Warren Buffett isn’t one to flinch usually, however Berkshire Hathaway’s (BRK.A, BRK.B) newest transfer turned heads.

The corporate quietly offered $6.1 billion in inventory in Q3, with the corporate’s steadiness sheet trying loads much less like a buying spree and extra like a ready room.

Berkshire’s income nonetheless got here in sizzling, however its urge for food for offers cooled considerably, a transparent sign that even Buffett, who’s lengthy been thought-about the inventory market’s optimist-in-chief, is perhaps bracing for rougher seas.

Warren Buffett is known for saying alternatives come at occasions when others are fearful. Recently, although, he appears to assume everybody’s a bit too assured.

Buffett’s disciplined method reveals once more as Berkshire quietly reshapes its huge portfolio.

Picture supply: Zuchnik/WireImage through Getty Photos

Warren Buffett’s Berkshire dumps $6.1 billion in inventory

Warren Buffett isn’t recognized for blinking, however Berkshire’s Q3 outcomes present the 95-year-old investor is in a uncommon defensive crouch.

The large headline is that the investing large offloaded $6.1 billion in frequent inventory throughout the three months ending September 30.

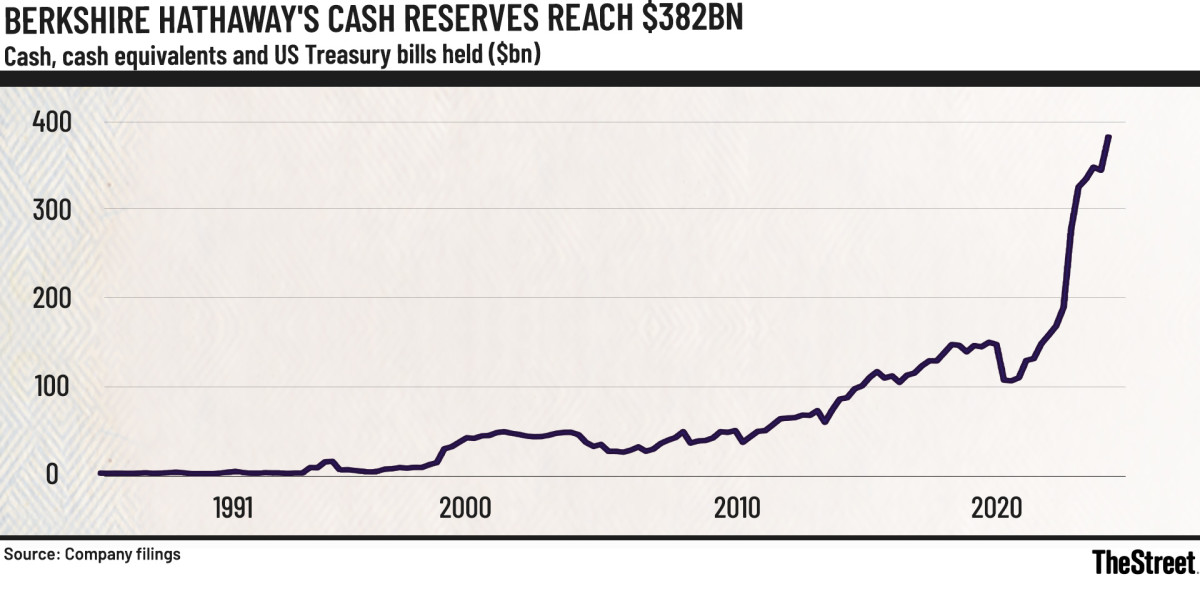

That was the third straight yr of internet promoting, whereas its money until soared to a file $382 billion. Moreover, that unbelievable money mountain excludes one other $23 billion parked in short-term Treasuries, highlighting how Buffett sees extra worth in ready than in shopping for.

For many years, Berkshire has constructed a repute for scooping up bargains when markets stumbled.

