The crypto market seems to be set to shut August on a constructive word, although it stays under the important thing $4 trillion mark. The full market cap at the moment sits at $3.87 trillion, nonetheless shy of that psychological threshold.

Merchants are eyeing the upcoming September with renewed curiosity, helped by expectations of potential fee cuts that would enhance threat urge for food. Inside this backdrop, Made in USA cash have come again into focus. Whereas main tokens like XRP, Solana, Cardano, and Chainlink proceed to dominate consideration, there are three lesser-watched Made in USA cash that would see motion in September.

Stellar (XLM)

Stellar (XLM) is about to shut August deep within the pink, down 8.7% over the month and 12.7% over the previous week. But regardless of this weak point, it is perhaps one of many Made in USA cash to observe in September.

The largest driver is its real-world asset (RWA) progress, which climbed 12.9% within the final 30 days to $511.42 million in worth. That makes Stellar one of many few large-cap initiatives ending August on a constructive elementary word.

Stellar’s RWA Progress: RWA.xyz

Increased transaction volumes may be essential to maintain this progress — a objective the Stellar Improvement Basis is clearly concentrating on.

In an unique bit to BeInCrypto, Matt Kaiser, Stellar analyst at Messari, stated:

“By the end of 2025, the Stellar Development Foundation aims for Stellar to have $3 billion in yield-bearing RWA’s onchain and be a top-ten chain in DeFi TVL. This could create a flywheel where more institutional capital increases user engagement, thereby leading to higher transaction volumes and ecosystem activity.”

