Solana has had a turbulent August. The token repeatedly tried to carry above $210 however did not maintain momentum, slipping again into vary. At press time, the Solana value trades close to $205, down 4.5% over the past 24 hours and about 1% decrease prior to now week. Month-to-month beneficial properties stay above 13%, and the yearly development remains to be optimistic at almost 50%.

Nonetheless, September might problem this uptrend as on-chain and technical indicators level towards potential weak spot.

Provide in Revenue Close to Six-Month Excessive

Probably the most essential metrics is the share of provide in revenue, which measures what number of cash are at present value greater than their price foundation.

This metric hit a six-month excessive of 96.56% on August 28 earlier than easing barely to round 90% now.

Solana Worth And Profitability: Glassnode

Historical past reveals that such highs typically precede corrections within the Solana value. On July 13, the metric touched 96% whereas the Solana value traded round $205, adopted by a 23% drop to $158.

Once more, on August 13, the metric peaked at 94.31%, triggering a 12% correction from $201 to $176. Later, on August 23, one other peak at 95.13% led to an 8% slide from $204 to $187.

With the metric again close to file highs, the chance of a deeper correction within the SOL value in September is rising.

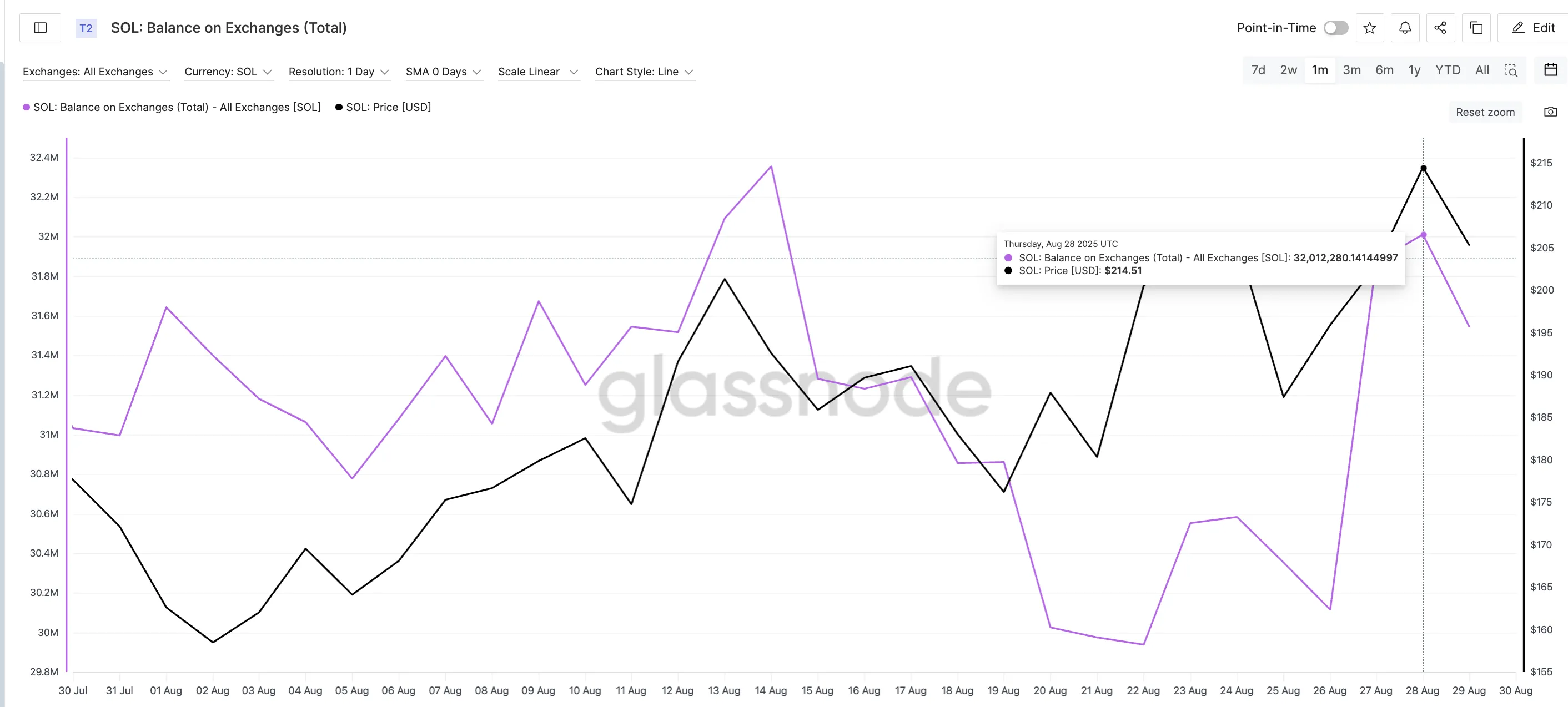

Trade Balances Reinforce Promoting Danger

That promoting threat is strengthened by change balances. The quantity of SOL held on centralized exchanges surged to greater than 32 million tokens on August 28, up from below 30 million earlier within the month. Rising balances often recommend holders are getting ready to promote.

Solana Worth And Steadiness On Exchanges: Glassnode

Solana Worth And Steadiness On Exchanges: Glassnode

The correlation is evident. On August 14, when balances peaked above 32 million, the Solana value dropped 8% from $192 to $176 inside days.

Now, with balances climbing once more, the same setup is forming, pointing to renewed draw back stress that might weigh on the SOL value in September.

Solana Worth Sample Suggests Bearish Setup Regardless of Constructive Historical past

Technicals additionally align with this bearish outlook. Solana is transferring inside an ascending wedge on the weekly chart — a sample that always indicators weakening momentum and might result in both a bearish continuation or reversal.

If the Solana value loses $195 and $182, the decline might lengthen to $160, marking one other potential 15–20% pullback. Curiously, such pullbacks have been beforehand seen when change balances and provide in revenue percentages spiked. A breach below $182 would even validate the bearish sample breakdown.

Solana Worth Evaluation: TradingView

Solana Worth Evaluation: TradingView

Nonetheless, bulls nonetheless have a solution to regain energy. A weekly shut above $217 — the final native excessive — would invalidate the wedge’s bearish implication and open the way in which towards larger targets. Till then, the bias stays tilted downward.

This bearish technical setup comes towards a backdrop of typically optimistic seasonality. Since 2021, Solana has delivered September beneficial properties of 29%, 5.3%, 8.2%, and 12.5%. However with provide in revenue at highs and change balances elevated, 2025 would be the 12 months this streak breaks.

Solana Worth Historical past: Cryptorank

Solana Worth Historical past: Cryptorank

Until SOL manages a decisive shut above $217, the Solana value in September might battle, even with the optimistic push of historic efficiency and ETF-related optimism.