Crypto mining agency Bitdeer Applied sciences’ inventory surged almost 30% on Wednesday to an all-time excessive of $27, extending a two-day rally fueled by stronger mining output and impressive AI knowledge‑middle plans.

The rally coincided with Bitcoin’s regular maintain close to $110,000, signaling resilience after current positive aspects and boosting confidence throughout the mining sector. The mixed market capitalization of listed miners has now exceeded $90 billion — greater than double the extent recorded in August.

Sponsored

Mining Output Hits New Data

Bitdeer mined 452 BTC in September, up 20.5% from August, pushing its self‑mining hashrate to 35 exahashes per second. Administration expects 40 EH/s by the top of October. These positive aspects comply with the rollout of latest SEALMINER A2 and A3 rigs, which obtain effectivity beneath 10 joules per terahash.

“Our expansion is fueled by growing demand for computing power,” stated Chief Enterprise Officer Matt Kong. “This has become a strong catalyst for accelerating both our mining and AI initiatives.”

Bitdeer’s complete energy pipeline has reached round 3 gigawatts, with new capability on-line in Norway, Bhutan, and Ohio. Its Clarington, Ohio website will ship 570 megawatts by late Q3 2026 — almost a 12 months forward of schedule.

$BTDR September 2025 Mining & Operations Replace:

🔹 452 $BTC self-mined, +20.5% MoM; 35 EH/s deployed for self-mining hashrate, on monitor to achieve 40 EH/s by Oct.

🔹 #SEALMINER A3 collection launched with Professional variations boasting 12.5 J/TH effectivity, and commenced mass manufacturing.

🔹… pic.twitter.com/9rGI23w2oN

— Bitdeer (@BitdeerOfficial) October 15, 2025

Sponsored

AI Information Facilities Poised to Rework Progress

The corporate plans to dedicate over 200 MW of capability to AI computing by 2026. Administration estimates that, in an optimistic state of affairs, annual AI‑associated income might exceed $2 billion. Extra conversions in Washington State and Tydal, a area in central Norway, are underway to assist GPU‑intensive workloads.

The initiative helps Bitdeer steadiness cyclical crypto revenues with regular AI service demand. Its AI facilities present versatile capability for purchasers in cloud computing, autonomous techniques, and huge‑scale mannequin coaching, permitting the corporate to monetize extra energy throughout Bitcoin downturns.

The broader development exhibits miners diversifying into AI internet hosting as GPU demand surges. Bitdeer’s vertical integration — from ASIC design to self‑mining and knowledge facilities — positions it as a “one‑stop” blockchain computing supplier. Its AI cloud service generates about $8 million in recurring income at 86% GPU utilization.

$BTDR beginning its personal crypto miner -> HPC/AI transistion introduced right now buying and selling on the highest quantity ever.

Some Notes:

*Ohio facility with 570 MW by Q3 2026

*Purchase GPU,s construct AI manufacturing facility, doubtlessly producing an annualized income run-rate (ARR) exceeding US$2 billion at… pic.twitter.com/2oU6N6I8ZO

— Ted Zhang (@TedHZhang) October 15, 2025

Sponsored

Analysts See Extra Upside Forward

Wall Avenue stays optimistic. Cantor Fitzgerald raised its value goal to $50 with an Obese score, whereas Roth Capital reaffirmed a Purchase at $40. BTIG, a US‑primarily based funding financial institution, set its goal at $25. Institutional holdings have additionally climbed sharply, with hedge funds boosting stakes by as a lot as 70% in current quarters.

Nonetheless, the sector faces challenges. Bitcoin’s community hashrate has surpassed one zettahash, pushing problem to report highs and decreasing hashprice to about $47 per petahash per second. Even so, buyers view Bitdeer’s mixture of AI growth and environment friendly mining as a uncommon twin‑engine development story within the digital infrastructure growth.

