Picture supply: BT Group plc

With BT Group (LSE: BT.) set to announce its half-year outcomes tomorrow (5 November), buyers shall be eager to listen to about any dividend steering.

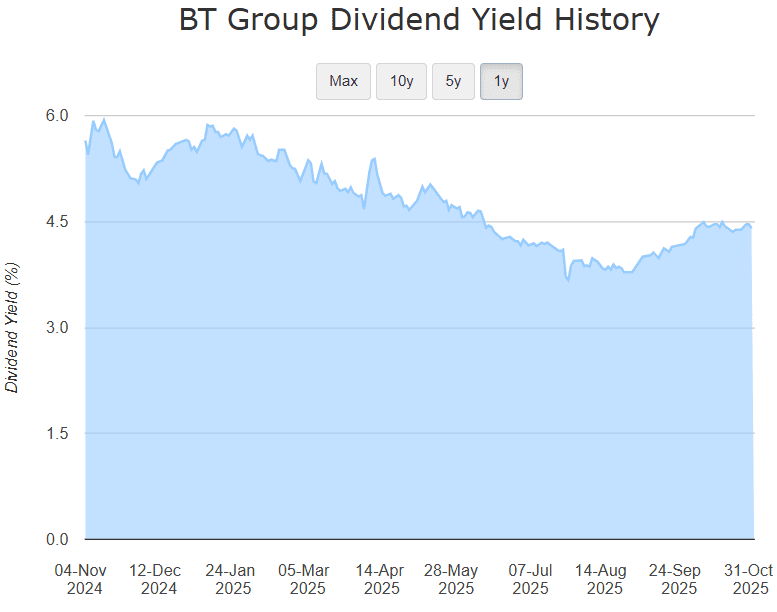

It at the moment has a dividend yield of round 4.4% – down considerably from roughly 6% in November final 12 months. The discount comes because the group raised its dividend by 3.9% in 2024, and by solely 2% within the newest 12 months. In the meantime, a roughly 30% share-price enhance over the previous 12 months has labored to tug the yield decrease.

So the large query is: will the yield proceed falling, or may this week’s outcomes sign bigger dividend rises in 2026?

Let’s see what the analysts are saying.

Reasonable progress potential

Forecasts level to average dividend will increase fairly than something spectacular. For instance, dividend-per-share expectations rise from about 8.16p to eight.33p in 2026, and the view is that the yield may climb to round 4.8% over the approaching years.

That suggests a modest enhance – maybe sufficient to draw income-oriented buyers, however unlikely to generate a lot pleasure.

After all, historical past has taught us that such forecasts depend on many assumptions and are seldom spot-on. If the share worth fell sharply, the yield may bounce greater (because it did in 2022). Conversely, if the share worth continues climbing, the yield may slip again beneath 4%.

Screenshot from dividenddata.co.uk

Screenshot from dividenddata.co.uk

That stated, BT has a reputable monitor file of elevating dividends. After the 2008 monetary disaster the corporate delivered annual will increase of 6% to 14% for a number of years. The pandemic interrupted this momentum, however the dividend now appears steered in direction of returning to pre-2019 highs (round 15.4p per share).

If the group opts for aggressive hikes as soon as the heavy funding section ends, the dividend may doubtlessly double by 2030 and produce the yield nearer to eight%.

Mitigating elements

Nevertheless, buyers ought to weigh up vital mitigating elements. The financial atmosphere may be very completely different at the moment: lingering results of the pandemic have given solution to issues reminiscent of geopolitical battle and commerce tariffs.

BT can also be in the midst of a significant community improve, which is draining earnings and placing strain on debt (internet debt stays round £20bn). These burdens restrict the tempo at which the dividend may rise, at the least within the close to time period.

On the brilliant aspect, two metrics give trigger for delicate optimism. First, the corporate’s cash-dividend protection appears to be like robust and the present valuation nonetheless appears modest in sure respects. Its price-to-earnings progress (PEG) ratio is cited at 0.68 and price-to-sales (P/S) about 0.91.

If investor confidence and fairness ranges enhance, debt pressures may ease and assist extra significant dividend rises.

Last ideas

BT’s financials and valuation seem to assist the case for additional dividend will increase. Even when massive rises don’t materialise imminently, the present dividend yield makes the inventory price contemplating as a part of an income-oriented portfolio.

That stated, the proof of the pudding is within the consuming: if this week’s outcomes fail to impress, the share worth may take successful. The yield could rise briefly consequently however that’s not ultimate for current shareholders.

I believe that till BT sees the fruits of its digital community improve, dividend will increase will stay average. In brief, the dividend yield is stable and the outlook is regular, however there’s little indication but of a dramatic leap forward.