The crypto market is bracing for heightened volatility as greater than $4.6 billion in Bitcoin and Ethereum choices expire at present. This pivotal occasion may dictate short-term value motion for each main belongings.

Analysts warning that the September expiry carries added weight, traditionally related to weaker efficiency and decrease liquidity throughout digital belongings.

Bitcoin, Ethereum Choices Expiry Looms With $14.6 Billion at Stake

Sponsored

Bitcoin (BTC) dominates this spherical of expiring choices, with a notional worth of $3.38 billion. In keeping with Deribit, whole open curiosity stands at 30,447 contracts.

The max ache level, the place the best variety of choices expire nugatory, is $112,000. In the meantime, the put-call ratio is 1.41, suggesting an edge for bearish positions and a market leaning towards warning.

Bitcoin Expiring Choices. Supply: Deribit

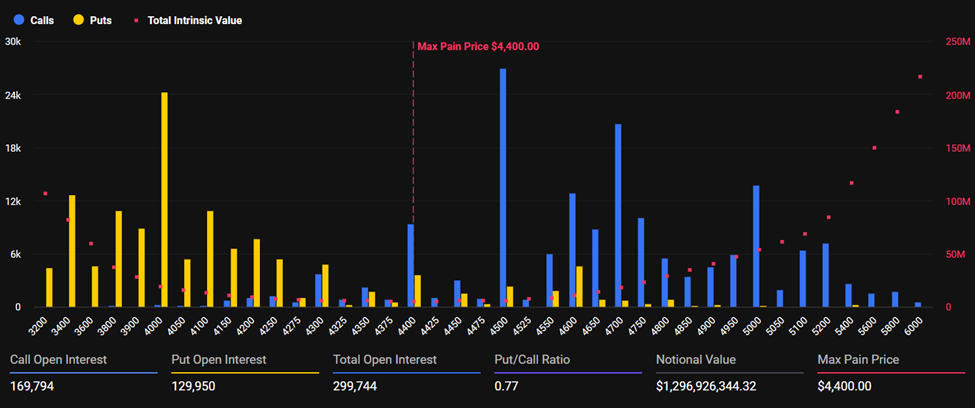

Ethereum faces a equally essential expiry with $1.29 billion in notional worth. Open curiosity is 299,744 contracts, with the max ache stage at $4,400.

The put-call ratio of 0.77 signifies stronger demand for calls (purchases), although analysts observe a big build-up above the $4,500 strike. Deribit highlighted this skew.

“…flows lean more balanced, but calls build up above $4.5K, leaving upside optionality,” Deribit famous.

Sponsored

Expiring Ethereum Choices. Supply: Deribit

Expiring Ethereum Choices. Supply: Deribit

Analysts at Greeks.dwell highlighted Ethereum’s implied volatility (IV), indicating that short-term IV has surged towards 70%. This means heightened expectations for value swings after the Ethereum value corrected over 10% from its latest peak.

“Weakness in US equities and the WLFI index has intensified market skepticism,” Greeks.dwell analysts wrote.

In the identical approach, IV throughout Bitcoin maturities has rebounded to round 40% after a month-long correction. Notably, this pullback noticed the Bitcoin value drop greater than 10% from its all-time excessive.

Nevertheless, analysts see a defensive stance amongst merchants. Proof of that is accelerating block buying and selling in places, which account for almost 30% of at present’s choices quantity.

Sponsored

Analysts Warn of September Weak point

Nonetheless, market sentiment is shifting rapidly. Greeks.dwell burdened that September has traditionally been a difficult month for crypto. Institutional rollovers and quarterly settlements usually subdue capital flows.

“The options market, in general, lacks confidence in September’s performance,” the analysts added.

The prevailing downtrend and declining crypto-related equities make danger aversion the first theme.

As choices close to expiry, Bitcoin and Ethereum costs have a tendency to tug towards their max ache ranges. For Bitcoin, buying and selling at $111,391 as of this writing means a modest uptick to $112,000. The identical goes for Ethereum, which traded for $4,326 at press time.

Sponsored

With at present’s third-quarter supply month, liquidity patterns and rollover exercise may amplify volatility in each instructions.

Due to this fact, defensive sentiment might dominate as merchants brace for extended weak spot or a possible breakout as soon as expiry clears. Nevertheless, the market tends to stabilize after 8:00 UTC when the choices expire on Deribit.

Sponsored

The crucial query stays whether or not expiry will pin Bitcoin and Ethereum close to their present ranges or act as a catalyst for a restoration.

Choice dynamics may exert magnetic strain within the close to time period, with max ache sitting simply above present costs for each BTC and ETH.

If historical past holds, September might proceed to problem bulls, however the market’s rising defensive posture suggests any shock upside might be met with equally aggressive repositioning.