The US financial system has surged over the previous two quarters, however not everyone seems to be cheering. A lot of the US financial system’s power has come from a flood of synthetic intelligence spending, relatively than as a result of US shoppers are feeling flush.

Tens of millions of Individuals are struggling to satisfy their on a regular basis bills, and with tariffs boosting inflation this 12 months, it hasn’t gotten any simpler.

Whereas inflation retreated steadily in 2024, it has rebounded since April, when President Trump’s reciprocal tariff technique was introduced. Client Value Index, CPI, inflation was 3% in September, up from 2.3% in April.

U.S. CPI inflation price in 2025 by month:

- September: 3%

- August: 2.9%

- July: 2.7%

- June: 2.7%

- Might: 2.4%

- April: 2.3%

- March: 2.4%

- February: 2.8%

- January: 3%

Supply: BLS

That is not excellent news for U.S. employees, particularly since cracks have shaped within the U.S. job market. Unemployment wasn’t reported for September because of the shutdown in Washington, however it clocked in at 4.3% in August — the best since 2021.

In the meantime, the variety of unfilled jobs shrank to 7.2 million in August, down from over 12 million in 2022, based on the Bureau of Labor Statistics’ Job Openings and Labor Turnover Survey, or JOLTS.

The decline in accessible jobs and an increase in layoffs as inflation rises has put the U.S. financial system on a razor’s edge, and Financial institution of America’s newest report on employee pay suggests the state of affairs is prone to worsening.

Wages are rising extra slowly than inflation for hundreds of thousands of employees

Financial institution of America is likely one of the largest banks in the USA. It was based in 1904 and it serves about 70 million clients throughout over 3,700 branches.

Its standing offers it with perception into a large swath of America’s employees, offering it with a singular skill to gauge the well being of the financial system and households.

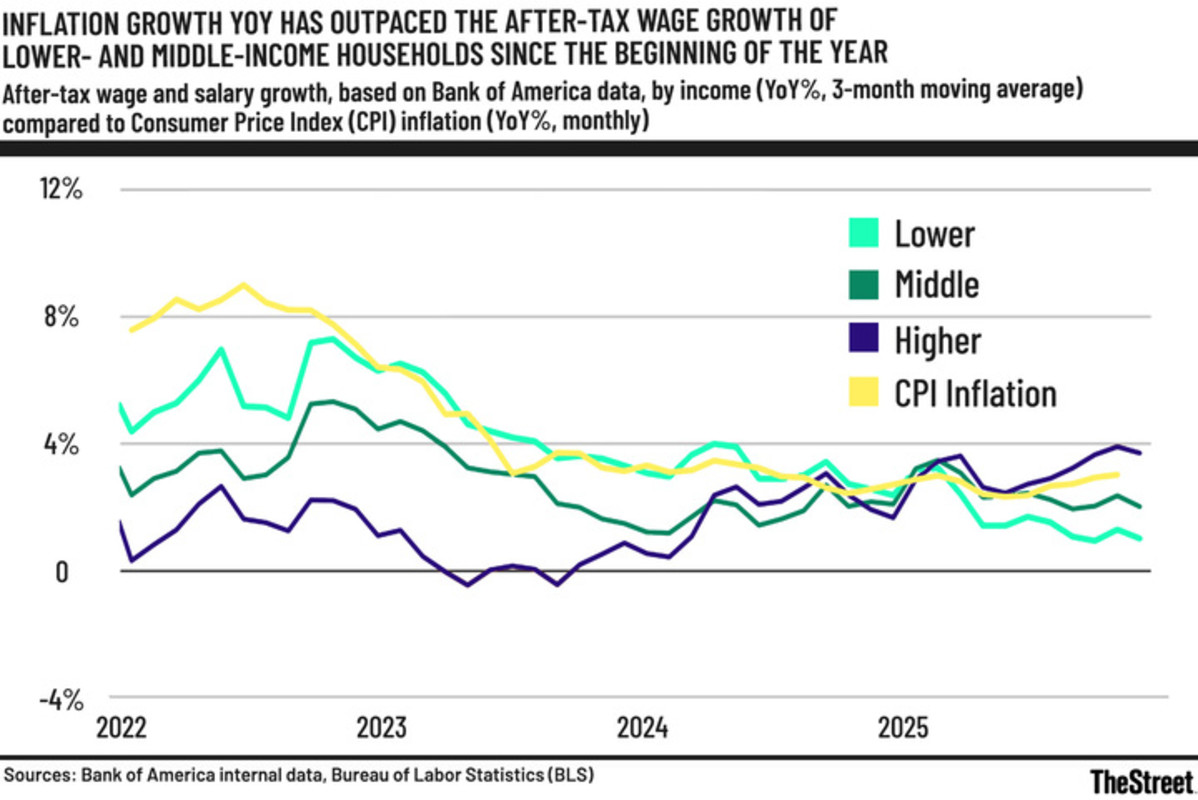

Its newest report crunching reveals a regarding pattern: pay for many Individuals is not retaining tempo with inflation once more. Solely the highest-income earners are seeing wages develop quicker than costs.

The slower-than-inflation pay development for lower- and middle-income Individuals is hitting millennials and Gen X the toughest.

“The number of lower-income households (especially Millennials and Gen X) living paycheck to paycheck continues to rise while there is almost no increase in the number of higher- and middle-income households,” mentioned Financial institution of America’s analysts.

Low-income households dwelling paycheck to paycheck by 12 months:

- 2025: 29%

- 2024: 28.6%

- 2023: 27.1%

Supply: Financial institution of America.

It has been a special story for high-income Individuals. Whereas there was a gentle stream of layoffs in high-paying jobs, together with these at main expertise corporations like Amazon and Microsoft, higher-income earners are nonetheless receiving larger raises than inflation.

For instance, higher-income millennials have seen their wages improve 5% quicker than these of lower-income millennials. Pay bumps for Gen X high-income earners have outpaced lower-income earners by 4%.

Total, higher-income earners skilled a 3.7% wage improve 12 months over 12 months in October.

Excessive-income wage development stays above inflation, however low and middle-income pay development is falling quick.

Financial institution of America/TheStreet

“Wages for lower-income earners have been easing relative to their higher-income counterparts since the beginning of 2025, after having risen much faster in 2021-22, before cooling in 2023-24 and falling this year,” mentioned Financial institution of America.

Retailers report widening hole

The hit to center and low-income-earning households is lowering discretionary budgets and forcing many to rethink their spending. The most recent tendencies within the fast-food trade are emblematic of the state of affairs.

In its newest earnings name, McDonald’s CEO Chris Kempczinski mentioned:

The spending tendencies in retail additionally replicate a shift towards low cost retailers, corresponding to T.J. Maxx, Marshalls, Burlington Shops, and Greenback Tree.

“Discount apparel spending accelerated to 3.3% [year over year] in October,” mentioned Financial institution of America retail analysts in a analysis notice shared with TheStreet.

That is a pointy distinction to spending at malls, which has been flat or unfavorable in comparison with the prior 12 months each month since March. Within the week ending Nov. 1, larger revenue shoppers spent 1.1% greater than final 12 months at malls, whereas decrease revenue shoppers spent 2.7% much less.

“The spread in clothing spending between low-income and high-income households remains high as inflation continues to have an outsized impact on lower-income spending across industries,” mentioned the analysts.

The dynamic is not overly reassuring as a result of it means that the US financial system is turning into more and more reliant on the spending of high-income earners. If job tendencies worsen or we see a downturn within the inventory market or house values, it may ship the financial system reeling.

Associated: Fed official forecasts big financial shift coming quickly