Widespread worry has overtaken the altcoin market, driving investor sentiment to its lowest level since April. With almost 90% of altcoins under their long-term traits, consultants counsel this might be a chief second for accumulation.

Though market uncertainty is excessive, information reveals parallels to durations when comparable circumstances led to altcoin rebounds. Contrarian traders are contemplating whether or not these fear-driven lows would possibly supply uncommon alternatives.

Sponsored

Market Capitulation or Alternative? Analyst Says It’s Time to Purchase Altcoins

Altcoin sentiment is close to its lowest degree, with simply 10% of Binance-listed altcoins buying and selling above their 200-day transferring common. This sample, seen as a basic indicator of market capitulation, occurs when most traders exit positions or lose confidence.

At the moment, 90% of the altcoin market trades under this key development, reflecting widespread disinterest amongst merchants and traders.

Altcoin Efficiency. Supply: X/Darkfost

Crypto analyst Darkfost famous that comparable setups have occurred 3 times through the present market cycle, every adopted by a big short-term restoration in altcoin costs. These zones of ‘selling exhaustion,’ he argues, have a tendency to supply a few of the most favorable entry factors for traders who’re prepared to attend.

“The best time to gain exposure to altcoins is often when no one wants them anymore. It’s precisely during these periods of disinterest that the market tends to offer the best medium-term opportunities,” the analyst wrote

Whereas the present setup might current alternatives, the skilled cautioned that selectivity stays vital. Buyers ought to deal with initiatives which have retained liquidity and on-chain exercise regardless of the broader downturn.

Sponsored

“But it’s best not to wait too long, as this type of setup tends to normalize quickly once the market realizes it’s gone too far in fear,” he added.

Bitcoin Dominance Drops to 59% After ‘Crypto Black Friday’

In the meantime, crypto market cycles typically see Bitcoin take in capital throughout uncertainty. Nonetheless, latest information has highlighted a swift reversal.

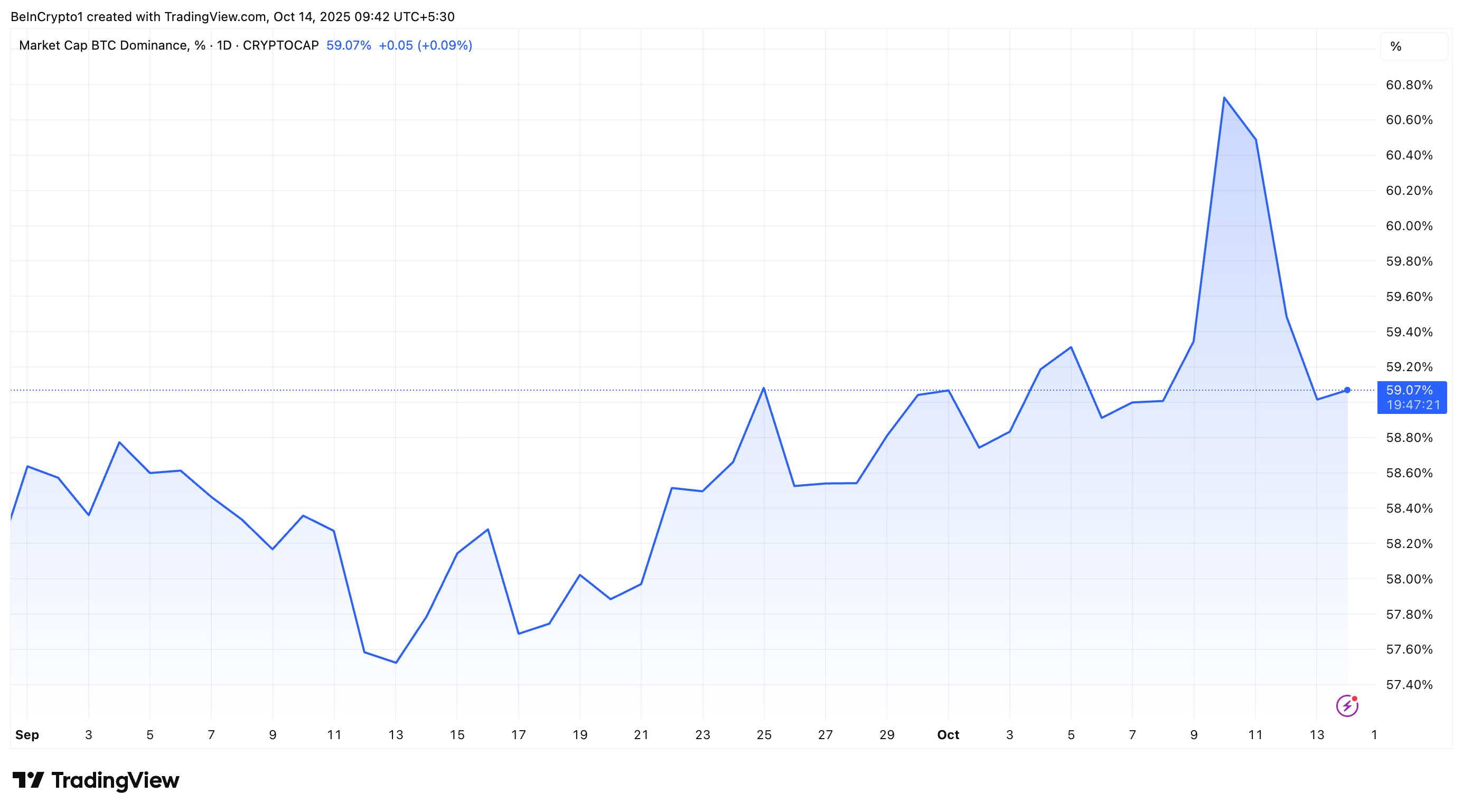

Bitcoin dominance—the share of the crypto market held by Bitcoin—has declined sharply after ‘Crypto Black Friday.’ At press time, it stood at 59.07%.

Sponsored

Market analyst Crypto Rover identified a head-and-shoulders (H&S) sample forming on Bitcoin Dominance’s every day chart. This can be a bearish reversal formation that always indicators the tip of an uptrend. If confirmed, this sample means that Bitcoin’s market share might proceed to say no within the close to time period.

Such a drop usually displays capital rotation into altcoins, as traders search larger returns in smaller-cap property. Traditionally, comparable setups have preceded the onset of ‘altcoin seasons’—durations when various cryptocurrencies outperform Bitcoin.

Sponsored

Sentiment Plunges to Excessive Lows—A Contrarian Sign?

Along with technical indicators and market movement, the crypto Worry & Greed Index—a number one sentiment gauge—has plunged to its lowest studying since April. Members are nonetheless cautious after latest sell-offs, and indecision is widespread.

Nonetheless, Darkfost sees moments of utmost worry as indicators {that a} market backside might be close to.

“Each time, the market bottom coincided with this extreme fear zone, a reminder that when consensus turns one-sided, markets tend to move in the opposite direction. Today, we’re entering that zone again… act accordingly,” he posted.

Thus, the present market circumstances level to a possible turning level for altcoins. Key indicators just like the Bitcoin dominance slipping, sentiment sinking into excessive worry, and historic patterns aligning help this outlook. Whereas dangers stay, the information signifies that the crypto market might be nearing the tip of its newest fear-driven cycle.