Picture supply: Getty Photographs

The FTSE 250 index is house to round 70 funding trusts as we speak. As such, there’s loads of selection for folks trying to construct long-term wealth.

Right here’s one FTSE 250 progress belief that I believe’s price taking a better have a look at proper now.

US progress shares

Baillie Gifford US Progress Belief (LSE:USA) does just about what its identify says. It goals for out-and-out progress by a portfolio of US-listed shares. So it’s no shock to see high-quality names like Amazon, Shopify, Nvidia, Netflix and Meta close to the highest of the portfolio’s inventory listing.

The belief additionally offers traders publicity to unlisted progress companies like rocket maker SpaceX and digital funds big Stripe. In truth, this pair make up two of the highest three holdings, price greater than 11% of the portfolio.

Nonetheless, to separate it from huge brother Scottish Mortgage within the FTSE 100, US Progress has decent-sized positions in smaller firms like software program agency Datadog and sports activities betting firm DraftKings.

Its unlisted portfolio additionally has start-ups not present in Scottish Mortgage. The managers consider a few of these disruptors might turn out to be the inventory market giants of tomorrow.

However are we in an AI bubble?

In fact, one key danger is that if we’re in an AI bubble as we speak. Even Alphabet boss Sundar Pichai has simply been telling the BBC that there’s a component of “irrationality” within the ongoing AI funding growth.

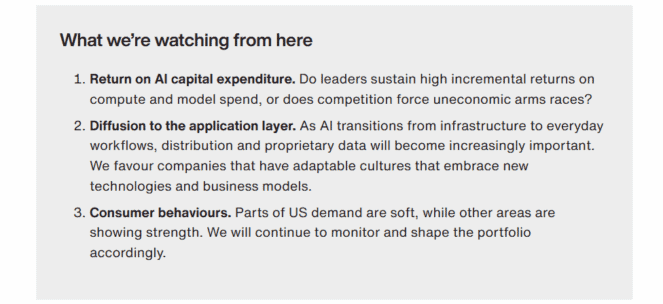

Baillie Gifford isn’t blind to this danger, saying “there’s a non‑zero likelihood that we’re in an exuberant part of AI infrastructure construct‑out, very similar to railroads, PCs, or the early web“.

Nonetheless, the belief has been pondering so much about this, arguing that inventory selectivity is “paramount“. It factors out that regardless of Nvidia’s earnings exploding, its price-to-earnings ratio is barely barely above its 2022 lows and materially beneath its five-year common.

That’s a far cry from Cisco within the dotcom bubble, when a surging share worth pushed valuations to extremes at first collapsed.

Additionally, whereas nonetheless believing that effectivity beneficial properties from AI are being underappreciated by traders, the belief’s managers have additionally been investing in non-AI areas like healthcare and industrials.

Supply: Baillie Gifford, November 2025.

Supply: Baillie Gifford, November 2025.

Enhancing efficiency

The belief had a sticky patch in 2022 when rates of interest shot up. This put stress on the valuations of progress shares.

Nonetheless, the surroundings appears extra settled now, with rates of interest more likely to ultimately settle into the two%-3% vary. As such, efficiency has improved. Within the 12 months to 30 Could, the belief returned 24.5%, simply beating the entire return of seven.2% for the S&P 500 index.

Low cost

At 264p, Baillie Gifford US Progress Belief is buying and selling at an 8.5% low cost to its underlying web asset worth per share. Basically, this implies traders should buy into the portfolio for lower than it’s perceived to be price (although unlisted property do add a little bit of complexity to the valuation course of).

Trying to the long run, I believe this belief is completely positioned to learn because the tech revolution deepens. And traders may subsequently wish to contemplate it for inclusion in a diversified portfolio.

In any case, even whereas warning about dangers, Alphabet’s boss additionally says AI is “the most profound technology” humankind is engaged on.