BTDR inventory efficiency over the previous day / Supply: Yahoo FinanceSponsored

Broader Market Rally Amongst Public Miners

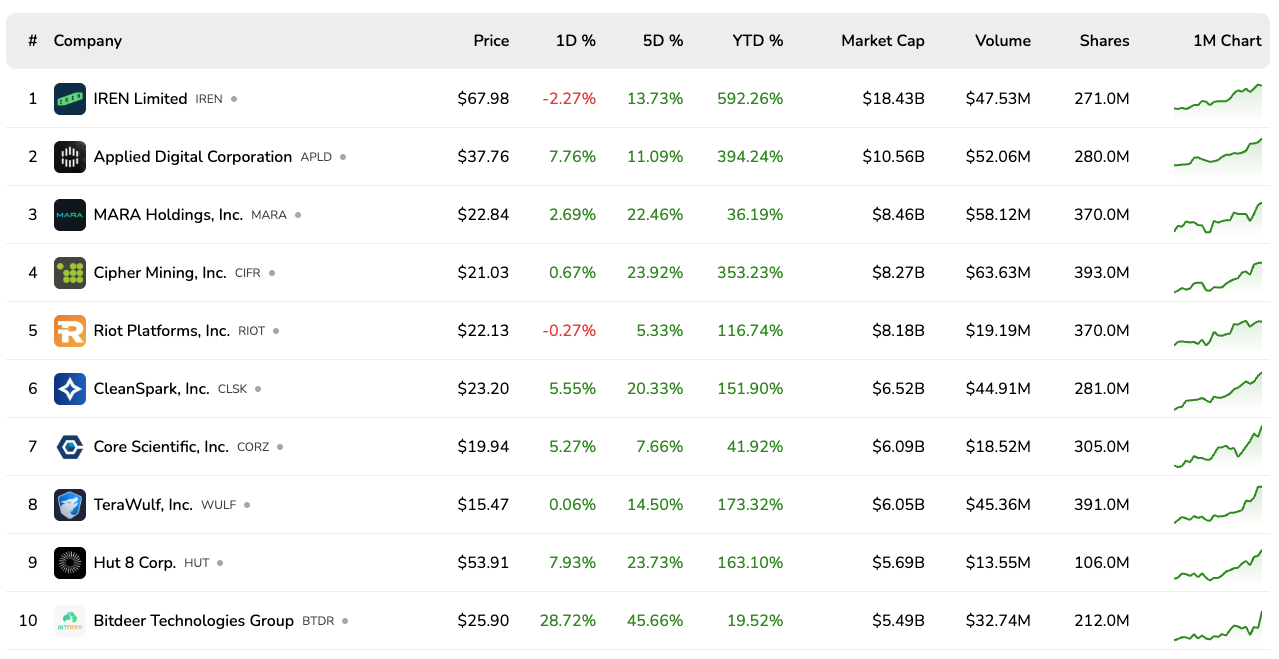

The rally has unfold throughout the mining sector. Marathon Digital closed the day at $22.84, sustaining upward momentum, whereas Riot Platforms completed close to $22.13, reflecting the same development. Each shares are buying and selling close to their current 52-week highs. In the meantime, CleanSpark superior 5.5% to settle at $23.20, as analysts pointed to improved price effectivity and new facility expansions.

Utilized Digital, which can also be pivoting towards AI knowledge‑middle companies, climbed 14% amid rising enthusiasm for GPU infrastructure performs. Hut 8 and Cipher Mining posted smaller positive aspects of 6–8%, whereas Canaan Applied sciences jumped greater than 10% after securing a big order for its Avalon A15 Professional miners.

These parallel positive aspects spotlight renewed confidence in vertically built-in miners that mix self‑mining, {hardware} design, and AI internet hosting capabilities. With Bitcoin costs secure close to report ranges and institutional funds rotating into digital infrastructure equities, the mining sector seems poised for a brand new part of development pushed by diversification and scale.

The mixed market capitalization of main public miners has surpassed $90 billion.