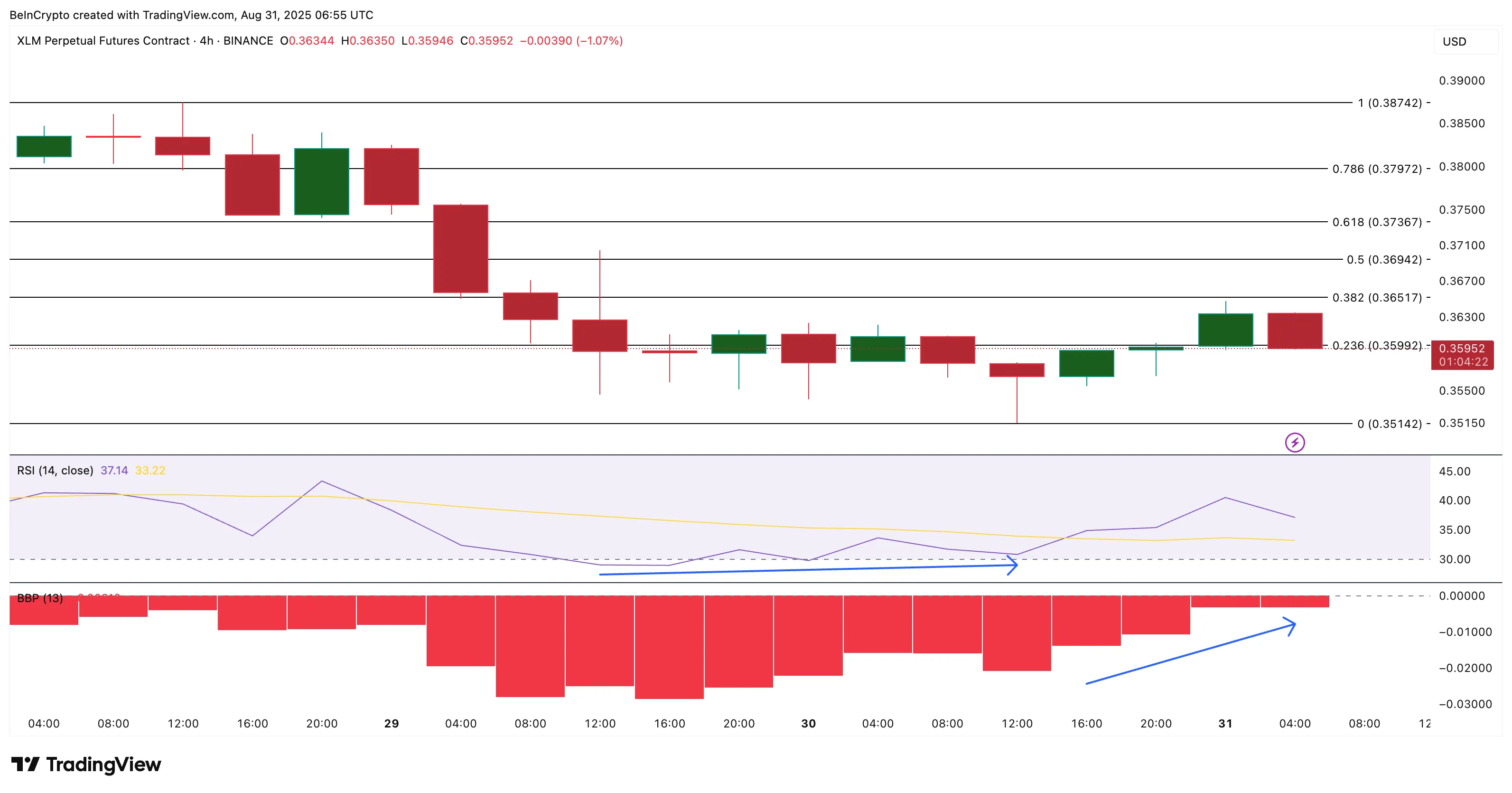

On the technical entrance, Stellar could also be flashing a short-term bullish sign. The 4-hour chart shows a hidden bullish divergence, the place the value made a decrease low, however the RSI (Relative Power Index, a momentum indicator) posted a better low.

Stellar Worth Evaluation: TradingView

Stellar Worth Evaluation: TradingView

On the similar time, the Bull-Bear Energy (BBP) indicator — which compares shopping for and promoting stress — has turned much less detrimental, validating the truth that sellers are shedding power. If this uncommon bullish setup continues, XLM may push towards resistance at $0.36 and $0.37, with invalidation under $0.35.

A transfer above $0.38 would make sure that the bullish setup reveals up even on the day by day chart.

Story (IP)

Story (IP), a layer-1 blockchain designed to anchor mental property on-chain, has been one of many standout performers this yr. The token is up greater than 30% previously 24 hours, extending its three-month features to 91%. On a yearly foundation, Story (IP) has surged over 300%.

The token’s progress comes amid continued hypothesis a few potential buyback program and after final month’s announcement of the Grayscale Story IP Belief, which additional fueled the token’s bullish narrative and pushed it to a brand new all-time excessive just some hours again.

Story Worth Evaluation: TradingView

Story Worth Evaluation: TradingView

From a technical perspective, Story (IP) has damaged out of an ascending broadening wedge, a sample sometimes related to bearish reversals.

By pushing previous the higher trendline, the IP worth has invalidated the bearish outlook and confirmed that bulls stay in management. That is additional bolstered by the Bull Bear Energy (BBP) indicator, which has flipped increased whilst costs consolidated, signaling underlying power heading into September.

At press time, Story trades at $7.86, with fast resistance at $8.23 and the all-time excessive close to $9.09. A breakout above these ranges would place the token once more in worth discovery mode, opening the door for contemporary highs in September. This validates Story’s presence within the Made in USA cash’ record.

On the draw back, the bullish setup can be invalidated if Story falls under $6.84, with deeper dangers rising under $5.45.

Pi Coin (PI)

