Picture supply: Getty Photos

The value of gold has been hovering recently. Properly, it was till two days in the past. On the time of writing on 22 October, it’s down 2% to $4,038 an oz. The day earlier than, it skilled its largest one-day fall (6%) for 12 years. It’s been a wierd week. On Monday (20 October), it reached an all-time excessive of $4,381.

However skilled buyers know to not panic about short-term value actions. Nevertheless — virtually inevitably — this value correction has resulted in commentators speculating whether or not the current rally is over and asking if the metallic has misplaced its shine.

Personally, I believe we have to preserve a way of perspective. Even after the occasions of the previous couple of days, the gold value continues to be 53% greater than it was initially of 2025!

A false alarm?

This bull run has been extensively interpreted as an indication that buyers are involved concerning the state of the world’s economic system and that equities — notably within the US — are dangerously overpriced. Traditionally, the metallic’s been considered as a ‘safe haven’ and a hedge in opposition to inflation.

Nevertheless, I’ve come throughout an instructional examine that challenges this assertion. Revealed within the International Finance Journal in September, ‘The diminishing lustre: Gold’s market volatility and the fading protected haven impact’ by Hussain Faraj, David McMillan and Mariam Al-Sabah, checked out costs over the previous 37 years.

The paper concludes: “Our findings undermine the conventional view of gold as a safe haven in the post-2005 period”. Nearly as in the event that they had been predicting this week’s occasions, the authors warned that in durations of market stress, “adding gold to a portfolio may raise volatility without providing expected protection”.

One thing to think about

With this in thoughts, now might be a great time to think about shopping for shares in RELX (LSE:REL), the FTSE 100 supplier of information-based analytics and choice instruments for professionals and companies. It employs synthetic intelligence (AI) options to assist enhance its providing to prospects. This implies it might be in the suitable sector on the proper time.

The group’s shares are at the moment altering palms for six% above their 52-week low. However its share value continues to be round 20% cheaper than it was in February.

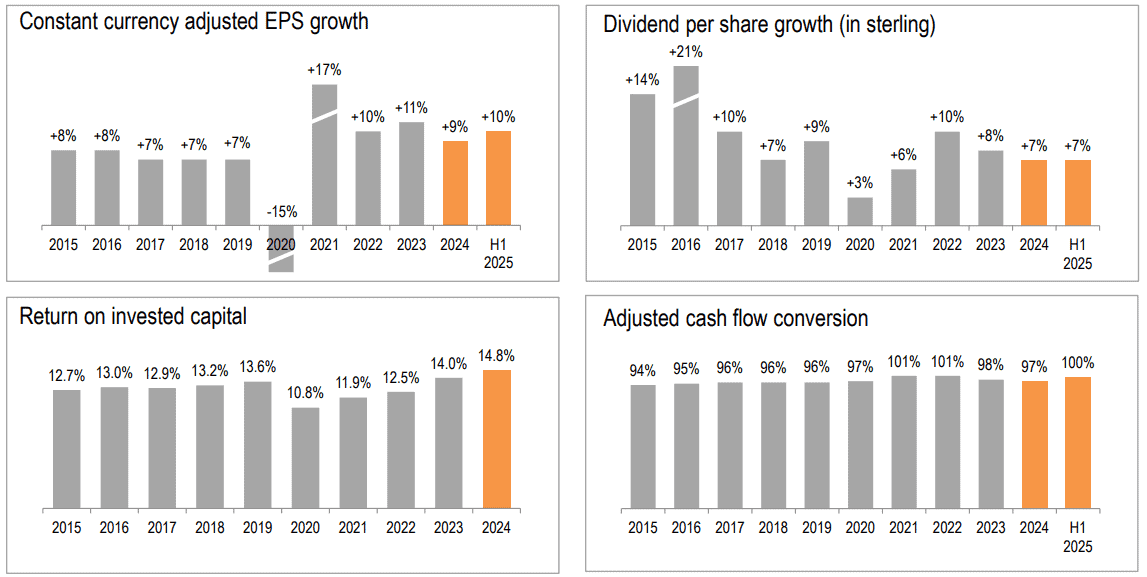

But this doesn’t replicate its spectacular observe file of enhancing its monetary efficiency.

Supply: firm presentation to buyers

Supply: firm presentation to buyers

Nevertheless, RELX faces some challenges.

With 84% of its income derived from on-line merchandise, it might be susceptible to a cyber assault. And satirically, the corporate reckons there’s a danger that its mental property might be circumvented by AI applied sciences.

However I believe it’s in fine condition. It retains a blue-chip buyer checklist and has a presence in over 180 nations. Additionally, as an IT-based provider, there’s little or no additional price incurred in offering its providers to a different buyer, which suggests it generates a wholesome margin.

As a enterprise, RELX might be as far faraway from a gold miner as you may get. I believe its inventory is value contemplating.