Bitcoin surged above $95,000 on Tuesday, reaching its highest stage in additional than 50 days, as a mixture of easing US inflation and escalating geopolitical danger triggered a broad transfer into crypto markets.

The rally adopted a pointy warning from the US State Division telling Americans to “leave Iran now” and to arrange for extended communication outages.

The alert got here as mass protests proceed throughout Iran and Washington’s rhetoric towards Tehran hardens, elevating fears of a wider regional battle.

Sponsored

Iran: U.S. residents ought to go away Iran now. Think about departing by land to Türkiye or Armenia, if secure to take action. Protests throughout Iran proceed to escalate. Elevated safety measures, street closures, public transportation disruptions, and web blockages are ongoing. The… pic.twitter.com/w9suu499Ef

— TravelGov (@TravelGov) January 13, 2026

US CPI Eliminated a Key Macro Threat and Geopolitical Threat Revived Bitcoin’s Hedge Enchantment

The US journey warning to Iran added a second catalyst. Markets usually transfer into secure or various belongings when conflict danger rises.

Bitcoin has more and more traded as a geopolitical hedge throughout international crises. The mixture of potential Center East escalation and web shutdowns in Iran strengthened its function as an asset outdoors authorities management.

As headlines intensified, merchants moved rapidly into Bitcoin and different liquid crypto belongings.

Sponsored

Bitcoin, which began the day close to $91,000, jumped greater than 5% inside hours. The broader crypto market additionally climbed, with Ethereum, Solana, and XRP costs additionally surging.

The rally started earlier within the day after the US Shopper Worth Index confirmed inflation working at a steady tempo. Costs are nonetheless rising, however not accelerating.

That issues for crypto. When inflation stays below management, the Federal Reserve doesn’t want to boost rates of interest additional. It additionally avoids the chance of a sudden recession attributable to aggressive tightening.

For traders, that creates a safer backdrop for holding danger belongings equivalent to Bitcoin. The CPI report eliminated a serious draw back danger simply as Bitcoin was stabilizing after weeks of ETF-driven promoting.

Bitcoin 24-Hour Worth Chart on January 13, 2026. Supply: CoinGeckoSponsored

Bull Market Indicators are Reforming

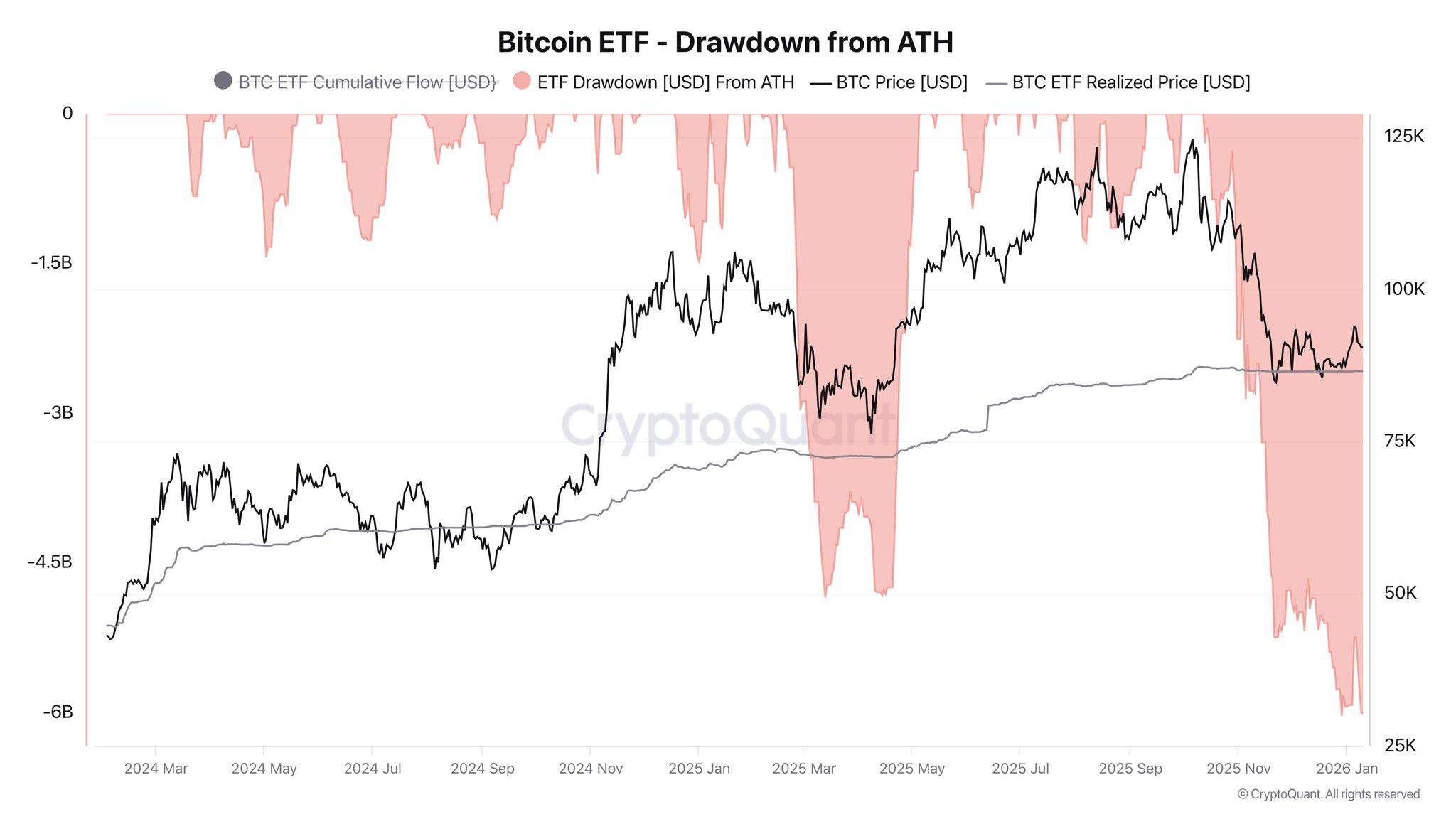

The transfer didn’t come from nowhere. Earlier in January, US spot Bitcoin ETFs noticed greater than $6 billion in outflows as late consumers from the October rally exited at a loss.

That promoting pushed Bitcoin down towards the ETF price foundation close to $86,000, the place strain eased. ETF flows have since stabilized, suggesting the washout section is basically full.

On the identical time, change information confirmed international consumers absorbing ETF-driven provide, whereas US establishments paused somewhat than exited the market. Coinbase’s premium turned adverse, indicating warning, not washout.

Sponsored

Bitcoin To Reclaim $100,000?

Bitcoin breaking again above $93,000 after the CPI report signaled that promoting had misplaced management. The push by way of $95,000 confirmed contemporary demand.

With inflation steady and ETF strain fading, geopolitical stress grew to become the spark that pressured sidelined capital again into the market.

For now, Bitcoin is rebuilding momentum after a mid-cycle reset. If ETF inflows resume and geopolitical danger stays elevated, merchants will look towards $100,000 as the following main check.

This rally reveals Bitcoin remains to be performing as each a macro asset and a disaster hedge in a world rising extra unstable.