The Zcash worth has spent months shifting sideways, irritating each bulls and bears. Regardless of periodic rallies and regular whale accumulation, ZEC stays trapped in a tightening vary.

This isn’t an absence of curiosity downside. It’s a timing and a Bitcoin downside. Plus, technical compression, combined on-chain indicators, and weakening sentiment are all pulling the worth in reverse instructions. Right here is why the Zcash breakout retains getting delayed.

Sponsored

Sponsored

Symmetrical Triangle Reveals a Technical and On-Chain Tug-of-Struggle

Zcash has been buying and selling inside a symmetrical triangle since mid-October. This sample types when the worth makes decrease highs and better lows on the identical time. It displays indecision. Consumers and sellers are energetic, however neither aspect has sufficient management to power a breakout or breakdown.

Every time ZEC approaches the higher trendline, sellers step in. Every time it dips towards the decrease trendline, consumers return. This tug-of-war has repeated for weeks, retaining the ZEC worth compressed.

Bull–bear energy (BBP) helps clarify this conduct. Bull–bear energy measures which aspect controls momentum. When Zcash not too long ago examined the higher boundary of the triangle, bulls briefly took management. Nonetheless, the most recent BBP candles present bear stress rising once more, flipping momentum again towards sellers.

This mirrors what occurred in early December, when a possible draw back break was prevented after bulls briefly regained management.

Zcash Triangle Formation: TradingView

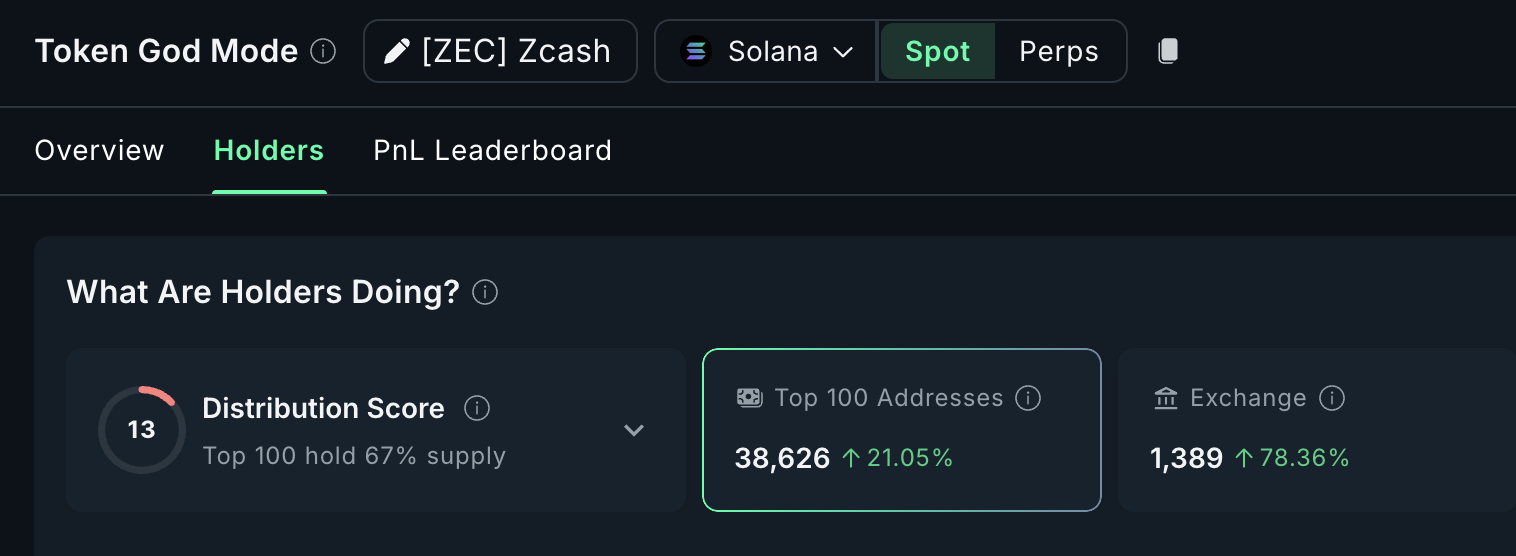

On-chain information tells the identical tug-of-war story. Mega whale wallets elevated their Zcash holdings by about 21% over the previous seven days. Their whole steadiness now sits close to 38,626 ZEC. On the present worth, that equals roughly $3.3 million in internet accumulation.

