The Cardano worth has bounced once more, however the final result appears acquainted. Since January 20, ADA climbed roughly 7%, briefly pushing increased earlier than stalling and settling close to $0.35. This was not a breakout. It was one other bounce that didn’t construct follow-through.

Three components clarify why Cardano’s worth bounces hold failing, and why the identical setup stays in place.

Motive 1: A Weak Hidden Bullish Divergence Sparked the Bounce

The newest bounce was triggered by a hidden bullish divergence on the 12-hour chart. Between late December and January 20, the ADA worth made the next low whereas the RSI printed a really shallow decrease low.

Sponsored

Sponsored

That element issues. A shallow RSI decrease low suggests promoting strain eased barely, not that consumers took management. The sort of divergence often results in short-lived rebounds, not sustained rallies.

Weak Divergence: TradingView

That’s precisely what occurred. Cardano’s worth bounced about 7% to $0.37 on January 21, however the transfer stalled rapidly.

The timing explains why. On January 21, when the value approached $0.37, Cardano’s improvement exercise rating peaked close to 6.94, its highest degree in a few month.

Growth exercise displays how a lot work is occurring on the chain and infrequently helps worth confidence. In mid-January, the native ADA worth peak intently adopted an area peak in improvement exercise.

That development-led help didn’t maintain. Growth exercise slipped, taking the value down with it. It has now risen to round 6.85, however the month-high degree hasn’t been damaged. The divergence stopped the selloff, nevertheless it didn’t create sufficient demand to push increased as improvement stalled.

Sponsored

Sponsored

Motive 2: Revenue Reserving Spikes Each Time the Cardano Value Rises

The larger downside is what occurs after Cardano begins transferring up.

The spent cash age band tracks what number of cash of all age teams are being moved. Rising values often sign promoting and revenue reserving. Over the previous month, every worth bounce has been adopted by a pointy rise in spent cash exercise.

In late December, Cardano’s worth climbed by roughly 12%, whereas spent cash exercise jumped by greater than 80%, exhibiting aggressive promoting into energy. In mid-January, ADA rose about 10%, and spent cash exercise surged by practically 100%, once more confirming that holders used the rally to exit positions.

The identical conduct is returning now. Since January 24, spent cash exercise has already elevated by greater than 11% from 105 million to 117 million, regardless that the ADA worth has not damaged increased but. That means sellers are positioning forward of one other bounce quite than ready for affirmation.

This is the reason momentum retains fading. Every rally try is met with quicker profit-taking than the final.

Sponsored

Sponsored

Motive 3: Whales Are Decreasing Publicity, Not Absorbing the Promoting

Usually, whales assist take in the sort of promoting strain. Proper now, they aren’t.

