Chainlink (LINK) has been one of many stronger performers out there, rallying greater than 109% over the previous yr. Even within the final three months alone, the LINK worth has gained about 68.5%.

However the previous week has revealed weak spot, with the token slipping greater than 9%, and each on-chain metrics and technical charts now counsel the year-long uptrend could also be dropping steam, a minimum of for now.

Revenue-Taking Pressures Mount As Holders Sit in Good points

One of many clearest indicators comes from the share of LINK provide in revenue, which continues to be hovering at traditionally excessive ranges.

As of August 29, practically 87.4% of the circulating provide is in revenue, near the current peak of 97.5% seen on August 20. That peak coincided with the LINK worth rally to $26.45, which rapidly retraced by over 6% to $24.82 the next day.

Chainlink Worth And Provide In Revenue: Glassnode

A glance additional again reveals the identical sample. On July 27, the provision in revenue stood at 82.8%, simply earlier than LINK corrected from $19.23 to $15.65, making a 19% dip. The present studying close to 87% is once more uncomfortably excessive, hinting at elevated dangers of profit-taking.

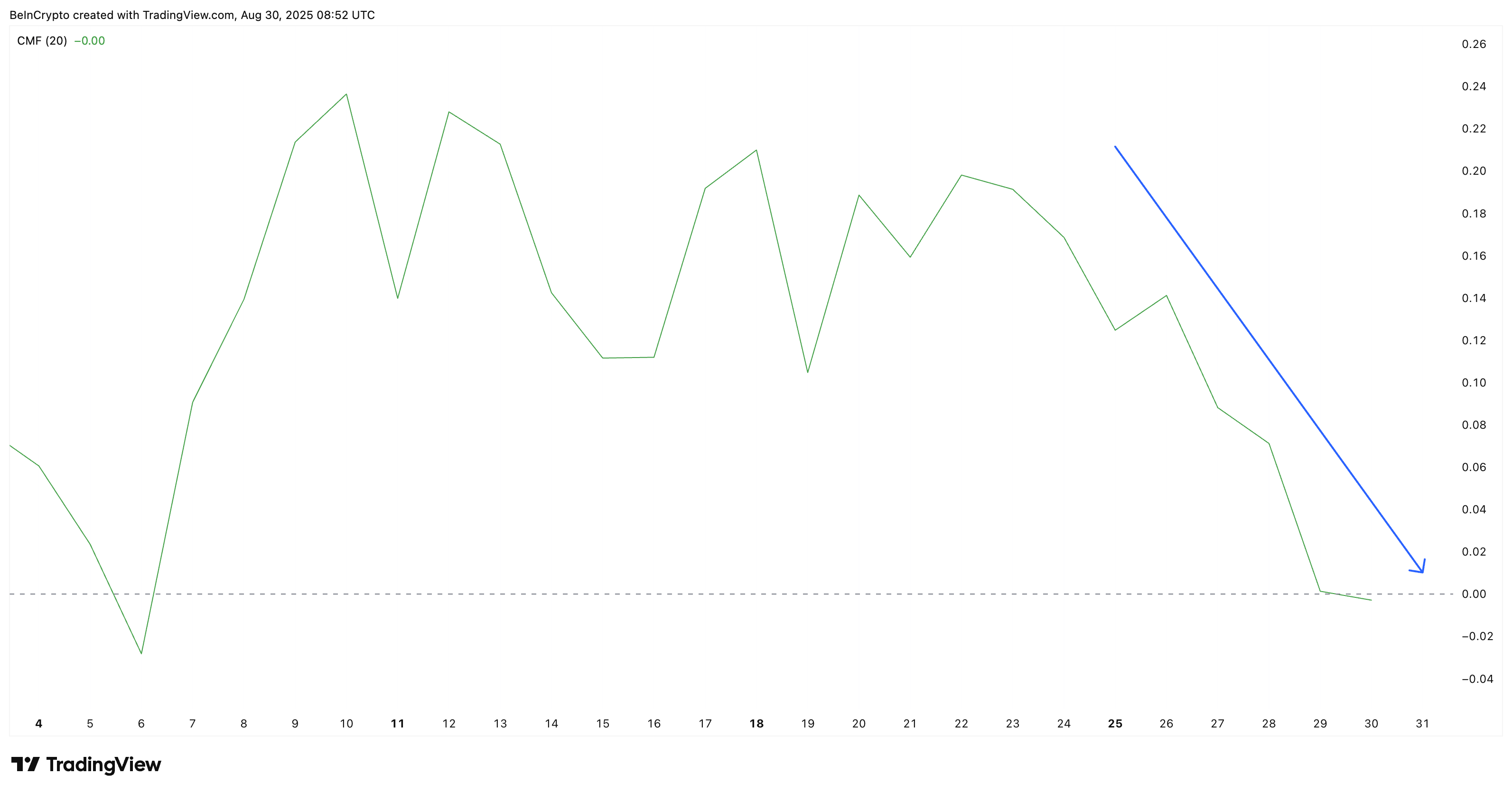

LINK Capital Inflows Displaying Bearish Indicators: TradingView

LINK Capital Inflows Displaying Bearish Indicators: TradingView

Moreover, the Chaikin Cash Stream (CMF), which tracks capital inflows and outflows, has trended downward since August 22 and eventually slipped beneath zero on August 29 for the primary time since August 6. This shift into damaging territory alerts fading shopping for stress and capital inflows, strengthening the case for a possible pullback.

Chainlink (LINK) Worth Motion Factors To Bearish Exhaustion

The each day chart reinforces this warning. The LINK worth is presently buying and selling at $23.31, sitting inside an ascending broadening wedge sample — a construction usually related to lack of upward momentum close to the top of a bullish section. This “megaphone” like sample is notorious to kickstarting bearish reversals, a threat that now looms over LINK.

LINK Worth Evaluation: TradingView

LINK Worth Evaluation: TradingView

The important thing help to look at is $22.84. A decisive break beneath this stage would expose the following draw back goal at $21.36, and falling beneath that would threat a deeper retracement. That may very well be anyplace within the 6% to 19% % vary, as skilled through the native “Supply In Profit” peaks.

Then again, if the LINK worth manages to reclaim $25.96, it might nonetheless try one other transfer increased.

However even such a restoration wouldn’t totally overturn the broader exhaustion indicators until the token can break convincingly above $27.88.