The Greenback-Value Averaging (DCA) technique can generate losses when the market enters a downtrend. Nonetheless, in sure phases, it could develop into extremely efficient when traders select the fitting second to start.

A number of components recommend that December could also be a super interval to start out this technique. The next sections present an in depth rationalization of those components.

4 Causes to Begin DCA Into Altcoins From December

Beginning a DCA technique doesn’t assure that costs will rise after the primary buy. This strategy requires correct capital allocation so traders keep away from lacking alternatives and safe optimum entry costs.

Sponsored

Sponsored

Altcoin Quantity Decline Creates a Golden Interval for DCA

The primary cause comes from declining altcoin buying and selling quantity, which displays a quiet market part just like earlier market bottoms.

In response to Darkfost’s evaluation, a comparability between 30-day altcoin quantity (towards stablecoin pairs) and the yearly common exhibits that altcoins have entered a “buy zone.”

Aggregated Altcoin Buying and selling Quantity for Stablecoin Quote Pairs. Supply: CryptoQuant.

The chart illustrates that historic durations when 30-day altcoin quantity dropped under the yearly common typically marked market bottoms. These phases can persist and check investor persistence.

“This is a period that encourages DCA if you’re betting on a continuation of the bullish trend. It’s a phase that can last for weeks or even months, giving enough time to optimize a DCA strategy with well-targeted entry points,” Darkfost commented.

Falling quantity means that many sellers have already accomplished their promoting actions, however market sentiment stays too weak for a restoration. Because of this, DCA can carry out effectively in such situations.

