Solana’s value has held regular over the previous couple of days, shifting sideways across the $200 mark.

This era of consolidation might shift towards bullish momentum as buyers step in with heavy accumulation, signaling renewed optimism for the altcoin’s near-term prospects.

Solana Buyers Choose Up Provide

Knowledge exhibits that balances on exchanges have dropped by 3.79 million SOL because the begin of the month. This marks a transparent shift in investor habits as cash go away centralized platforms, a typical signal of accumulation and long-term holding.

Sponsored

Sponsored

In only a week, buyers scooped up $770 million value of SOL, highlighting a robust bullish stance. The expectation is that continued accumulation will strengthen help above $200, probably enabling Solana’s value to interrupt via larger resistance ranges.

Solana Alternate Stability. Supply; Glassnode

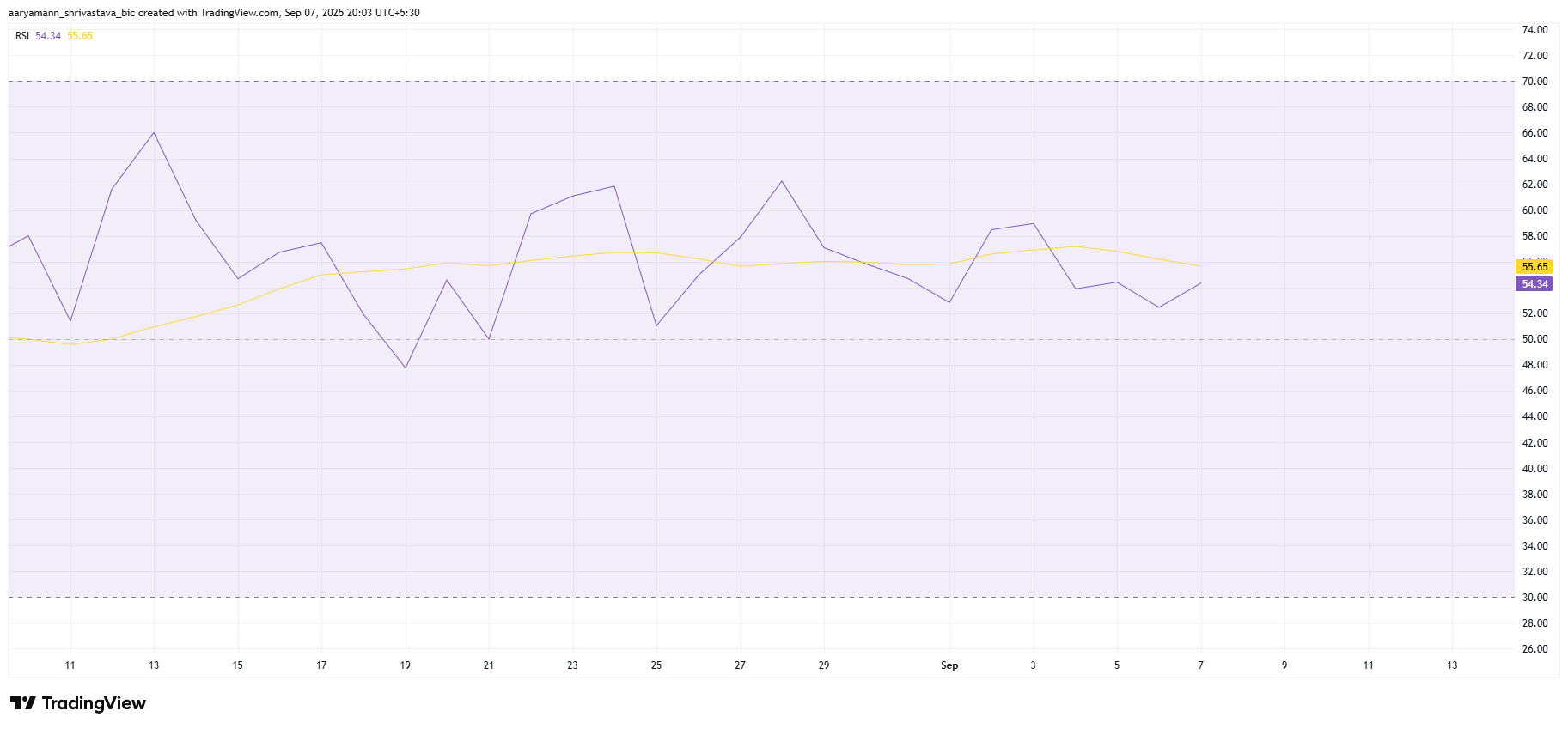

From a technical perspective, Solana’s Relative Power Index (RSI) is holding comfortably above the impartial 50.0 mark. The indicator stays in constructive territory, suggesting bullish momentum persists and that the altcoin nonetheless has room for upward motion.

