The December 9–10 FOMC assembly is drawing intense consideration as merchants worth in a doable 25 bps fee minimize, a transfer that might deliver a brief burst of liquidity again into danger property. The crypto market remains to be shifting with warning, slipping about 1.1% forward of the announcement. Nonetheless, some crypto whales are positioning early.

A handful of tokens are seeing a transparent pickup in whale accumulation, with some exhibiting rebound or breakout constructions on their charts. This piece lists three of them.

Aster (ASTER)

Aster is exhibiting one of many strongest accumulation indicators from crypto whales previously 24 hours. The token is down 4% right now and greater than 10% over the past month, but whales have added 11.61% to their holdings, growing their stash to 44.76 million ASTER at a worth close to $0.93. This implies Aster whales added roughly 4.67 million tokens, priced at nearly $4.34 million at present costs.

Sponsored

Sponsored

Accumulation into weak point is usually an indication that whales count on a shift in circumstances as soon as the FOMC assembly final result is thought.

Aster Whales: Nansen

The ASTER worth chart presents a part of the reason.

Between November 3 and December 7, Aster’s worth shaped a better low, whereas the RSI (Relative Power Index) — which tracks momentum — printed a decrease low. This creates a hidden bullish divergence, a construction that usually indicators pattern continuation and a fade in promoting stress.

The identical sample appeared between November 3 and November 29, and Aster rallied about 22% afterward. Crypto whales could also be inserting early bets on the same response if market sentiment turns risk-on after the speed determination.

BREAKING: There’s now a 94% probability that the Fed will minimize rates of interest on Wednesday, per Polymarket.

The third fee minimize of 2025 is coming. pic.twitter.com/d7a7coKSDY

— The Kobeissi Letter (@KobeissiLetter) December 8, 2025

The ASTER worth can also be shifting inside a tightening triangle sample, which often displays buyer-seller indecision earlier than a bigger transfer. The primary degree to reclaim is $1.01. A break above that zone opens the trail towards $1.08, and a stronger transfer might push the token towards $1.40.

Sponsored

Sponsored

However this construction fails if Aster loses $0.89, which might expose $0.84 and invalidate the trend-continuation setup whales seem like watching.

Pippin (PIPPIN)

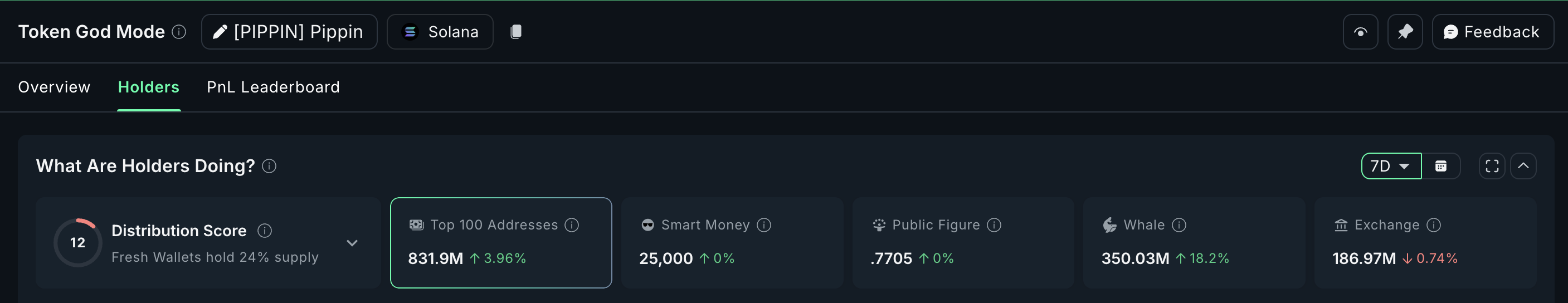

Pippin is the second token seeing clear accumulation from crypto whales forward of the December FOMC assembly. Whales expanded their holdings by 18.2% over the previous seven days, bringing their stash to 350.03 million PIPPIN. This implies they added roughly 53.9 million PIPPIN, price about $9.75 million at present costs.