Sponsored

Sponsored

Declining Social Curiosity Aligns With Market Backside Situations

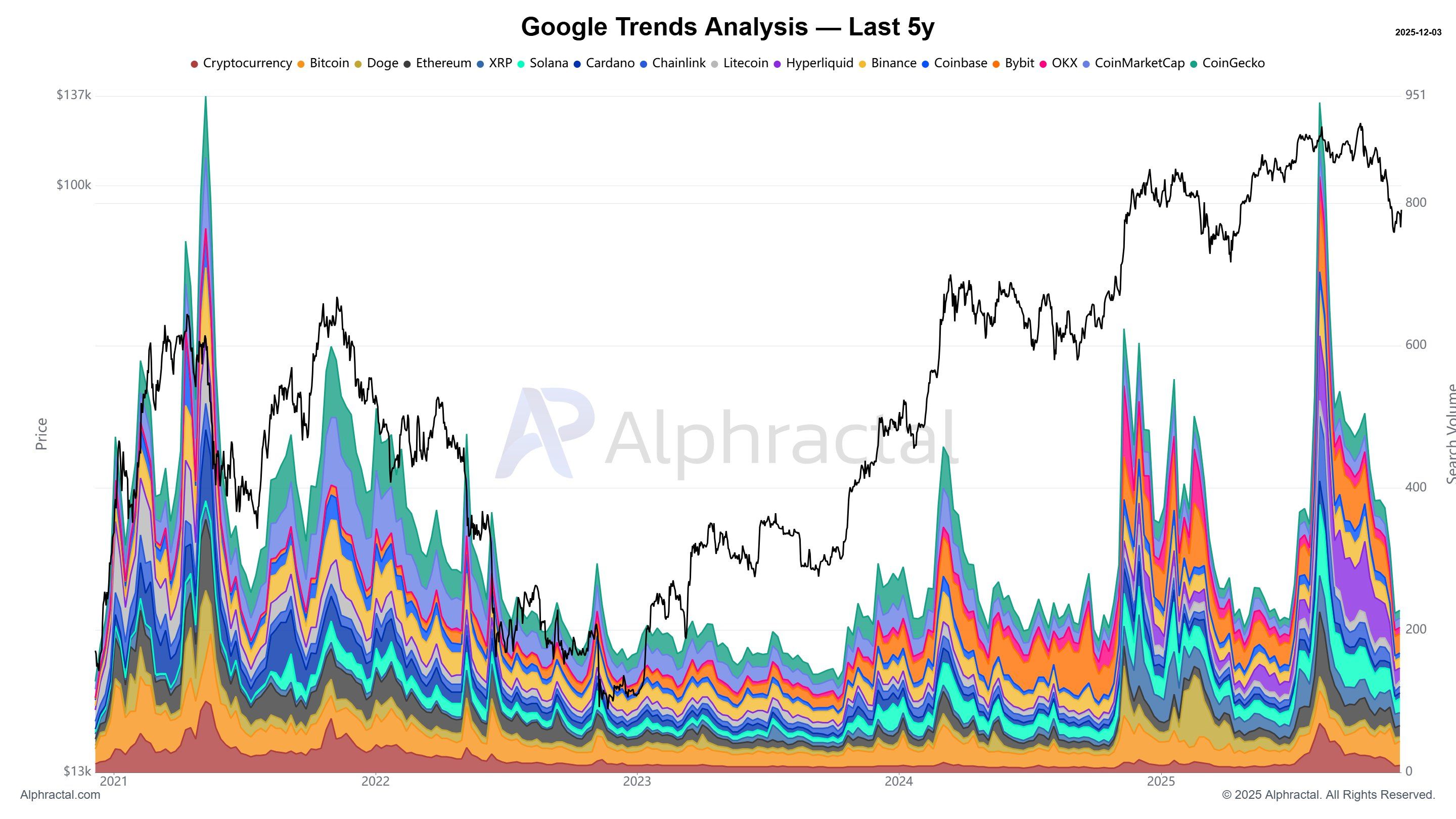

The second cause stems from declining social curiosity, as mirrored in Google Developments – a counterintuitive sign that always signifies potential hypothesis alternatives.

Knowledge from Joao Wedson, CEO of Alphractal, exhibits that searches for crypto-related subjects, main exchanges like Binance or OKX, and market trackers reminiscent of CoinMarketCap or CoinGecko have dropped 70% from the September 2025 peak.

“Historically, low social interest has been associated with bear markets — but ironically, these periods have also been the best times to speculate while everyone else is disengaged,” Joao Wedson stated.

His reasoning aligns with the basic mindset of being grasping when others are fearful. Historic knowledge present that declining curiosity sometimes seems close to market bottoms. This conduct appears to be attribute of the cryptocurrency market.

Santiment additionally notes that unfavourable discussions throughout varied platforms, together with X, Reddit, Telegram, 4Chan, BitcoinTalk, and Farcaster, typically align with market bottoms. This sample has resurfaced just lately.

