Zcash (ZEC) has turned heads with a close to 400% surge in October and a 44.2% bounce this week. Even the previous 24 hours added one other 6.6%, exhibiting robust shopping for strain. However whereas the Zcash value retains climbing, indicators of exhaustion are surfacing.

Momentum indicators now level to a pullback danger, at the same time as Zcash stays inside a bullish construction.

Sponsored

Pullback Dangers Develop as Value Outpaces Momentum

Between October 11 and October 29, Zcash’s value saved making increased highs, whereas the Relative Power Index (RSI) made decrease highs. RSI is a momentum indicator that measures shopping for versus promoting power. When costs rise whereas the RSI falls, it indicators bearish divergence — indicating that momentum isn’t confirming the transfer.

This divergence has come amid Zcash’s 400% month-on-month rally, suggesting that the surge itself is now driving RSI danger. In different phrases, value has moved too far, too quick, and RSI hasn’t adopted. That imbalance normally hints at a cooldown.

ZEC Value And Constructing Bearish Divergence: TradingView

Word: Whereas this type of bearish divergence on the each day chart typically indicators a development reversal, ZEC’s near-term historical past reveals commendable value power. That power may restrict the pullback danger, if and when the Zcash value corrects.

Notably, Zcash continues to be using its flag-breakout momentum, and the broader rally appears to be like intact.

Sponsored

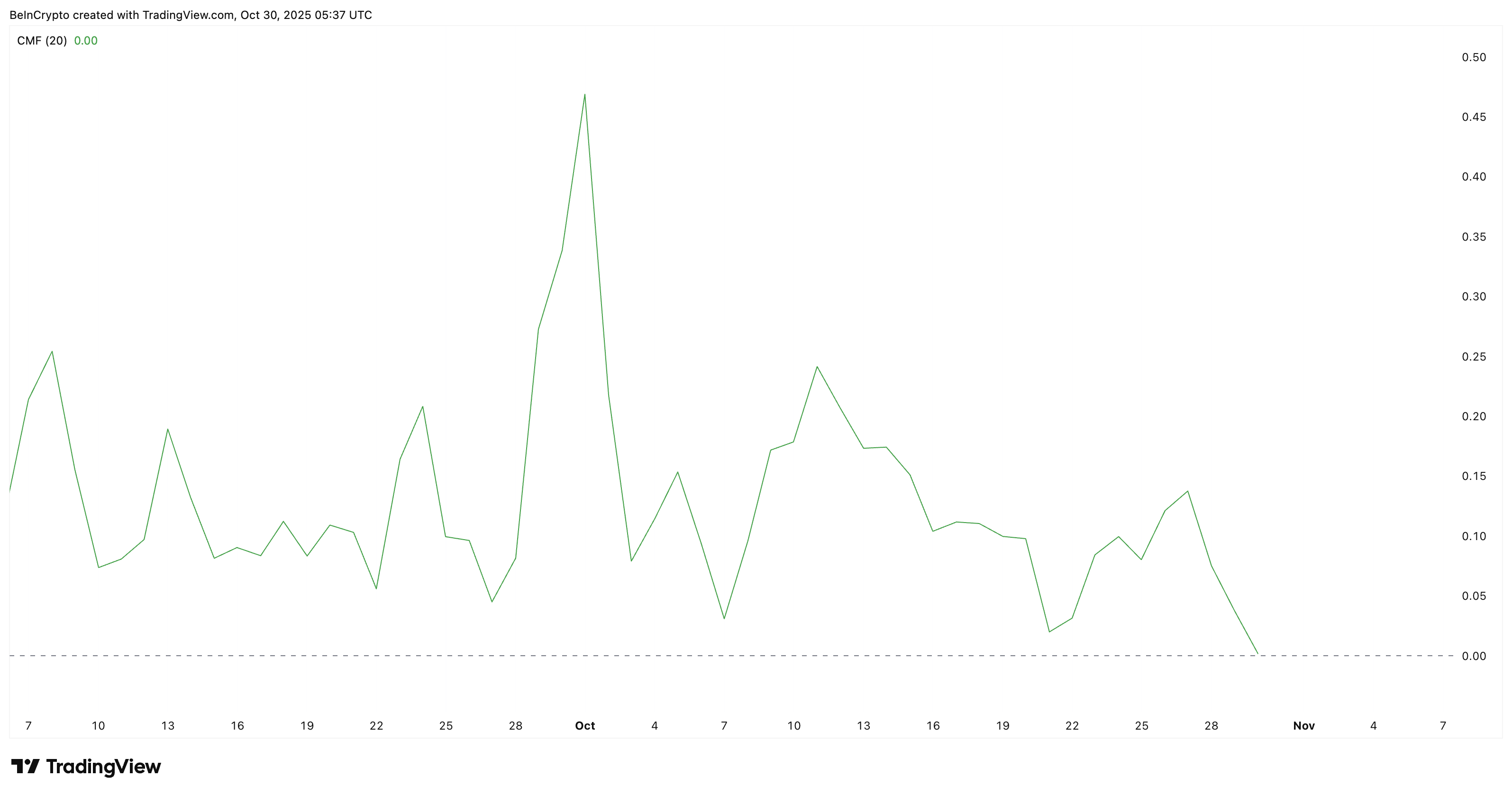

On the identical time, the Chaikin Cash Movement (CMF) — which tracks how a lot huge cash is flowing in or out — has been trending down since the previous few classes. It’s now hovering close to zero, that means giant traders could also be reserving earnings as an alternative of including publicity.

