The Bitcoin mining business’s competitors intensifies after a latest halving, with main corporations like Marathon Digital showcasing sturdy output and holdings.

In the meantime, different gamers face vital challenges, reflecting a dynamic and evolving market panorama.

Competitors Turns into Fiercer

The Bitcoin mining business is coming into a fiercely aggressive part following the 2024 halving, as a result of working prices proceed to rise. This has compelled many smaller miners to exit the market, leaving the enjoying discipline to giant publicly listed mining corporations. Consequently, the focus of mining in giant corporations additionally causes the market to face the issue of centralization.

Sponsored

Sponsored

Based on CompaniesMarketCap, main gamers similar to Marathon Digital (MARA), Riot Platforms, CleanSpark, and Cango preserve multi-billion-dollar market capitalizations and proceed serving as pillars of the Bitcoin ecosystem. Mining corporations rebounded in July when the community hashrate almost reached an all-time excessive regardless of rising issue and competitors.

However what about August?

Bitcoin hashrate. Supply: Blockchain.com

MARA Stays Regular

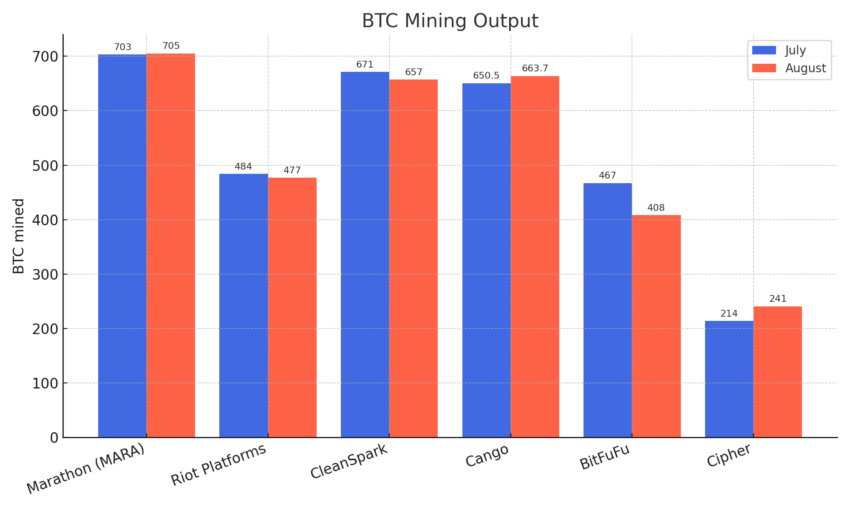

Public corporations’ general Bitcoin mining output in August was not notably optimistic in comparison with July, although the expansion charges various considerably.

Usually, notable shifts got here from smaller miners like BitFuFu and Cipher. BitFuFu’s mining output fell sharply to 408 BTC, down 12.63% from July’s 467 BTC, at the same time as its holdings rose barely to 1,899 BTC. Cipher, against this, recorded sturdy development, mining 241 BTC in contrast with 214 BTC in July, a 12.62% enhance. As well as, its holdings additionally expanded considerably to 1,414 BTC, up 16% month-over-month.

Firm

BTC Mined (July)

BTC Mined (Aug)

Change (BTC, %)

BTC Holdings (Finish Aug)

Marathon (MARA)

703

705

+2 (0.28%)

52477

Riot Platforms

484

477

-7 (-1.45%)

19309

CleanSpark

671

657

-14 (-2.09%)

12827

Cango

650.5

663.7

+13.2 (+2.03%)

5193

BitFuFu

467

408

-59 (-12.63%)

1899

Cipher

214

241

+27 (+12.62%)

1414

Quite the opposite, bigger miners confirmed extra reasonable adjustments. For example, Cango mined 663.7 BTC, up 2.03% from July, whereas CleanSpark produced 657 BTC, down 2.09%. In the meantime, Riot Platforms slipped 1.45% to 477 BTC, although its holdings climbed to 19,309 BTC.

Above all, Marathon Digital remained regular, with output rising 0.28% to 705 BTC, and it bolstered its place because the business’s largest holder with 52,477 BTC. The corporate bolstered its lead as the biggest holder, ending the month with 52,477 BTC, a rise of 1,838 BTC.

Supply: BeInCrypto

Supply: BeInCrypto