Picture supply: Getty Photographs

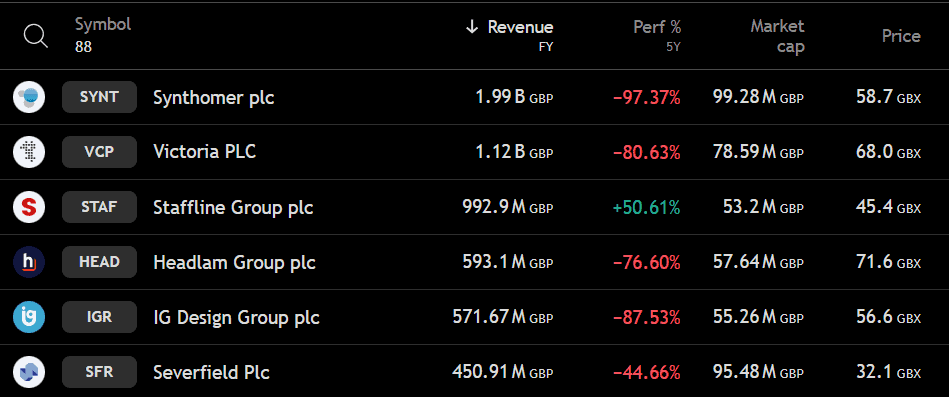

It isn’t uncommon to see a penny inventory that has suffered heavy losses, however few have fallen fairly so far as Synthomer (LSE: SYNT). Down 97.37% up to now 5 years, the most important provider of aqueous polymers has grow to be one of many worst-performing penny shares within the UK.

And but the corporate nonetheless introduced in nearly £2bn in income final yr — greater than every other penny inventory in the marketplace. As soon as a constituent of the FTSE 250, Synthomer dropped into penny inventory territory final month after its market cap fell beneath £100m.

Screenshot from TradingView.com

Screenshot from TradingView.com

In its 2024 full-year outcomes, the group reported a internet revenue lack of £72.6m – down sharply from a £208m revenue in 2021. The newest half-year outcomes for 2025 made issues worse, with an earnings per share (EPS) lack of -26p, in contrast with forecasts of a 2p revenue.

So what has gone unsuitable — and may it get better?

The increase and bust years

Synthomer’s story is considered one of cycles. In 2018, the corporate loved a pointy enhance in demand for nitrile butadiene rubber (NBR), a key ingredient in disposable medical gloves. Earnings spiked and acquisitions helped place the group as a worldwide speciality chemical substances participant, giving traders confidence in its progress story.

By 2019, that momentum pale. Increased uncooked materials prices and weaker demand in Europe and Asia noticed income contract. Then got here 2020 and the pandemic. As soon as once more, glove demand soared, sparking one other rally.

However the increase was short-lived. The acquisition of Omnova Options in 2020 saddled the corporate with heavy debt. Because the pandemic pale and glove demand normalised, Synthomer was left with rising prices, falling income, and a stability sheet underneath stress.

The shares, now buying and selling round 58p, are down 98.5% since a September 2021 excessive above 4,000p. Traders who purchased on the prime have seen extraordinary worth wiped away.

Growth and financials

In October 2021, Synthomer purchased Eastman Chemical’s adhesives enterprise for $1bn, which included a manufacturing unit within the Netherlands producing round 80 completely different artificial resins. Whereas the deal expanded the product base, it added to the debt pile.

Even ,so, the stability sheet isn’t with out benefit. The group holds £2.45bn in property and £996.6m in fairness towards £960m of debt. It additionally generated £15.7m in working money circulate final yr.

Administration is now targeted on deleveraging, and covenant reduction agreed with lenders runs till 2026, giving some respiration room. Plus, free money circulate improved final yr and internet debt has already been nearly halved from prior ranges.

May it get better?

Restoration will depend on lowering the online debt-to-EBITDA ratio to a safer stage. Which will contain promoting non-core property, refinancing on higher phrases or ready for rates of interest to ease. Any signal of earnings stabilisation or debt discount might immediate a rerating of the Synthomer share worth.

Personally, I feel this penny inventory is simply value contemplating for traders with a powerful danger urge for food. It may very well be a basic high-risk, high-reward turnaround story.

However for me, the heavy leverage, continued losses and unsure macroeconomic setting make it look too speculative for now.