For Zcash to regain momentum, CMF should flip increased, and RSI ought to rise previous 75. RSI transferring above 75 alongside rising costs will put momentum and value in sync, at the very least within the quick time period. And that might invalidate the pullback bias.

Lengthy Liquidations Add to the Pullback Danger

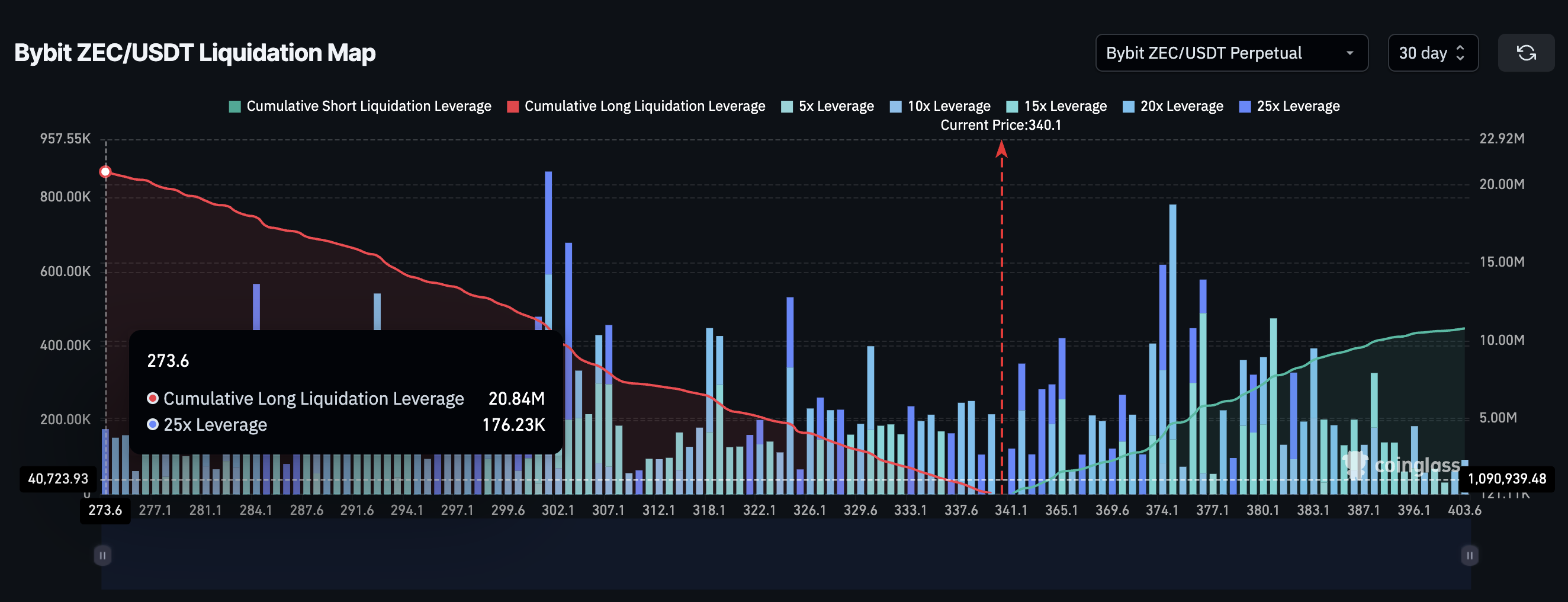

ZEC’s liquidation map from Bybit alone reveals how closely the market is tilted towards lengthy positions. Over $20.8 million in lengthy leverage is presently stacked towards solely $10.7 million in shorts. This implies most merchants are nonetheless betting on upside.

Sponsored

Such positioning raises the lengthy squeeze danger — a pointy transfer down that forces overleveraged longs to shut positions, pushing costs even decrease. Even a small drop might set off this, particularly with Zcash’s volatility historical past.

The largest liquidation clusters sit between $308 and $295, making them high-risk zones if promoting strain builds. Provided that the ZEC value responds to derivatives, the worth pullback danger stays until leverage cools.

Sponsored

Bullish Zcash Value Construction Holds, However Not With out Dangers

Regardless of these short-term warning indicators, Zcash’s technical construction stays bullish. On the 12-hour chart, ZEC trades inside an ascending channel, a sample that normally results in upward breakouts.

The higher trendline, although, is weak — with solely two touchpoints, that means a transfer above it might be explosive if bulls retake management. The important thing degree to look at is $365, which has rejected each advance since October 27.

If ZEC breaks above it, $382 and $400 grow to be fast targets, with $400 appearing as a robust psychological barrier. An in depth above $400 might open the door to $456 and even $548, primarily based on Fibonacci extensions.

On the draw back, $308 stays essential assist. A sustained fall beneath it might ship ZEC towards $267 or $226, turning the present sample from bullish to corrective.

The break underneath $308 would additionally set off lengthy liquidations, as talked about earlier. That might even break the bullish channel construction and push the Zcash value in direction of $267 or decrease.