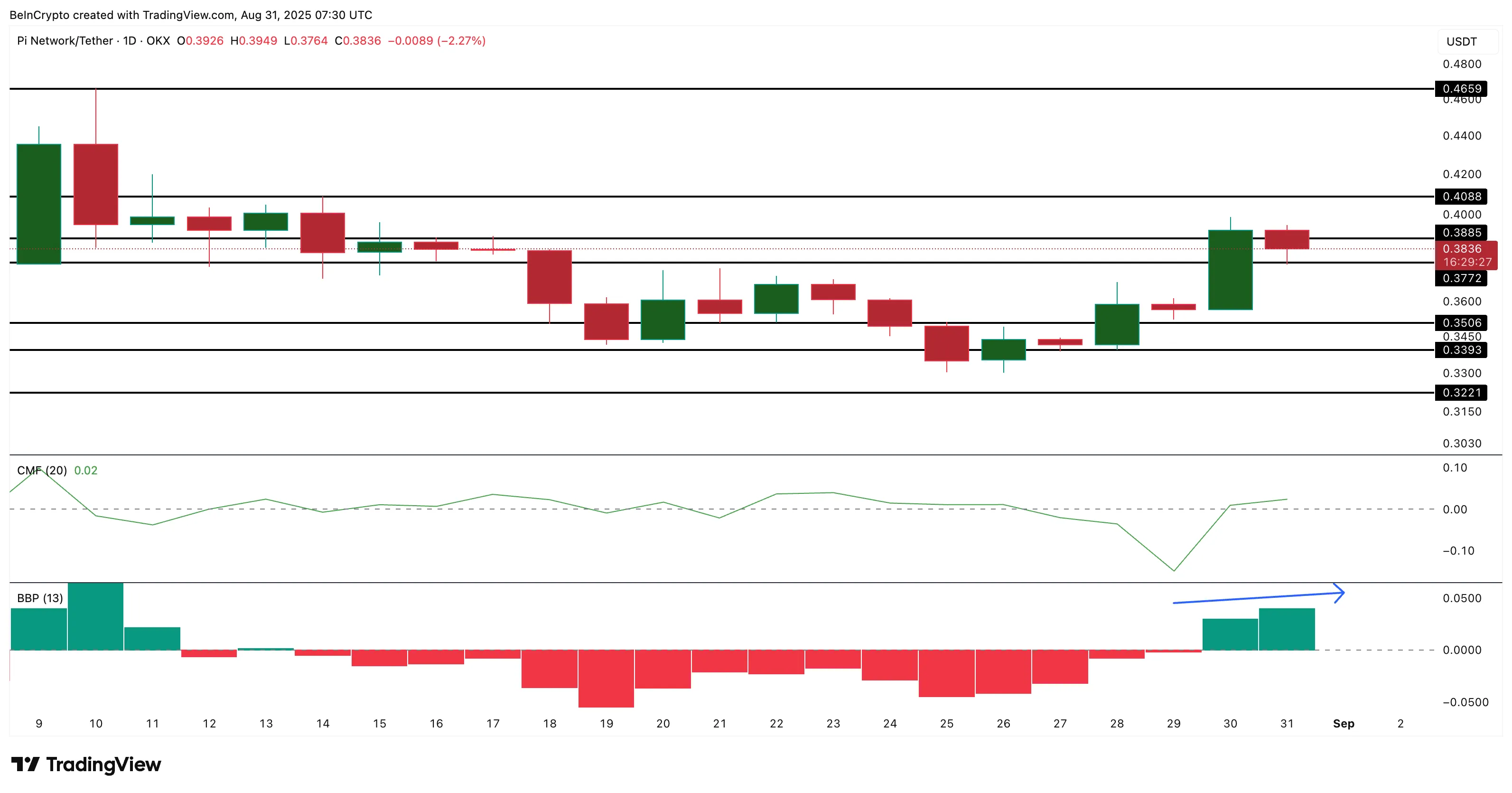

Pi Coin (PI) has been one of many underperformers in 2025. The token is down 4.7% over the previous month, up 8% previously week, however nonetheless down over 55% year-on-year. At $0.38, the broader construction stays bearish, but September may hold merchants occupied with short-term spikes.

Two developments have helped put PI again on the radar as a key Made in USA coin: the current protocol improve that added a Linux node and the launch of a Valour Pi Community ETP amongst eight new merchandise, each of which have generated some momentum.

Pi Coin Worth Evaluation: TradingView

Pi Coin Worth Evaluation: TradingView

On-chain and technical indicators assist the case for near-term strikes. The Chaikin Cash Circulation (CMF) has flipped above zero for the primary time shortly, signaling inflows.

A decisive transfer above 0.05 on the CMF would affirm stronger shopping for stress. The BBP indicator has additionally turned constructive, pointing to rising bullish momentum.

If momentum continues, PI may climb towards $0.46 — a 20%+ rally from present ranges. Nevertheless, if the token breaks underneath $0.33, the dangers of contemporary lows under $0.32 return.

For now, the setup suggests merchants might eye Pi Community for fast intraday or swing strikes in September moderately than a sustained restoration. It’s value noting that the general Pi Coin worth construction nonetheless leans bearish.