Picture supply: Getty Photos

Not too long ago, analysts from a number of banks have voiced issues a few short-term inventory market correction, together with Deutsche Financial institution, Morgan Stanley and Societe Generale. Whereas expectations fluctuate, some recommend a fall of as a lot as 15% – or extra.

No one actually is aware of what may occur nevertheless it pays to be ready. And searching on the market, I can perceive their warning.

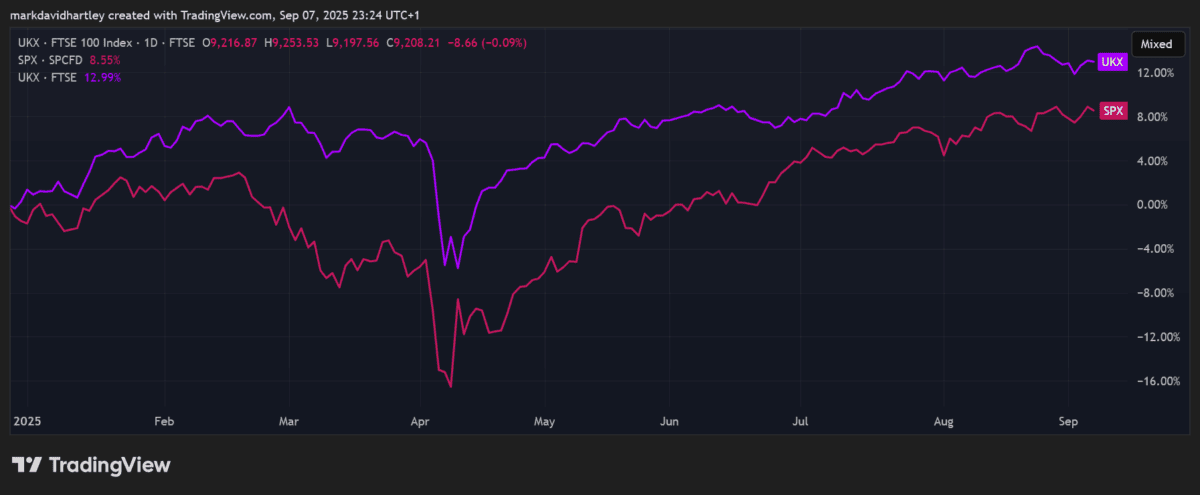

The S&P 500 hasn’t had the strongest yr, but valuations nonetheless look stretched following final yr’s rally. The index is buying and selling on a price-to-earnings (P/E) ratio of 27, far increased than its long-term historic common of 16.

The FTSE 100‘s in a similar position. It’s up 12.99% yr so far, in contrast with 6.7% at this level final yr. The P/E ratio sits at 19.7, increased than its three-year common of 15.7.

Created on TradingView.com

Created on TradingView.com

Why are specialists frightened?

Issues vary from commerce tariffs to financial weak spot and stretched valuations. With tariff prices more likely to be handed onto customers, the worry is that family spending will sluggish. That might drag down earnings throughout a number of industries, placing stress on fairness markets that already seem costly.

When a market correction appears to be like doable, some buyers select to carry a money pile. The concept’s easy — look forward to the autumn after which purchase at cheaper ranges. I like this technique however I additionally assume it’s price remembering that not all shares decline throughout downturns.

Some defensive firms, notably in retail, prescribed drugs and utilities, have a tendency to carry up higher. Tesco and Nationwide Grid are two traditional examples. Achieved appropriately, a well-balanced defensive portfolio of shares may even ship stronger returns than the typical Money ISA.

One inventory I like

For my very own portfolio, AstraZeneca‘s (LSE: AZN) a core defensive holding. It’s the most important firm on the FTSE 100 and has constructed a fame for reliable income and earnings. Over the previous decade, it’s delivered annualised returns of 11.24% — spectacular consistency for a enterprise of its measurement.

Current efficiency has been clouded by weaker vaccine gross sales as soon as pandemic demand fell away. Revenues dipped in late 2022 and thru 2023 consequently. Nevertheless, stripping out Covid-19 merchandise, the enterprise has continued to develop strongly. Core income rose 17% in 2022 and 15% in 2023, exhibiting its underlying power.

After all, there are nonetheless dangers. Commerce tariffs may impression international operations and provide chain disruptions are at all times a priority for a corporation with such extensive attain. Administration’s already introduced plans to take a position $50bn in US manufacturing by 2030 to assist scale back publicity, although this might be expensive and there’s no assure it is going to ship the specified advantages.

However from a defensive viewpoint, its valuation appears to be like affordable, with a ahead P/E ratio of 17.8. Equally, profitability and margins are first rate for the trade, with a return on fairness (ROE) of 20%.

Last ideas

A possible 15% inventory market correction could sound alarming however historical past reveals they’re pretty frequent. My strategy is to maintain some money available whereas additionally guaranteeing my portfolio has adequate defensive protection.

With a stable steadiness sheet supported by wholesome money stream and manageable debt, AstraZeneca stays considered one of my favourites. For buyers trying to scale back danger throughout a downturn, I believe it’s a inventory properly price contemplating.