RBB Bancorp (NASDAQ: RBB) closed at $21.57, unchanged on the day.

Enterprise Overview

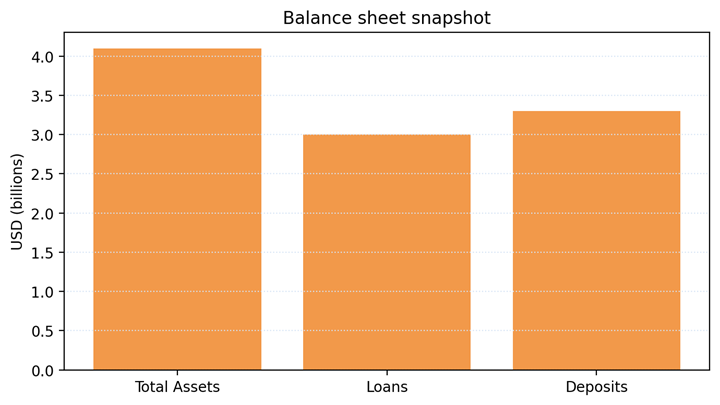

RBB Bancorp operates a diversified mortgage portfolio centered on residential mortgages and business actual property. The financial institution affords deposit and lending merchandise to retail and business prospects and manages credit score remediation efforts by way of focused exercise applications.

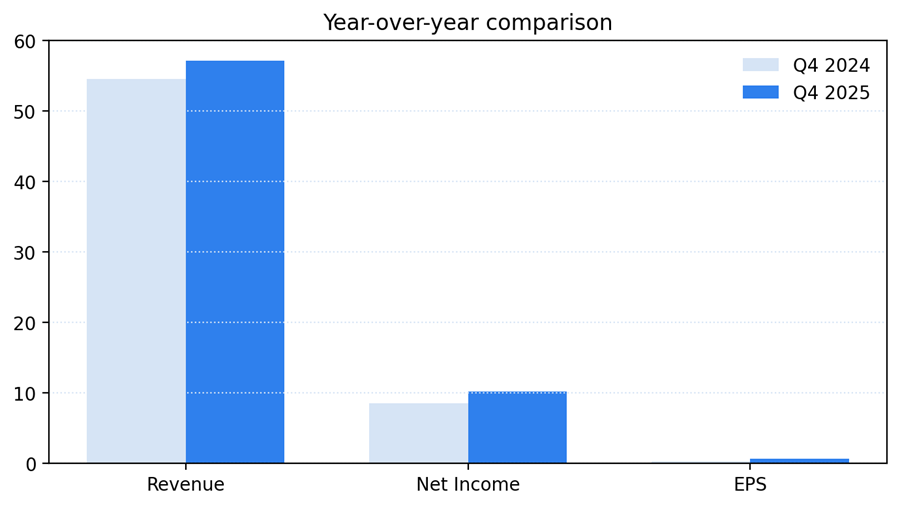

Monetary Efficiency

For the quarter ended Dec. 31, 2025, consolidated curiosity and dividend earnings totaled $57.2 million. Web earnings for This autumn was $10.2 million, and diluted earnings per share amounted to $0.59. Full-year 2025 internet earnings reached $31.9 million with diluted EPS of $1.83, each increased than the prior 12 months.

Working Metrics

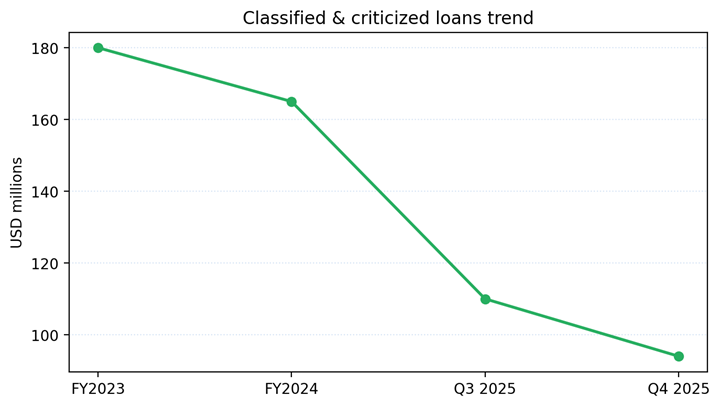

Web curiosity earnings for the quarter was roughly $29.5 million. The web curiosity margin rose to 2.99% in This autumn 2025. Loans held for funding grew 8.6% for the fiscal 12 months, whereas categorised and criticized loans declined through the interval.

Key Developments

Administration reported reductions in categorised loans and nonperforming belongings through the 12 months. The financial institution continued asset‑high quality remediation and modest originations in focused segments. No materials company transactions had been introduced within the quarter.

Dangers and Constraints

Key constraints embrace sensitivity to deposit prices, margin strain from funding combine adjustments, and the tempo of mortgage decision. Credit score normalization stays topic to macroeconomic situations and native actual property market efficiency.

Outlook / Steering

What to observe for: trajectory of categorised asset reductions, quarter‑to‑quarter internet curiosity margin motion, mortgage‑development momentum, and any administration updates on capital deployment or capital returns. Upcoming quarterly releases will make clear margin and provisioning traits.

Further context: The financial institution stays centered on restoring asset high quality whereas pursuing disciplined lending in core markets. Market individuals will watch funding prices and margin administration in coming quarters.

The quarter’s outcomes continued to mirror the financial institution’s multi-quarter efforts to enhance asset high quality whereas sustaining lending exercise.

Administration highlighted progress on exercise applications and pledged continued deal with decision timelines for remaining categorised loans.

Funding and liquidity metrics remained secure through the quarter, supporting ongoing lending operations and deposit flexibility.

Market observers will look ahead to any shift in deposit pricing and its impression on internet curiosity margins in coming durations.

Operational initiatives to streamline expense traces and enhance effectivity had been reiterated in administration commentary through the interval.

Commercial