Picture supply: Getty Pictures

Passive earnings hunters typically look to the FTSE 100 for dependable dividends – however may ChatGPT truly construct a greater passive earnings ISA portfolio than a human? I made a decision to place it to the take a look at.

Choice standards

ChatGPT started by laying out a set of wise ideas for constructing a passive earnings portfolio. These included:

- Sustainable payout ratios

- At the very least a decade of constant dividends

- Sturdy free money stream era

- Defensive, resilient enterprise fashions

- Significant world income publicity

It additionally warned in opposition to counting on extremely cyclical firms with stop-start dividend histories.

To be truthful, that’s a strong framework for anybody chasing long-term passive earnings. However what in regards to the shares it picked primarily based on these standards?

Core inventory portfolio

The bot got here again with 5 “core” shares: Unilever, Diageo, Nationwide Grid, Shell, and HSBC. Based mostly on the factors above, the primary and the final seem like worthy contenders. However I’m far much less satisfied by the remaining three.

Take Diageo. Neglect the share worth collapse – the larger subject is leverage. Its internet debt-to-EBITDA ratio is now above thrice. With a brand new CEO plus a cost-cutting programme underway, I wouldn’t rule out the danger of a dividend reset.

Nationwide Grid lately rebased its dividend decrease to assist fund its £60bn capital funding plan. Shell reduce its payout throughout Covid too. To be truthful, it has rebuilt the dividend since then, however with a yield of simply 3.8%, it hardly qualifies as a passive earnings standout.

Excessive yielder

A really excessive headline yield doesn’t mechanically make a inventory poisonous – it simply means it’s worthwhile to dig a bit deeper.

Authorized & Common (LSE: LGEN) yields 9.1%, solely behind beleaguered WPP. On paper, it’s not low cost: trailing price-to-earnings (P/E) sits at 81.

Dividend cowl is fragile too, at simply 0.14 occasions, with earnings barely overlaying the payout. Detrimental free money stream over the past two years has meant tapping different sources to take care of the dividend.

So why do I personal the inventory regardless of these worrying metrics?

Various measure

The problem with relying solely on customary IFRS accounting is that it may possibly masks an organization’s actual sources of capital.

A extra significant metric, utilized by the enterprise itself, is working surplus era (OSG). This measures the underlying, sustainable earnings engine of the corporate.

Dividends are funded by this long-term surplus, not by short-term accounting earnings or money stream fluctuations. It at the moment stands at 1.42 occasions, which is wholesome.

Compounder

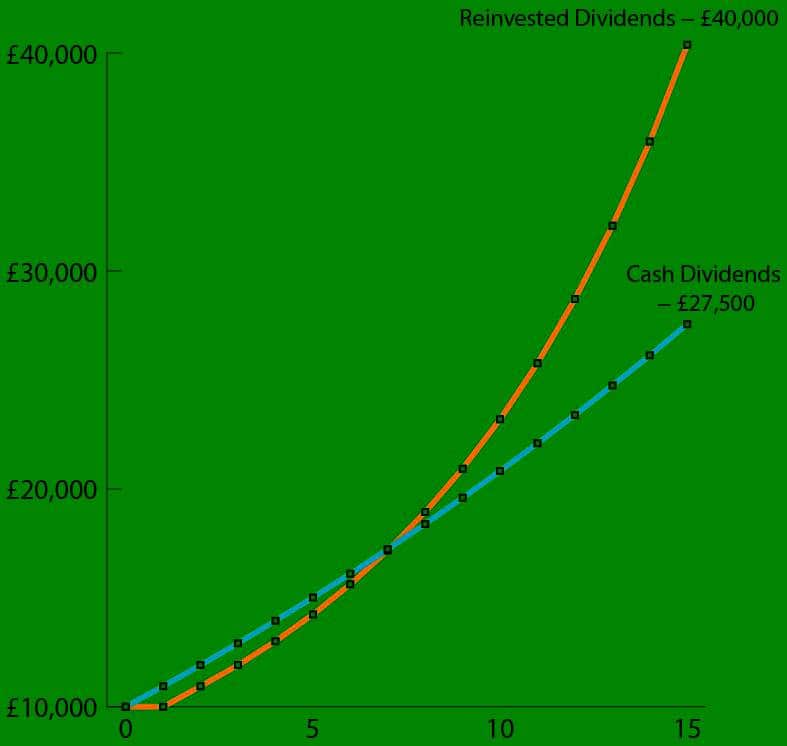

To visualise the inventory’s passive-income potential, I like to indicate how dividends can compound over time. If I invested a lump sum of £10,000 and reinvested all dividends for 15 years, how a lot may it develop?

Chart generated by creator

Assuming zero share worth progress and a 3% annual improve in dividends per share, my preliminary funding may compound into 4 occasions its unique worth over that interval.

In fact, rather a lot can occur over the following 15 years. A recession may result in a dividend reduce or there may be leaner years. However averaging all of it out, I view the mannequin as extraordinarily conservative in nature.

Authorized & Common is certainly one of my oldest ISA holdings and I’ve topped up alongside the way in which too, serving to to construct a gradual passive earnings stream.