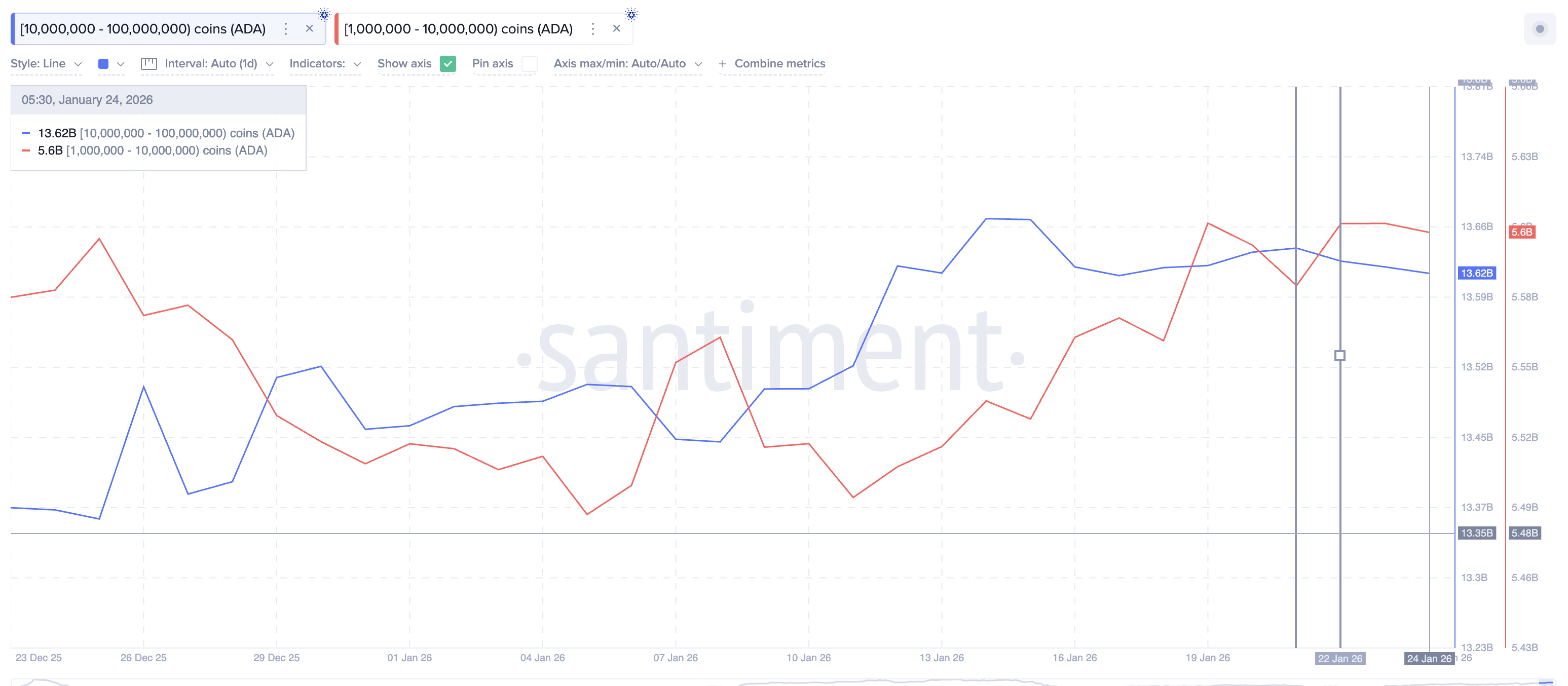

Wallets holding between 10 million and 100 million ADA have diminished their steadiness from roughly 13.64 billion ADA to about 13.62 billion ADA, a drop of round 20 million ADA since January 21. Beginning January 22, wallets holding between 1 million and 10 million ADA have slipped from about 5.61 billion ADA to roughly 5.60 billion ADA, shedding near 10 million ADA.

These will not be panic exits, however they’re clear internet reductions. That lack of whale demand means profit-taking is now not being absorbed, leaving the value extra uncovered to draw back strain as soon as it arrives.

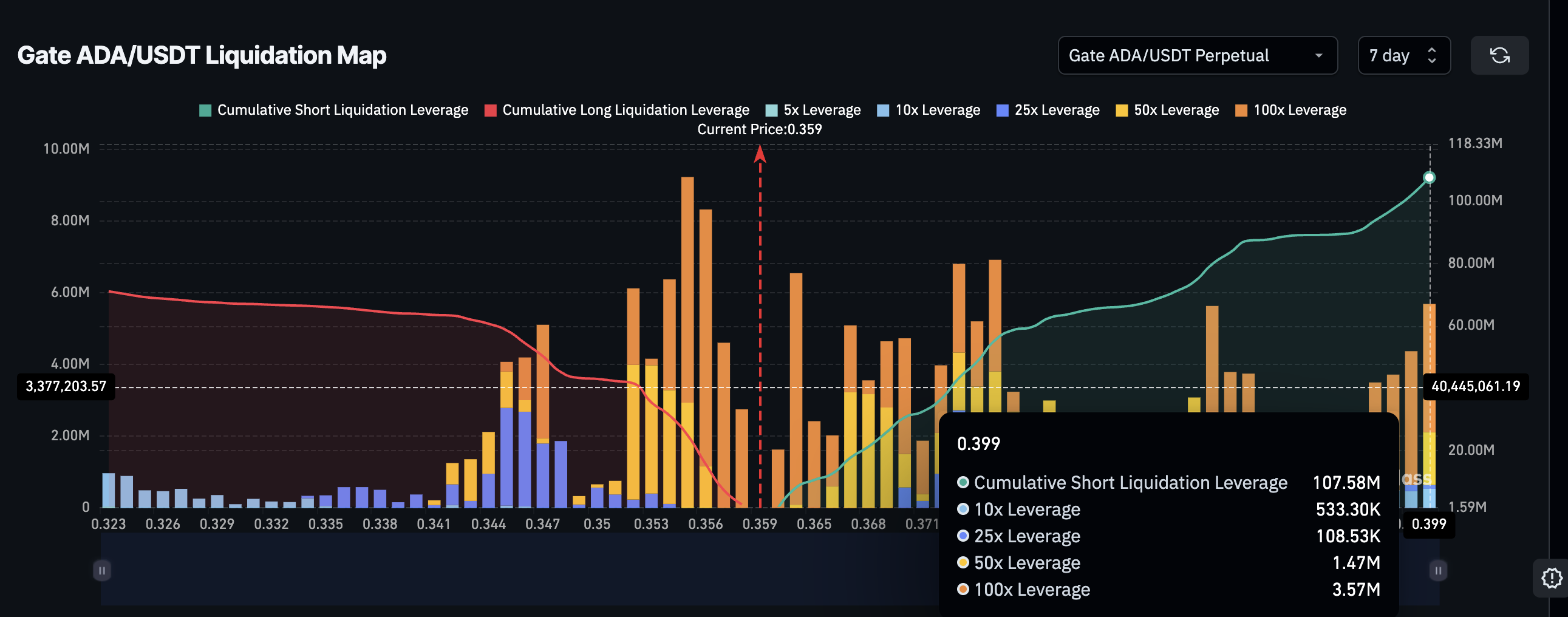

Derivatives information reinforces this weak spot. Over the following seven days, brief liquidations stand close to $107.6 million, whereas lengthy liquidations sit nearer to $70.1 million. Shorts outweigh longs by greater than 50%, exhibiting that merchants predict rallies to fail quite than prolong.

Sponsored

This imbalance suggests the market expects promoting strain to return rapidly if Cardano makes an attempt one other bounce, particularly close to resistance.

Cardano Value Ranges That Resolve What Occurs Subsequent

The value construction now makes issues clearer.

On the upside, $0.37 stays the primary vital degree. A clear break and maintain above it could set off brief liquidations and provide momentary reduction. Nonetheless, $0.39 is way extra vital. A transfer above this zone would liquidate most remaining shorts and mark the primary significant shift in momentum. Past that, $0.42 is the extent the place the broader construction might be bullish once more.

On the draw back, $0.34 is the important thing help. A lack of this degree would liquidate a big portion of remaining lengthy positions and will speed up draw back strain rapidly as leverage unwinds.

For Cardano to flee this cycle, three issues should align. Growth exercise must reclaim and maintain above current highs. Spent cash exercise should sluggish as a substitute of rising into bounces. And whales must return as internet consumers.

Till then, Cardano’s worth bounces stay weak.