Sponsored

Sponsored

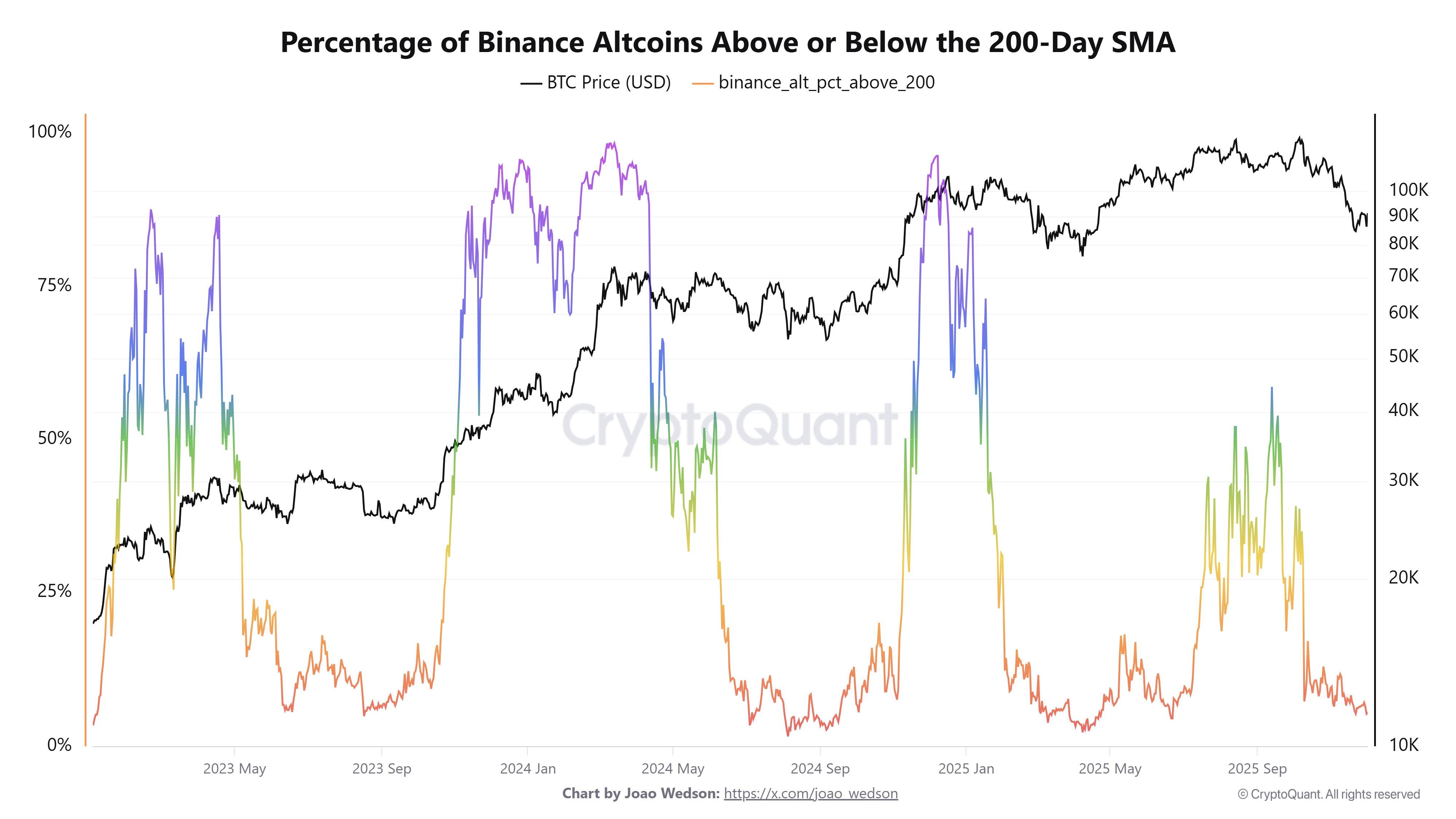

95% of Altcoins Are Buying and selling Beneath the 200-Day SMA

The third cause comes from technical indicators. Roughly 95% of altcoins are buying and selling under the 200-day Easy Transferring Common (SMA), a traditionally important purchase sign.

CryptoQuant knowledge exhibits that solely 5% of altcoins at the moment commerce above the 200-day SMA. This determine displays harsh situations for altcoin holders, a lot of whom are probably experiencing losses.

Traditionally, when this metric drops under 5%, the market typically kinds a backside and later phases robust recoveries.

From this angle, traders who allocate capital progressively and start DCA throughout such phases might generate earnings after a number of months.

Sponsored

Sponsored

USDT Dominance Exhibits Indicators of Correcting in December

The ultimate cause comes from USDT Dominance (USDT.D), which displays USDT’s share of the entire market capitalization. When USDT.D decreases, it signifies that traders are utilizing USDT to buy altcoins.

This shift seems to be occurring in December as USDT.D pulls again from the 6% resistance zone.

USDT.D (1W) – rotation stress constructing

Stablecoin dominance is as soon as once more forming a high on the similar resistance zone that has capped each rally since jan 2024.

Every time USDT.D tags this degree:

Momentum stalls, Stochastic RSI tops out and capital rotates into altcoins.

We’re… pic.twitter.com/V40SXfjyYE

— CrypFlow 📉📈 (@_Crypflow_) December 4, 2025

CrypFlow’s statement additionally signifies that the weekly stochastic RSI of USDT.D confirms a bearish cross.

A latest report from BeInCrypto notes that whole stablecoin market capitalization started rising once more in early December after declining all through November. This development displays rising stablecoin accumulation in preparation for getting alternatives.

These 4 components point out that December presents a number of key situations for a DCA technique. Nonetheless, selecting which altcoins to build up presents a separate problem. Many consultants consider the market has modified, and never all altcoins will ship robust features as seen in earlier altcoin seasons.