Picture supply: Getty Photographs

If Lloyds Financial institution analysis is to be believed, a whopping 28m of us Britons use ChatGPT to affect our private finance choices. This consists of finishing up inventory market analysis and searching for share suggestions. May the mannequin inform me which course the BP (LSE:BP.) share worth will go subsequent?

ChatGPT mentioned…

I’m not satisfied by synthetic intelligence (AI) fashions and their capability to supply sage investing viewpoints. I’ve discovered its rationale behind inventory choosing concepts and broader private finance suggestions to be questionable. A lot of the knowledge it bases its views on may also be hopelessly unsuitable.

However hey, within the pursuits of public service I’ve requested ChatGPT to supply a near-term forecast for BP’s shares. Who is aware of? It may a minimum of present some fascinating nuggets for consideration, even when it doesn’t reply my query.

I requested it: “Will the BP share price rise or fall over the next 12 months?” Its reply was:

I lean to a modest rise slightly than a pointy climb.

Good and unhealthy

ChatGPT mentioned that “if oil/fuel costs maintain up or enhance and BP executes price controls, the share worth may rise by maybe 10% to twenty% over 12 months“.

It added that the FTSE 100 firm “advantages from increased oil & fuel costs, sturdy dividend yield, and scope for share buybacks if money flows enhance“.

Within the pursuits of stability, ChatGPT additionally mentioned that “there’s materials threat of flat efficiency or perhaps a decline if oil costs drop, or BP misses on buybacks/dividends“.

The AI added that “if these fall (due to global slowdown, regulatory risk, supply changes), the share price could drop.”

Flawed solutions

On the entire, ChatGPT’s solutions have been hardly illuminating. Oil worth threat is a extreme and fixed hazard to vitality shares, and one which the AI didn’t actually deal with by way of right now’s provide and demand image.

The opposite data it supplied was pretty customary, too, and contained nothing that market commentators and analysts haven’t been speculating on for months (if not years). However most worrying to me was the actual fact ChatGPT’s prediction that BP’s shares may rise 10%-20% was based mostly on out-of-date data.

This assumed a share worth rise from 444p per share right now to 492p. BP’s share worth truly sits round 464p, which might characterize a much more modest 6% enhance.

Extra worth forecasts

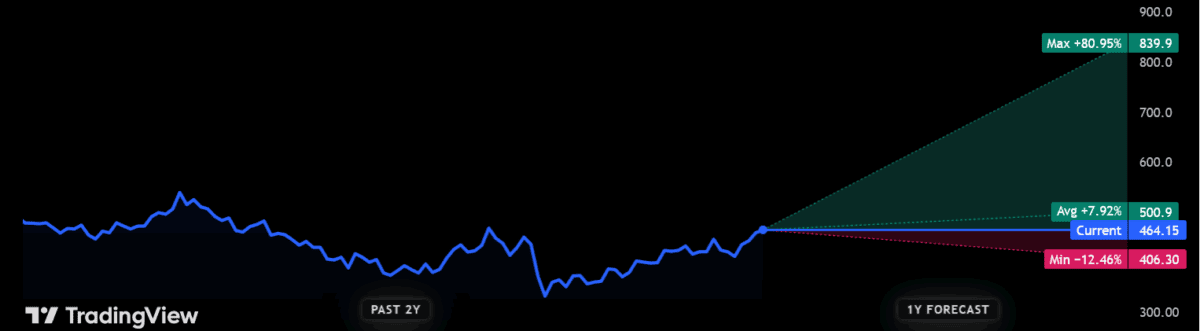

I took a have a look at Metropolis forecasts for BP after consulting ChatGPT. The 29 analysts with rankings on the inventory have connected a mean worth goal of round 501p per share, up 8% from right now’s ranges.

However as you may see, analysts aren’t united of their bullishness, with some sharp share worth falls additionally predicted:

Supply: TradingView

Supply: TradingView

BP’s share worth may certainly surge if oil costs rise. Nevertheless, there’s additionally a excessive hazard of the reverse situation transpiring as each OPEC+ nations and different nations ramp up crude manufacturing. With the Footsie firm additionally scaling again its inexperienced vitality ambitions, it’s far too dangerous for me because the transition in the direction of renewables and nuclear heats up.