Extra Warren Buffett:

- Financial institution of America quietly echoes Warren Buffett’s favourite technique

- Warren Buffett’s Berkshire Hathaway reveals homebuying transfer

- Warren Buffett strains up Berkshire’s largest deal in years

- Warren Buffett’s retirement creates a shopping for alternative

Nonetheless, with AI bubble chatter throughout, he’s choosing endurance over aggression. Additionally, Berkshire hasn’t repurchased shares for 5 consecutive quarters, whereas its Class A inventory has lagged the S&P 500 by 12% since Buffett introduced his retirement earlier this yr.

Even after trimming billions in inventory, although, Berkshire’s portfolio stays tightly targeted. As of September 30, 2025, simply 5 corporations made up 66% of Berkshire’s inventory holdings.

These 5 shares comprise two-thirds of Berkshire Hathaway’s holdings:

- Apple (AAPL)

- American Specific (AXP)

- Financial institution of America (BAC)

- Coca-Cola (KO)

- Chevron (CVX)

Why promoting now breaks Buffett custom

Buffett has constructed his empire by working towards worry, not away from it.

Each Buffett fan is conversant in his mantra to “be greedy when others are fearful,” spearheaded by a few of his boldest bets within the 2008 disaster and opportunistic strikes throughout 2020’s Covid chaos.

Associated: Palantir may very well be observing an enormous downside

That’s precisely why promoting into power in Q3 might really feel off-script.

Nonetheless, the markets are agency, and pricing multiples are wealthy. For perspective, Factset estimates that on a 12-month foundation, the S&P 500 is buying and selling round 22.9 occasions earnings (10-year common at 18.6 occasions).

Moments when Buffett went towards the group:

- Sept. 2008 – Buys Goldman within the panic: Berkshire injected $5 billion into Goldman Sachs’ most popular inventory on the peak of the disaster.

- Aug. 2011 – Bails out BofA: Places $5 billion into Financial institution of America most popular shares, together with $700 million price of warrants (coming at a remarkably low level).

- Might 2020 – Dumps airways early: Exited all stakes in American Airways, Delta Air Traces, Southwest Airways, and United Airways, saying “the world has changed,” whereas others saved chasing the reopening rally. Supply:Reuters

Berkshire’s battle chest nears $390 billion

Berkshire Hathaway’s money machine continues to roar.

It wrapped up Q3 with roughly $382 billion in money and Treasury payments, up from $344 billion in June (the most important quarterly bounce in its historical past).

Berkshire Hathaway’s money reserves attain $382 billion chart

Berkshire Hathaway

Furthermore, the Omaha large’s working revenue skyrocketed by 33.6% yr over yr to $13.49 billion, led by a pointy rebound in insurance coverage underwriting, the place income almost tripled to $2.37 billion.

Associated: ChatGPT maker OpenAI might quickly set one other file

On the similar time, internet revenue rose 17.3% to $30.8 billion, as a result of power throughout just about each main enterprise. Its reported Q3 earnings per share of $6.25 beat market estimates by a good-looking 52 cents.

Even a relative laggard like BNSF Railway posted a 4.8% acquire in after-tax earnings, whereas income in manufacturing and retail jumped over 8%.

Life after the Oracle of Omaha‘s retirement

As he steps down on December 31, 2025, Buffett formally passes the baton to Greg Abel, who turns into CEO in January 2026.

Abel takes the reins at a time when Berkshire is sitting on a file money pile with zero buybacks, giving him room to maneuver with out swinging blind.

Three challenges new Berkshire CEO Greg Abel faces:

- Capital allocation at scale: Deploying a $380 billion money battle chest with out diluting returns.

- Sustaining the Berkshire “moat”: Preserving decentralized autonomy backed by capital self-discipline whereas tightening threat controls in areas corresponding to insurance coverage, utilities, and different capital-intensive items.

- Signaling to markets: Speaking a transparent playbook (buybacks, offers, dividends).

Associated: Apple CEO’s iPhone 17 pitch has clear message for customers