This stay weblog is refreshed periodically all through the day with the newest updates from the market.To search out the newest Inventory Market Right now threads, click on right here.

Completely happy Friday. That is TheStreet’s Inventory Market Right now for Jan. 30, 2026. You’ll be able to comply with the newest updates available on the market right here in our every day stay weblog.

Replace: 10:00 a.m.

Opening Bell

The U.S. market is now opened for the day.

This morning, President Donald Trump introduced his new Fed Chair decide: Kevin Warsh, who served as a Fed Governor from 2006 to 2011. Within the greater than decade since Warsh left his publish on the central financial institution, he has served on the board of United Postal Service, grow to be a lecturer at Stanford, and brought up just a few different posts.

Warsh had been an advocate for greater rates of interest, shrinking the Fed’s $7 trillion steadiness sheet, and letting asset costs fall. In different phrases, swap decrease charges for decrease asset costs. However how? Warsh reckons that the structural, years-long growth in productiveness ought to result in charge cuts.

He is additionally essential of the central financial institution. Many would name him “hawkish”, which will likely be fascinating to sq. with the President’s need to win a extra sympathetic, dovish Fed. To that finish, Warsh is prone to be squarely centered on the central financial institution’s personal issues than elements past its twin mandate.

Exterior of that purview, the 55-year-old is unlikely to err a lot into politics or theatrics. Nonetheless, we’ll have to attend to see how his affirmation to the Fed actually modifications issues — and to that finish, he’ll first want the approval of each Democrats and Republicans, which could not occur till an investigation introduced by the President towards the incumbent Fed Chair has wrapped.

In response to this morning’s massive announcement, U.S. benchmarks briefly dipped to session lows; the Nasdaq (-0.41%), Russell 2000 (-0.37%), Dow (-0.35%), and S&P 500(-0.31%) are all decrease. The Russell’s malaise seems to be persevering with into the ten a.m. hour, whereas the opposite three indexes seem like bouncing.

The 10YTreasury is 2 foundation factors greater at 4.247%, one other signal of response from the fastened earnings crowd. The 20Y and 30Y are 2.3 bips and a couple of.6 bips greater at 4.832% and 4.88%.

Additionally notable, after technical difficulties delayed the beginning of buying and selling on the London Steel Change, steady futures in high-flying metals are decrease right now. Gold (-5.29% to $5,071.60) and Silver (-13.51% to $98.97) are seeing some fairly steep declines. On the flip facet, power commodities like Pure gasoline (+5.05% to $4.166%) and Brent crude oil(+0.23% to $69.75) are seeing a pleasant bump.

Heatmap: S&P 500

That stated, here is a glimpse of the S&P 500, the best-situated index this morning amongst main U.S. benchmarks. Telecom giants are the brightest inexperienced pocket this morning after Verizon‘s earnings (extra under), whereas credit score companies are decrease after American Categorical reported.

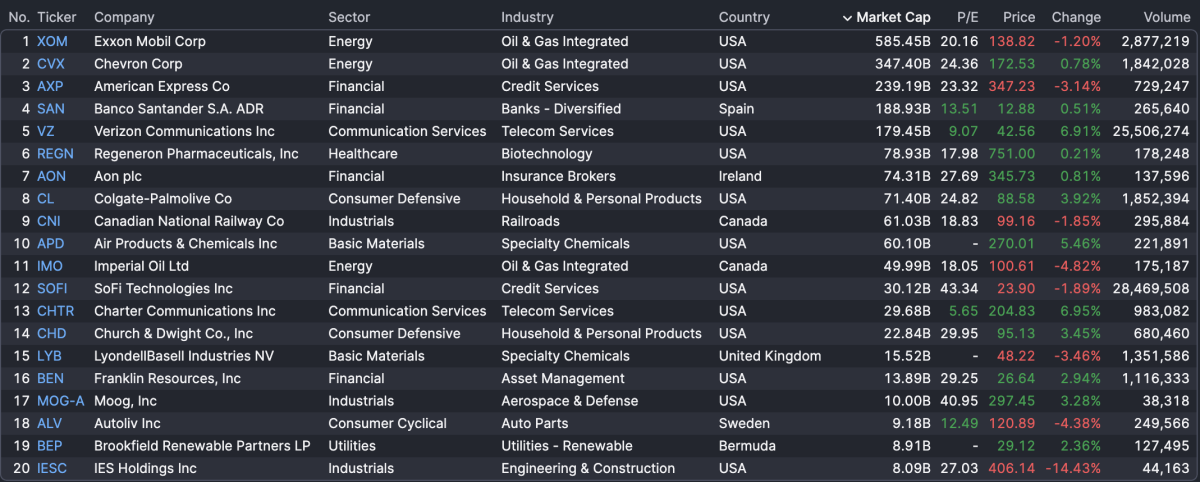

Earnings Right now: Exxon Mobil, Chevron, American Categorical

This morning noticed a big selection of earnings, together with oil companies Exxon Mobil and Chevron, fee processor American Categorical, and others. Among the many larger strikes within the largest experiences of the day are Verizon (+6.91%) and IES Holdings (-14.43%). Here is the listing of A.M. experiences for right now:

After the market shut, FinViz says that there will likely be two experiences at dimension, each overseas: Japan’s Sumitomo and Nomura will report, each financials.

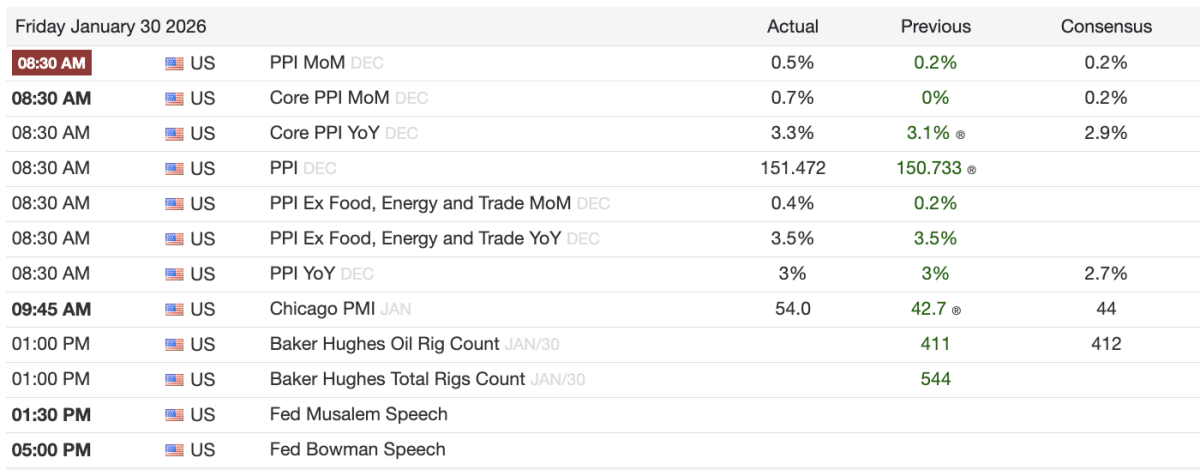

Financial Occasions: Fed Chair Decide, Producer PRice Index, Chicago PMI

Except for President Donald Trump saying his new decide for Fed Chair, there have been additionally plenty of financial experiences launched this morning, together with the Producer Worth Index. Here is the shortlist: