Picture supply: Getty Photographs

Nvidia (NASDAQ:NVDA) shares are up 1,279% during the last 5 years. That’s sufficient to show £1,000 into one thing price £13,787.

The large query for traders is what comes subsequent. And whereas I’m not anticipating a repeat efficiency over the following 5 years, I believe there are causes for optimism.

Progress

The explanation Nvidia shares have been such a very good funding during the last 5 years is easy. The corporate makes far extra money than it did in 2020, principally as a result of spectacular income development.

Traders ought to observe, nevertheless, that issues have began to reasonable lately. Quarterly gross sales development charges have fallen from 265% within the final three months of 2023 to 56% in the newest quarter.

QuarterYear-over-Yr Income GrowthQ1 2024262.12percentQ2 2024122.40percentQ3 202493.61percentThis autumn 202477.94percentQ1 202569.18percentQ2 202555.60%

That’s solely regular for a corporation of Nvidia’s dimension, nevertheless it’s extraordinarily vital. As development charges gradual, the valuation multiples the inventory trades at have come to mirror much less optimistic assumptions.

During the last two years, the price-to-earnings (P/E) ratio the inventory trades at has fallen from 110 to 50. That’s nonetheless excessive, nevertheless it’s a big decline from the place it was.

Different issues being equal, that’s sufficient to trigger the share value to fall by greater than 50%. However different issues aren’t equal on this case – wider margins have triggered earnings per share to develop extra rapidly.

Wanting forward, I believe income development is more likely to maintain slowing. However the query for traders is whether or not development will keep robust sufficient to justify a P/E ratio of 49.

Outlook

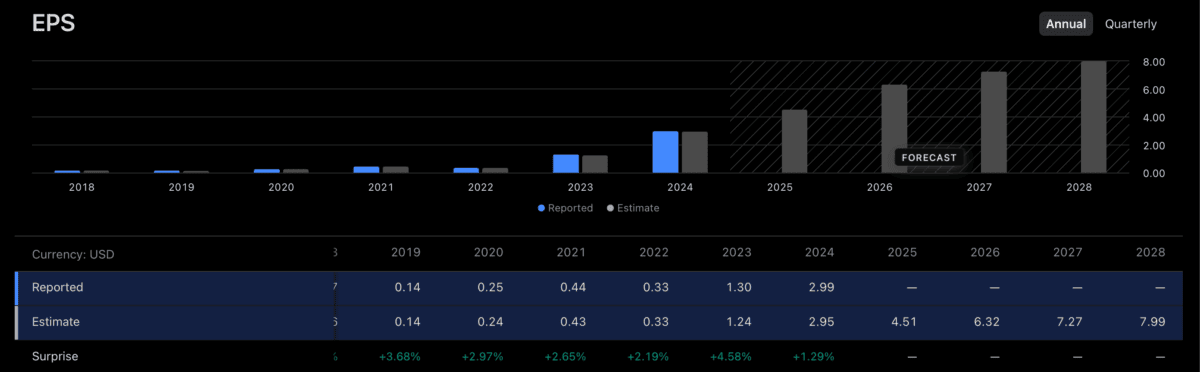

Analysts predict gross sales to develop round 32% in 2026, then 17% in 2027, and eight% in 2028. That’s fairly a dramatic decline, however earnings per share (EPS) are forecast to develop extra rapidly.

Nvidia’s EPS is forecast to succeed in $7.99 by 2028, which entails 40% development in 2026, which is ready to gradual to 10% by 2028. That is perhaps proper, however I don’t see development slowing a lot from there.

If I’m proper, Nvidia’s EPS might attain $9.67 by 2030. In that state of affairs, I anticipate the inventory to commerce at a P/E ratio between 25 and 30, which means a share value within the $241-$290 vary.

That’s between 38% and 65% above the present degree – sufficient to show £1,000 into £1,650. That’s a good distance from the return of the final 5 years, nevertheless it wouldn’t be a nasty outcome by any means.

All of this, nevertheless, is dependent upon the agency sustaining its aggressive place. Proper now, Nvidia chips are indispensable to the rise of synthetic intelligence and future EPS development depends on this.

Gauging the chance of competitors is troublesome. However there’s a hazard that the US limiting exports to China might end in a drive for innovation in Asia, leading to a DeepSeek-style various.

Dangers and rewards

As with all inventory, investing in Nvidia is about gauging dangers and rewards. And whereas I believe there’s nonetheless room for optimism, it’s positively much less engaging than it was 5 years go.

Whereas there aren’t any apparent rivals, the chance of 1 rising must be thought-about fastidiously. So traders may ponder whether they’ve higher alternatives elsewhere for the time being.