High 100 addresses (mega whales) have additionally added to their positions, growing their holdings by 3.96%. When each whales and main holders accumulate throughout a cooling part, it usually indicators confidence {that a} new transfer might type quickly.

Sponsored

The PIPPIN worth motion helps that view.

Pippin is up 3.06% within the final 24 hours after a quiet week, but it stays greater than 400% greater over the previous month. The present construction resembles a bull flag, a continuation sample that seems when a robust rally pauses. Whales positioning into this consolidation suggests they count on volatility to rise after the FOMC determination.

PiPPIN first must reclaim $0.21 and $0.26 to verify a robust flag breakout. The breakout requires a transfer above $0.34, which has acted as a agency resistance since Pippin topped. At current, the PIPPIN worth has damaged out of the higher trendline of the flag, however a clear day by day candle shut above $0.21 is required for affirmation.

If PIPPIN slips under $0.14, the construction weakens, and a fall below $0.10 may break the flag sample fully, exposing deeper assist close to $0.08. For now, whales seem like treating this consolidation as a possibility fairly than exhaustion.

Sponsored

Sponsored

Chainlink (LINK)

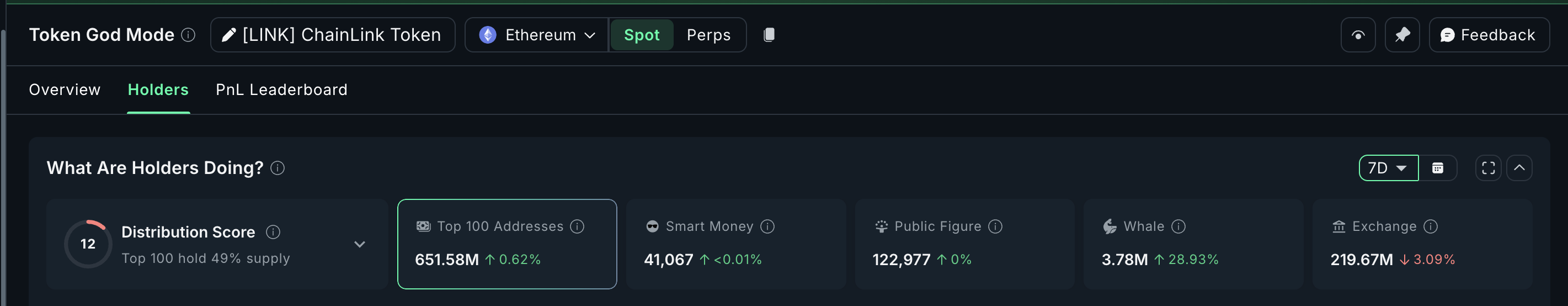

Chainlink is the third token seeing regular crypto whale curiosity forward of the December FOMC assembly and anticipated fee cuts. Over the previous seven days, LINK whales elevated their holdings by 28.93%, elevating their stash to three.78 million LINK. On the present worth, this added place is price roughly $11.5 million.

High-100 addresses additionally elevated their provide by 0.62%, whereas trade balances dropped by 3.09%. These often trace at elevated demand from each whales and retail.

Whale conviction aligns with what the 12-hour chart is exhibiting. LINK is up 12.5% this week, hinting at a short-term uptrend. Between December 7 and 9, the worth shaped a better low, however the RSI made a decrease low, which is a hidden bullish divergence. Hidden bullish divergence usually factors to pattern continuation as a result of it exhibits promoting stress is weakening at the same time as the worth holds greater ranges.

For this construction to play out, LINK wants a clear break above $13.72 with a stable 12-hour shut. The extra vital barrier sits at $14.19, which rejected LINK earlier this week. If this degree breaks, LINK may stretch towards $14.95, and above that, the subsequent main resistance is close to $16.25.

If the market turns risk-off after the FOMC assembly, the primary assist to observe is $12.97 on the 0.618 Fibonacci zone. Shedding this degree exposes $11.75, which has acted as a robust ground since December 1.

Whales are including aggressively whereas LINK prints hidden bullish divergence, making a setup the place even a small increase in market liquidity from the FOMC final result can prolong the continued uptrend.