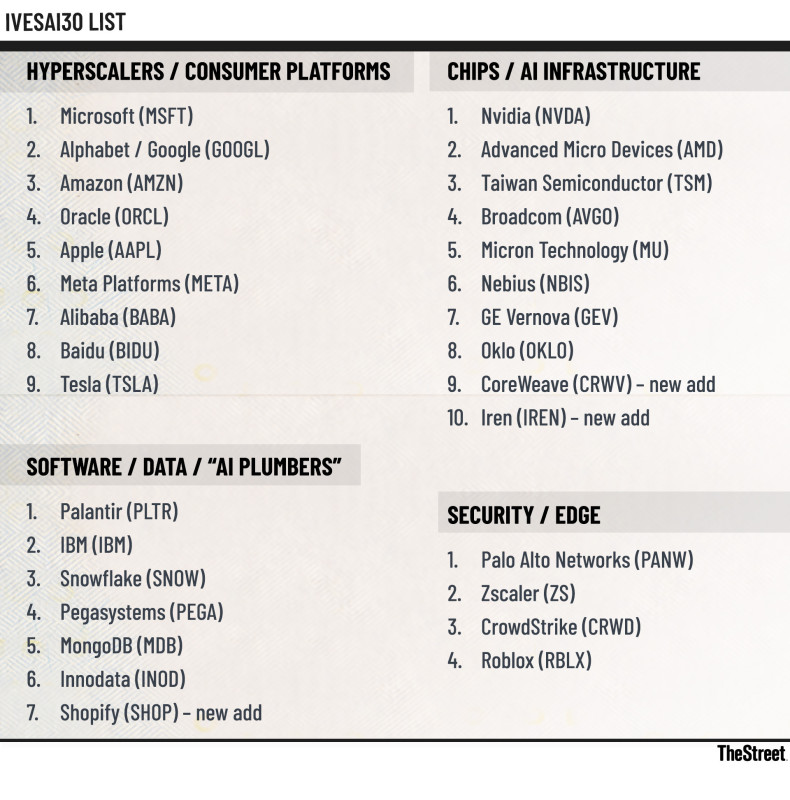

Dan Ives is again with a recent shakeup to his widespread IVESAI 30 record.

The veteran tech analyst at Wedbush simply added two red-hot AI pure-plays in CoreWeave (CRW), Iren (IREN), and one other tech large, Shopify (SHOP), to his roster of AI winners heading into 2026.

He’s hailing them as arguably three of the best-positioned tech names for the sector’s shift from infrastructure buildout to actual monetization.

Ives has been pounding the desk on AI and its potential to spearhead an enormous super-cycle, predicting one other 20% leap in tech shares subsequent yr.

In his opinion, it isn’t a bubble that’s ready to burst, however the early innings of the Fourth Industrial Revolution, he instructed CNBC.

The refreshed record now gives a clearer snapshot of the place the cash and momentum are anticipated to maneuver subsequent.

Ives has constructed a popularity over time along with his prescient calls on the best in tech, making it just about unattainable to disregard the record.

Dan Ives is pointing buyers towards two recent AI shares he says may lead the 2026 surge.

Picture by Myunggu Han on Getty Pictures

Ives expands his AI winners circle

Ives’ up to date record leans closely on companies supplying the compute, the ability, and the size wanted for AI’s subsequent chapter.

That stated, three recent names simply earned their method into the winner’s circle.

Dan Ives’ “AI 30” Listing

T

CoreWeave is the AI infrastructure rocket ship

CoreWeave’s insane rise within the AI infrastructure area has been nothing wanting extraordinary.

It notched one of many greatest IPOs in trendy tech historical past, valuing the enterprise at a whopping $23 billion, Reuters reported.

Associated: Cathie Wooden dumps $8.46 million in software program large

Since then, it has ridden an unimaginable surge in demand for GPU-heavy cloud capability, benefiting from an insatiable starvation for extra compute.

Moreover, with its distinctive positioning as a “neocloud” tailor-made for AI mannequin coaching and inference, it has been capable of ink multi-billion-dollar contracts with tech heavyweights equivalent to OpenAI, Meta, and Microsoft.

That features a huge five-year OpenAI deal, initially price $11.9 billion, which has now expanded to roughly $22.4 billion, together with a six-year, $14.2 billion settlement with Meta.

Nvidia is a major a part of the general dynamic. It holds a 6% stake within the firm and agreed to a $6.3 billion capability backstop by way of 2032, in response to Reuters, which ensures CoreWeave’s demand, even throughout downturns.

Iren: Clear vitality meets AI information facilities

Iren is one other red-hot inventory (up virtually 400% yr so far) that’s gone from a Bitcoin to maybe the largest behind-the-scenes AI participant.

Separating it from the pack is its buildout of vertically built-in AI information facilities operating on 100% clear vitality.

That provides it a aggressive edge as AI workloads explode.

In line with a World Sources Institute report, the U.S. information facilities may account for someplace between 4.6% and 12% of complete electrical energy demand by 2030, and at present, about 56% of that energy comes from fossil fuels.

Associated: Nvidia faces a fast-growing rival you’ll want to find out about

That explains Iren’s push to increase shortly, having secured 3 gigawatts of unpolluted energy capability in North America, with 2.9 GW devoted to GPU information facilities.

A assured energy footprint is a significant strategic asset, which is why Iren has grown as massive because it has, with a market cap exceeding $13 billion because it secures extra marquee AI internet hosting offers.

Shopify turns AI into real-world income

Shopify will not be your basic AI inventory, nevertheless it’s been weaving the expertise by way of its sticky ecosystem to nice impact.

It’s the type of real-world AI monetization Ives feels may outline 2026.

Shopify has the basics to again it up, having grown its high line by over 23% previously three years, and greater than 30% yr over yr.

On high of that, it continues to scale profitably, with its three-year free money circulation progress at an outstanding 64%, together with $6.50 billion in its money until.

With its immense scale, Shopify can proceed layering AI throughout thousands and thousands of retailers and customers, a much more quick payoff than different speculative AI performs.

Wedbush shifts focus away from lagging performs

Wedbush’s newest replace additionally highlighted names Ives believes are unlikely to maintain up with the subsequent part of the AI cycle.

SoundHound, ServiceNow, and Salesforce obtained booted off the record, every for various causes.

As soon as an Nvidia-backed firm, SoundHound was touted as a promising voice-AI challenger. Since then, it has struggled to carve out a moat towards the bigwigs in Amazon, Apple, and Google.

Extra Tech Shares:

- Traders hope excellent news from Nvidia provides the rally extra life

- Palantir CEO Karp simply settled main debate

- Spotify simply solved a significant drawback for listeners

- Amazon lawsuit could possibly be a warning to different employers

Regardless of posting a 68% year-over-year income enhance in Q3, it stays deeply within the purple and is determined by inorganic progress to drive growth, a difficult combine when dilution and aggressive strain are rising.

ServiceNow and Salesforce have been eliminated for his or her sluggishness in monetizing AI.

Each rolled out recent AI options, however the affect on top-line growth has been largely modest.

Salesforce posted $1.2 billion in annualized AI-related gross sales, nearly 5% of complete gross sales, as aggressive pressures from Microsoft continued weighing down outcomes.

Furthermore, ServiceNow has layered its widespread Now Platform with nifty new generative AI assistants and workflow instruments, however Wedbush notes that these features have but to provide significant AI-driven gross sales.

Associated: This defense-AI inventory is up 50 p.c in 6 months: It’s not Palantir