Investor consideration is popping towards World Liberty Monetary after its powering token, WLFI, debuted for buying and selling, and its flagship stablecoin USD1 surged to a $2.64 billion provide in simply six months.

Amidst the rising adoption, hypothesis is wild on which altcoins stand to profit probably the most. Based on analysts, BNB coin, Chainlink (LINK), and Bonk (BONK) will be the seemingly contenders.

Why BNB, LINK, and BONK Might Profit from WLFI Adoption

Sponsored

Sponsored

The BNB Chain has rapidly change into the spine of USD1’s growth. Based on CoinMarketCap, 81% of the USD1 provide is presently held on BNB Chain, making it the dominant community for WLFI’s stablecoin.

Whereas the USD1 stablecoin provide on different chains grew by $437.59 million in August, BNB Chain stays far forward.

USD1 Provide on BNB Chain. Supply: CoinMarketCap

This focus suggests BNB’s central position in WLFI’s ecosystem. As USD1 issuance continues to climb, demand for BNB Chain block area and liquidity provisioning is more likely to comply with.

For BNB holders, the community impact might translate into sustained utility and elevated transaction volumes. This might bode effectively for the BNB value.

Chainlink (LINK) is the second potential beneficiary, whose Cross-Chain Interoperability Protocol (CCIP) has change into a crucial infrastructure layer for WLFI’s operations.

Zach Rynes, Chainlink’s neighborhood liaison, revealed that CCIP processed over $130 million in cross-chain switch quantity in a single day. Of this, $106 million, or 81.5%, is reportedly tied on to WLFI transfers.

Sponsored

Sponsored

WLFI has additionally adopted Chainlink’s Cross-Chain Token (CCT) commonplace, making LINK’s oracle and interoperability providers indispensable to its growth technique.

With greater than 80% of CCIP quantity linked to WLFI, the partnership locations LINK on the coronary heart of a rising multi-chain ecosystem.

Rising WLFI exercise might subsequently translate into stronger fundamentals for the LINK value.

Chainlink (LINK) Worth Efficiency. Supply: BeInCryptoSponsored

Chainlink (LINK) Worth Efficiency. Supply: BeInCryptoSponsored

Sponsored

A 3rd however no much less promising altcoin is Bonk (BONK), Solana’s main meme token. WLFI just lately tapped Bonk.enjoyable because the official launchpad for USD1 on Solana, a transfer hailed as transformative for each ecosystems.

“We’re proud to announce that we’ve partnered with World Liberty Financial to become the official USD1 launchpad on Solana… bringing the next wave of users onto Solana,” Bonk.enjoyable introduced.

Analysts like Unipcs argue that the deal might unlock a surge in liquidity for the Bonk ecosystem. They level out that USD1 drove $30 billion in buying and selling quantity to BNB Chain in its first month alone.

many proceed to take with no consideration how massive of a deal the $WLFI partnership with BonkFun is

USD1 drove $30 billion in quantity to BNB chain the primary month it went reside on the chain

that is a number of instances extra quantity than we see within the trenches on Solana month-to-month, regardless of Solana being… https://t.co/xa29spNs0k

— Unipcs (aka ‘Bonk Man’) 🎒 (@theunipcs) September 2, 2025

As WLFI replicates its success on Solana, BONK and its related ecosystem might see important inflows of liquidity and a spotlight.

Sponsored

Sponsored

Brief-Time period Headwinds, Lengthy-Time period Alternative for WLFI Ecosystem

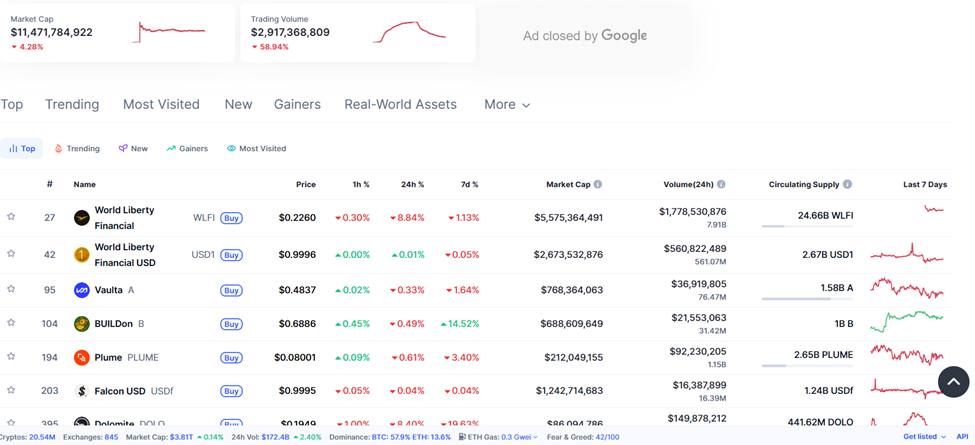

Regardless of these bullish indicators, the broader WLFI sector faces short-term headwinds. CoinMarketCap knowledge exhibits the ecosystem’s market cap fell 4.28% to $11.47 billion, whereas buying and selling quantity has dropped practically 60%.

Prime WLFI Ecosystem Tokens by Market Capitalization. Supply: CoinMarketCapSponsored

Prime WLFI Ecosystem Tokens by Market Capitalization. Supply: CoinMarketCapSponsored

Sponsored

Analysts recommend early exits might weigh WLFI’s value motion, although sentiment might shift as new partnerships like Bonk.enjoyable’s go reside.

Finally, BNB, LINK, and BONK stand out as the highest altcoins poised to profit from WLFI’s increasing footprint.

These tasks may very well be the forefront of the following wave of liquidity, interoperability, and stablecoin-driven progress throughout the crypto markets. Nevertheless, that is contingent on WLFI adoption accelerating.