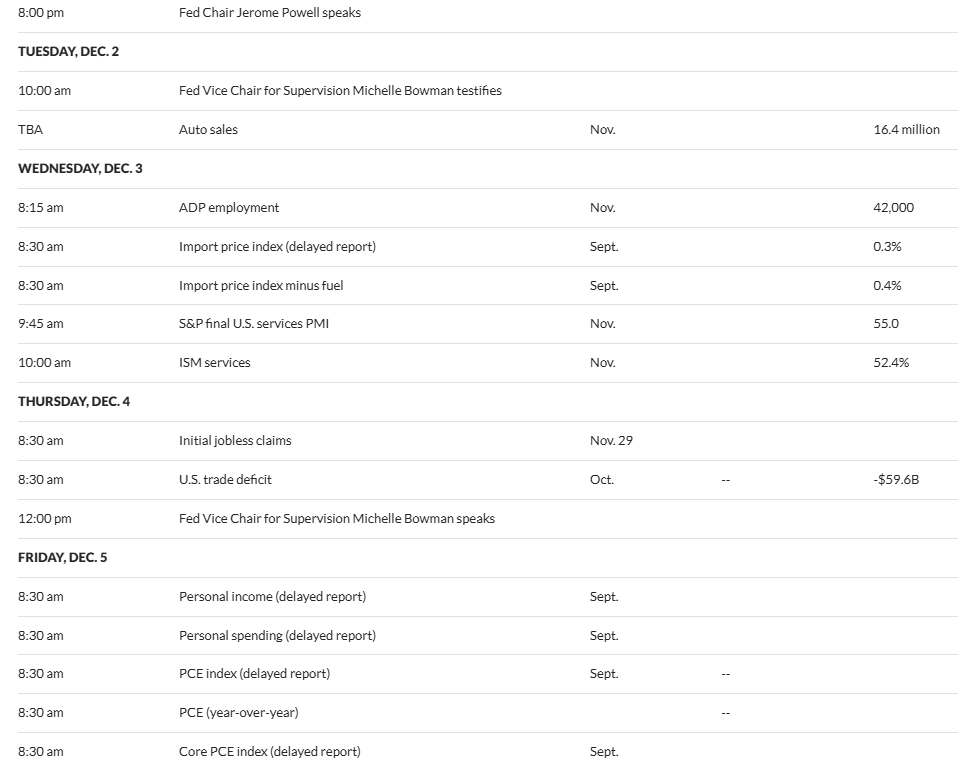

The primary week of December 2025 options important US financial occasions that may affect financial coverage expectations and Bitcoin’s path, as merchants put together for potential Federal Reserve (Fed) actions.

Bitcoin buyers face a pivotal week as Federal Reserve Chair Jerome Powell speaks on December 1, coinciding with the official finish of quantitative tightening (QT). With odds of a price minimize in December now at 86%, vital volatility is predicted throughout danger belongings.

Powell’s Speech and Finish of QT

Fed Chair Jerome Powell is about to deal with markets on Monday, December 1, at 8:00 pm ET. This date marks not simply his extremely anticipated speech but in addition the official finish of the Federal Reserve’s quantitative tightening program, an vital coverage shift introduced by the FOMC in October.

Sponsored

Sponsored

“The Committee decided to conclude the reduction of its aggregate securities holdings on December 1,” learn an excerpt within the Fed’s October 29 assertion.

This resolution displays the presence of ample reserves within the banking system. Powell’s remarks come amid hypothesis about potential modifications in Fed management, introducing one other layer of market uncertainty.

🚨 BREAKING:

JEROME POWELL WILL GIVE A SPEECH ON DECEMBER 1ST AND QT ENDS THE SAME DAY.

RATE CUT ODDS FOR DECEMBER HAVE NOW SURGED TO 86%.

I WILL KEEP YOU UPDATED ON THE OUTCOME, NOTIS ON.

HUGE VOLATILITY AHEAD. pic.twitter.com/MV7UhJWUWi

— NoLimit (@NoLimitGains) November 30, 2025

As a result of Powell’s speech takes place simply earlier than the Fed’s blackout interval forward of the December coverage assembly, it’s more likely to have outsized significance.

Any hints concerning future charges may set off rapid market reactions. Ending quantitative tightening alerts a shift towards a extra accommodative financial coverage, presumably rising greenback liquidity.

Including to the uncertainty, reviews point out President Trump has chosen Powell’s alternative, although there is no such thing as a official announcement but.

This hypothesis might increase volatility, as markets weigh the prospect of a brand new chair who may push for sooner price cuts.

Possibilities of Fed Chair Jerome Powell Substitute Prospects. Supply: KalshiSponsored

Sponsored

ADP Employment

Computerized Information Processing Inc. (ADP), the most important payroll processor within the US, is about to launch the ADP Employment Change report for November, which measures the change within the variety of individuals privately employed within the US, at 8:15 am ET on Wednesday.

The prior November report confirmed simply 42,000 jobs added, in response to MarketWatch’s financial calendar. New knowledge will present key insights into the well being of the labor market forward of the official authorities jobs numbers.

A powerful employment determine may scale back probabilities of a price minimize and put strain on Bitcoin and different danger belongings. In distinction, weak job development would reinforce the case for Federal Reserve easing, which usually advantages crypto markets.

The colloquial AI bubble is predicted to play a job within the US jobs report this week, whilst totally different trade consultants specific their sentiment.

For the report, U.S. shares peaked in October 2007 and the economic system entered recession in December 2007. As of now, the S&P 500 peaked in October.

ADP personal payroll job creation yr so far is on the similar stage it was at when the GFC recession began.

