Picture supply: Getty Photographs

The Glencore (LSE: GLEN) share value was up 8% in early buying and selling right this moment (9 January) after experiences that Rio Tinto (LSE: RIO) is in early-stage merger talks with the FTSE 100 miner. This comes on the heels of the proposed Anglo American–Teck Assets merger, signalling that consolidation is again on the agenda within the metals sector.

For Glencore, the main focus is much less on headlines although and extra on what the deal might imply for copper – and the way the corporate’s coal publicity components into the dialogue.

Merger particulars

Early particulars are restricted, and each corporations stress that nothing is agreed but. Rio Tinto is clearly seeking to increase its copper portfolio, whereas Glencore brings not simply metals however a serious buying and selling division.

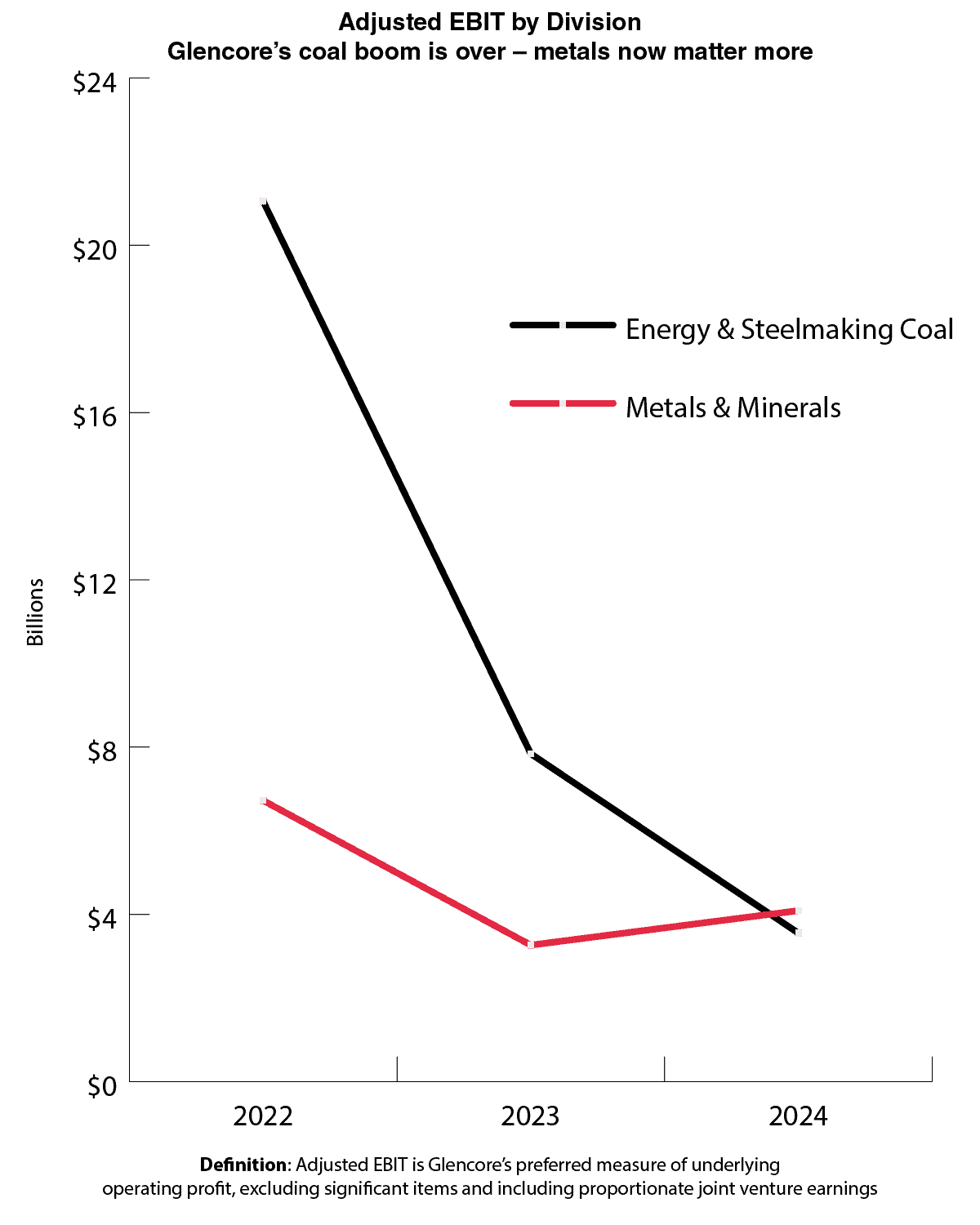

Coal is the apparent sticking level. Rio has exited coal fully, whereas Glencore’s operations in Australia and past nonetheless account for round half of whole income. But in follow, coal is much much less central to Glencore’s money flows than many assume.

The chart under reveals the miner’s adjusted earnings (EBIT) throughout its two divisions: whereas coal earnings have collapsed for the reason that post-Covid spike, metals and minerals have remained remarkably resilient. That shift offers Glencore flexibility in any deal and reduces the danger that coal alone might derail a transaction.

Chart generated by writer

Copper is the story

In the event you strip away the headlines, that is basically a copper story. Glencore is positioned to be one of many world’s largest producers, concentrating on round 850,000 tonnes this yr and doubtlessly reaching 1.6m tonnes by 2035.

Provide is constrained: Chile’s output is flat, new discoveries are uncommon, and allowing can take 15 years.

In the meantime, demand is climbing, pushed by electrification, renewable power, AI knowledge centres, and industrial progress. Even modest value stability mixed with regular volumes can meaningfully increase earnings.

Rio Tinto, in contrast, has been mild on copper, relying closely on iron ore. Accessing Glencore’s copper belongings would give it a much more credible place in a market the place a 30% provide shortfall is projected by 2035. For shareholders, that’s the angle that basically issues: copper is now central to the power transition, and each corporations wish to the long run.

Glencore’s buying and selling enterprise is the ace within the pack. Many rivals have tried to repeat it, none have succeeded. In a world of accelerating provide constraints and risky costs, this division is successfully priceless.

Dangers

Any merger of this scale could be behemoth-level, with monumental regulatory hurdles throughout a number of jurisdictions. Integrating two very totally different company cultures – one trading-heavy, the opposite typical mining – is much from trivial.

Coal, whereas smaller than earlier than, might nonetheless pose ESG, political, or financing issues. And the sheer dimension of the mixed firm would make it extremely uncovered to commodity cycles, geopolitical tensions, and operational disruption.

Backside line

The Glencore-Rio Tinto story isn’t about speedy share value spikes. It’s about copper optionality, disciplined manufacturing, and strategic positioning in a market more likely to stay undersupplied for years.

For buyers snug with Glencore’s volatility, right this moment’s merger headlines add context however don’t change the basics. Copper stays the driving force – the a part of the story most certainly to form earnings, progress, and long-term market relevance.