance close to $117, which capped a number of rallies in January. A sustained transfer above $117 can be required to neutralize the bearish construction.

Till then, draw back dangers stay elevated.

With staking collapsing, trade shopping for weakening, and speculative positioning rising, extra SOL is coming into circulation simply as technical assist weakens. Until long-term accumulation returns, Solana stays susceptible to a deeper correction towards $65.