Is the AI tremendous bubble… pic.twitter.com/yqI4WcjEz2

— Mac10 (@SuburbanDrone) November 30, 2025

Labor statistics are essential for the Fed’s twin mandate and information coverage selections.

Sponsored

Sponsored

Preliminary Jobless Claims

Preliminary jobless claims arrive on Thursday, December 4, at 8:30 am ET. As a weekly measure of layoffs, this report offers a real-time view of labor market situations. It determines the variety of US residents who filed for unemployment insurance coverage for the primary time final week.

INITIAL JOBLESS CLAIMS REPORT 📉

This week’s preliminary claims held regular close to 220K, near latest multi-year lows — signaling continued labor market resilience.

Key highlights:

🔴Preliminary claims stay far under recession-trigger ranges, reinforcing the soft-landing narrative.… pic.twitter.com/ggNRWeDo4E

— Zeiierman Buying and selling (@zeiierman) November 26, 2025

Rising claims might point out financial weak point and help requires simpler financial coverage, whereas falling claims would recommend resilience and fewer urgency for price cuts.

Traditionally, Bitcoin has been extremely delicate to employment releases since they form Fed financial outlooks and liquidity.

Merchants typically place forward of those reviews, producing elevated volatility in each spot and derivatives markets.

Sponsored

Sponsored

PCE Inflation Information

Friday, December 5, brings the PCE (Private Consumption Expenditures) value index at 8:30 am ET, the Fed’s most well-liked inflation benchmark.

This report is pivotal, because it tracks progress towards the central financial institution’s 2% purpose. It is going to be launched alongside private earnings and spending knowledge, offering a complete view of client well being.

Buyers will give attention to each headline and core PCE numbers. A softer studying may verify the disinflation pattern, solidifying expectations for a December price minimize.

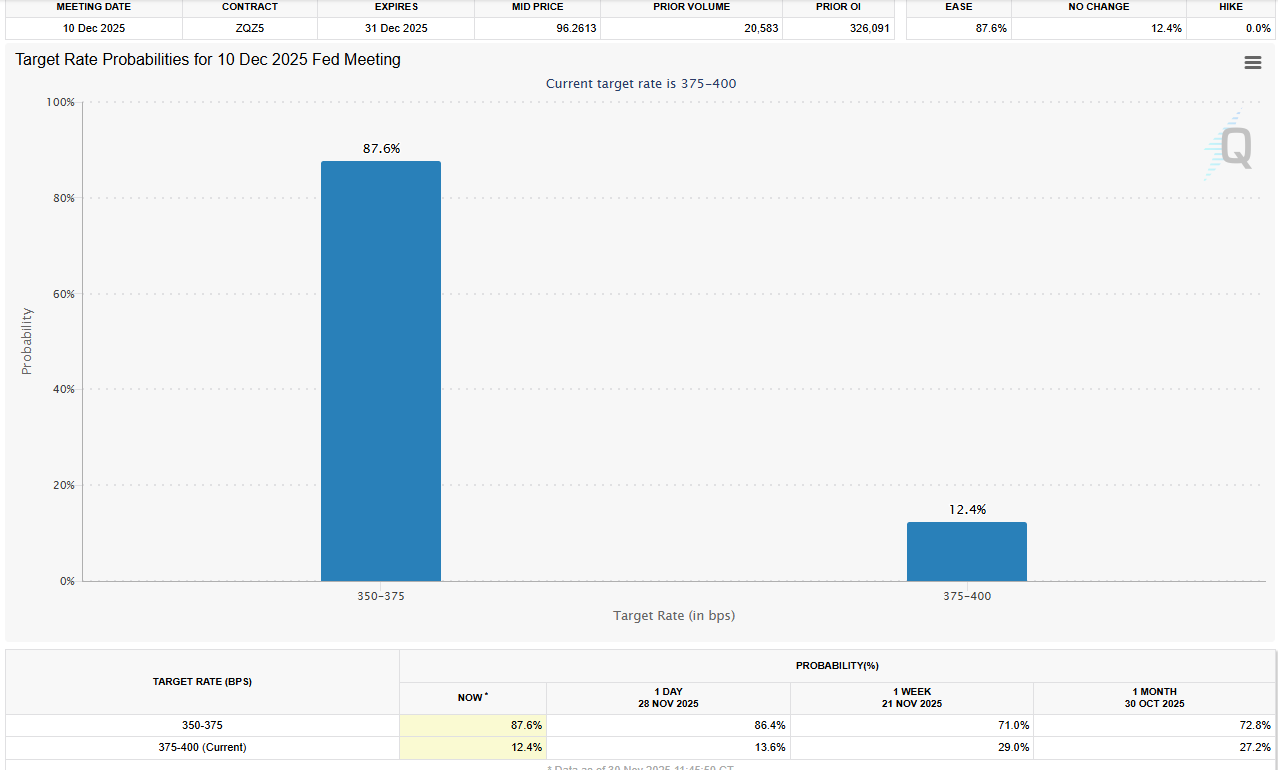

Information from the CME Fed Watch Instrument reveals that curiosity bettors wager an 87.6% probability of a price minimize within the December 10 assembly, in opposition to a 12.4% probability that policymakers will maintain regular.

Conversely, persistent inflation would immediate warning from the Fed, presumably disappointing markets searching for aggressive easing.

Client sentiment is reported at 10:00 am ET, with the prior worth at 51.0 on the financial calendar. This knowledge gauges family views on the economic system and spending. Weakening sentiment can sign slowing demand and additional help the case for simpler financial coverage, which regularly lifts Bitcoin.

As the primary week of December commences, the interaction between jobs knowledge, inflation traits, and the Federal Reserve’s stance will decide Bitcoin’s momentum and response to altering financial coverage alerts.