Sponsored

However this shopping for has been offset by retail conduct. Trade inflows rose by about 78%, exhibiting that many smaller holders used current power (25% up month-on-month) to promote. Briefly, whales are shopping for, retail is promoting, and the worth stays caught. That steadiness explains why the triangle squeeze drags on.

Sentiment Collapse Explains Why Whale Shopping for Is Not Sufficient

Whale accumulation alone doesn’t transfer Zcash. Sentiment has at all times performed a serious function in ZEC’s rallies, and proper now, sentiment is lacking.

Constructive sentiment rating has fallen sharply over the previous month, dropping from round 151 to close 2. This issues as a result of Zcash has traditionally responded strongly to sentiment spikes.

In early December, when constructive sentiment surged above 150, ZEC jumped from roughly $345 to $464 in lower than every week, a transfer of about 34%. Later, round December 27, sentiment rose once more to close 32, and worth adopted with a fast rally from about $512 to $549, roughly 7%.

Sponsored

Sponsored

As we speak, that gasoline is gone. Regardless that whales are accumulating, the broader market will not be emotionally engaged. With out constructive sentiment, whale shopping for lacks follow-through. Value can stabilize, but it surely struggles to development.

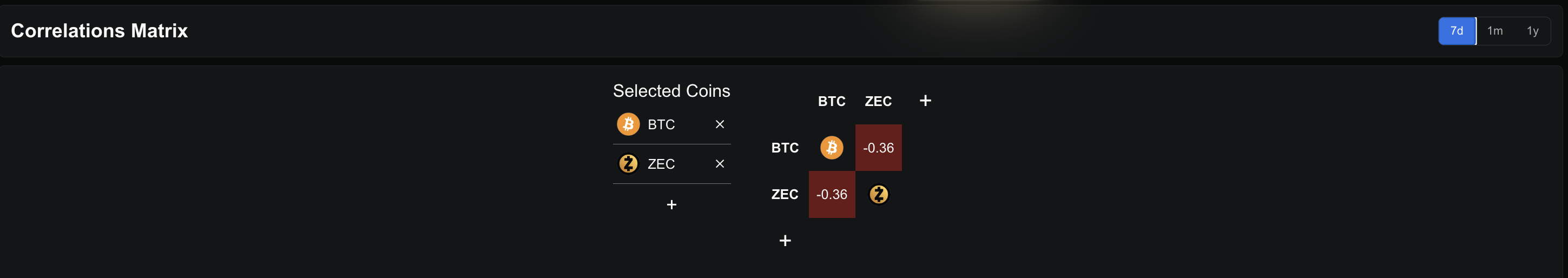

This sentiment drop additionally aligns with broader market dynamics. Bitcoin has been reclaiming key ranges, and Zcash nonetheless exhibits a detrimental short-term correlation with Bitcoin close to −0.36.

As Bitcoin attracts capital, ZEC demand weakens on the margin, additional delaying a breakout. It’s value mentioning that BTC is up virtually 4% week-on-week, whereas the ZEC worth gave away 7% of its beneficial properties. Traditional inverse correlation at work.

Sponsored

Sponsored

Sensible Cash and Key Zcash Value Ranges Outline the Delay

Knowledgeable positioning confirms the wait-and-see surroundings. The Sensible Cash Index, which tracks early positioning throughout quieter market hours, has slipped beneath its sign line. This often indicators lowered confidence in near-term upside, not aggressive promoting.

Sensible cash tends to front-run breakouts when conviction is excessive. That’s not taking place right here.

From a worth perspective, the hurdle is obvious. Zcash wants a clear day by day shut above $561 to convincingly break the higher trendline of the symmetrical triangle and the final native resistance. That stage is roughly 14% above present costs and marks the purpose at which compression lastly resolves.

If that breakout occurs, upside might open shortly. However with out renewed sentiment and broader participation, the transfer stays unlikely. On the draw back, the construction stays intact above $400. Beneath that stage, the triangle would fail and reset expectations.

For now, Zcash will not be breaking down. It’s ready.

Whales are shopping for, however retail is promoting. Sentiment has cooled, and good cash is standing apart. Till one aspect decisively wins this tug-of-war, the Zcash worth is more likely to stay compressed, delaying the breakout many merchants are awaiting.