This positioning additionally alerts resilience towards broader market pressures. With RSI not but within the overbought zone, Solana seems well-placed to proceed its climb, supplied investor inflows stay regular and no sharp promoting undermines the development.

Solana RSI. Supply: TradingView

Solana RSI. Supply: TradingView

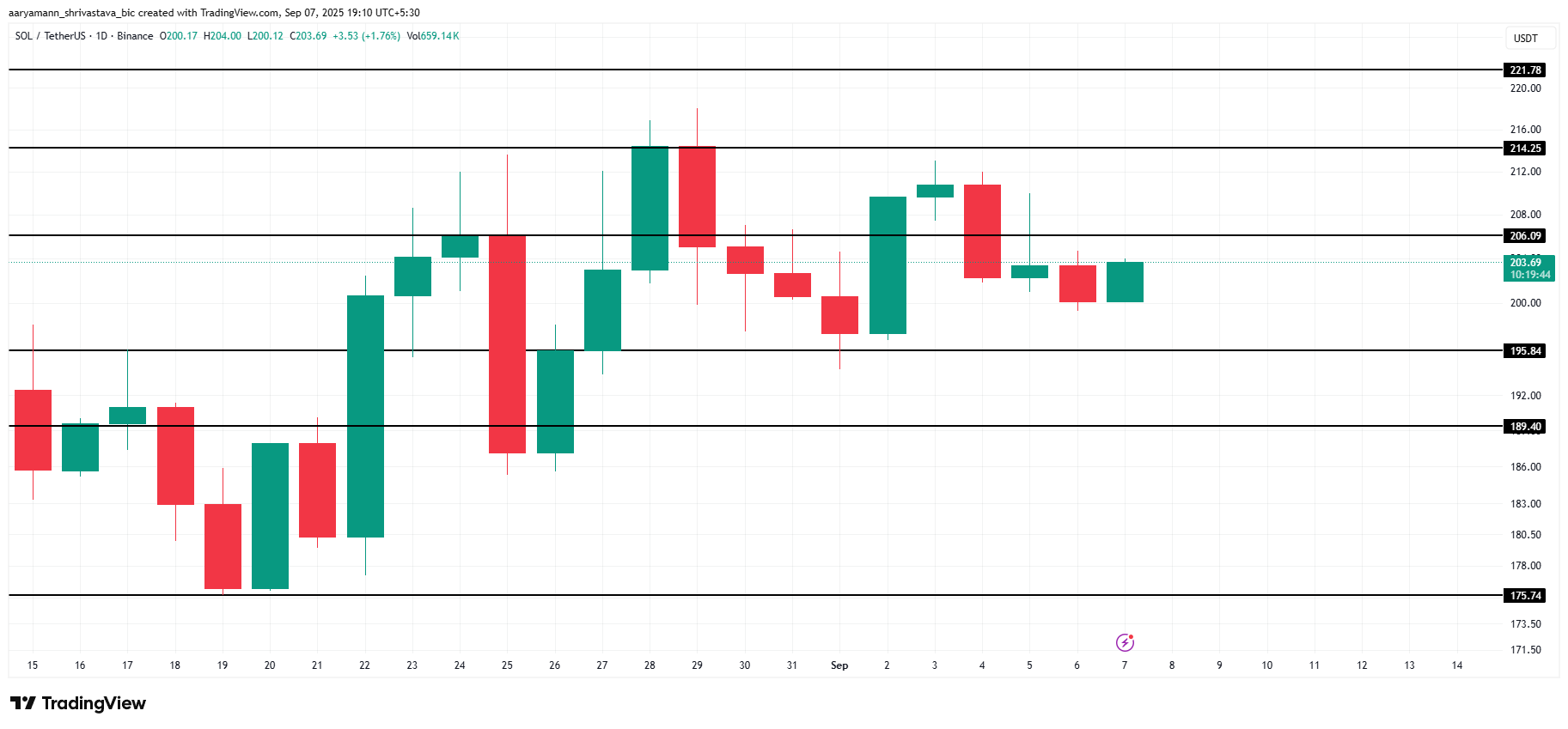

On the time of writing, Solana is priced at $203, just below the instant resistance of $206. Holding above $200 stays key, because it supplies the inspiration for additional positive factors within the close to time period.

Sturdy investor help might push SOL previous $206 and towards $214 within the coming days. A profitable breakout above that stage would open the door to $221, including momentum to the bullish outlook.

Solana Worth Evaluation. Supply: TradingView

Solana Worth Evaluation. Supply: TradingView

Nonetheless, if holders resolve to lock in earnings, Solana might face a pullback. Dropping the $195 help would expose the value to a decline towards $189 or decrease. This might successfully invalidate the bullish case and lengthening sideways motion.