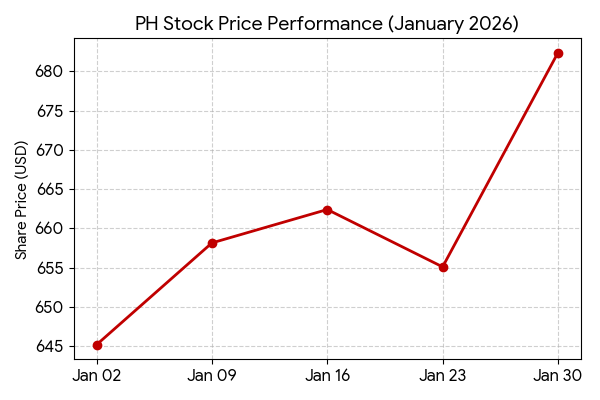

Parker Hannifin Company (NYSE: PH) shares elevated 4.16% throughout Friday’s buying and selling session. The transfer adopted the corporate’s launch of its fiscal 2026 second quarter monetary outcomes. Information displays the market place as of the market shut on January 30, 2026.

Market Capitalization

The market capitalization of Parker Hannifin Company stands at roughly $87.42 billion as of as we speak’s shut.

Newest Quarterly Outcomes

For the second quarter ended December 31, 2025, Parker Hannifin reported consolidated gross sales of $4.9 billion. This represents a 1.2% improve in comparison with $4.8 billion within the prior-year interval. Web revenue for the quarter was $705 million, in comparison with $610 million within the earlier yr, a rise of 15.6%. Adjusted earnings per share reached $6.45.

Phase Highlights:

- Diversified Industrial North America: Gross sales reached $2.1 billion with an working margin of 23.3%.

- Diversified Industrial Worldwide: Gross sales have been $1.4 billion with an working margin of 21.8%.

- Aerospace Programs: Gross sales totaled $1.4 billion, reporting an working margin of 26.5%.

Monetary Tendencies

Full Yr Outcomes Context

For the complete fiscal yr 2025, the corporate reported file annual gross sales and elevated internet revenue. Directional developments point out sustained development within the Aerospace phase and stability in worldwide industrial markets. No contraction was reported in major phase margins over the 12-month interval.

Enterprise & Operations Replace

Parker Hannifin reported a quarterly working money move of $767 million, representing 15.6% of gross sales. The corporate lowered its gross debt by $400 million through the quarter. Operational focus remained on the ‘Win Strategy’ framework to extend phase working margins.

M&A or Strategic Strikes

The corporate didn’t announce new large-scale acquisitions through the second quarter. Strategic exercise remained targeted on the mixing of earlier expertise acquisitions and the deleveraging of the steadiness sheet. The web debt to adjusted EBITDA ratio was reported at 1.9x.

Steerage & Outlook

Parker Hannifin up to date its steering for the complete fiscal yr ending June 30, 2026. The corporate adjusted its reported earnings per share vary to $23.10 to $23.70. On an adjusted foundation, the steering vary was raised to $26.70 to $27.30. Elements to look at embody international industrial demand and aerospace manufacturing charges.

Efficiency Abstract

Parker Hannifin shares rose 4.16% on January 30. Quarterly gross sales reached $4.9 billion with a internet revenue of $705 million. Aerospace Programs reported the best phase working margin at 26.5%. Full-year adjusted earnings steering was raised.

Commercial