Picture supply: Getty Pictures

The variety of folks utilizing Particular person Financial savings Accounts (ISAs) to purchase shares is rising. However not everybody saving or investing in these tax-efficient merchandise is assured to make a pleasant pile of money over time.

Listed here are three steps that ISA customers can take to assist considerably develop their wealth.

1. Set clear targets

Earlier than filling up a Shares and Shares ISA, it’s essential to think about what you’re making an attempt to realize. This can affect each aspect of an investing technique.

Somebody trying to construct a retirement fund is prone to have time on their facet. As a consequence, they could need to take into account prioritising development shares, which, whereas unstable, can ship distinctive long-term returns.

Conversely, a person who’s in search of to fund their youngster’s schooling could have lower than a decade to construct their ISA. On this occasion, they might need to stability riskier, high-growth shares with extra defensive shares like utilities. They could additionally need to maintain some a refund in a Money ISA.

Please notice that tax therapy will depend on the person circumstances of every shopper and could also be topic to alter in future. The content material on this article is supplied for data functions solely. It isn’t supposed to be, neither does it represent, any type of tax recommendation. Readers are liable for finishing up their very own due diligence and for acquiring skilled recommendation earlier than making any funding selections.

2. Be affected person

All of us love the thought of getting wealthy in a single day. However taking a ‘Hail Mary’ strategy with high-risk property not often works. In actual fact, it will probably go away people nursing a big gap of their pockets.

In actuality, self-discipline, endurance, and a measured risk-reward technique are usually essentially the most highly effective weapons for focusing on life-changing returns.

Charlie Munger, who was right-hand man to Warren Buffett for 45 years, mentioned, “the massive cash shouldn’t be within the shopping for or the promoting, however within the ready“. With this strategy, buyers can let the facility of time and compound returns do the heavy lifting for them.

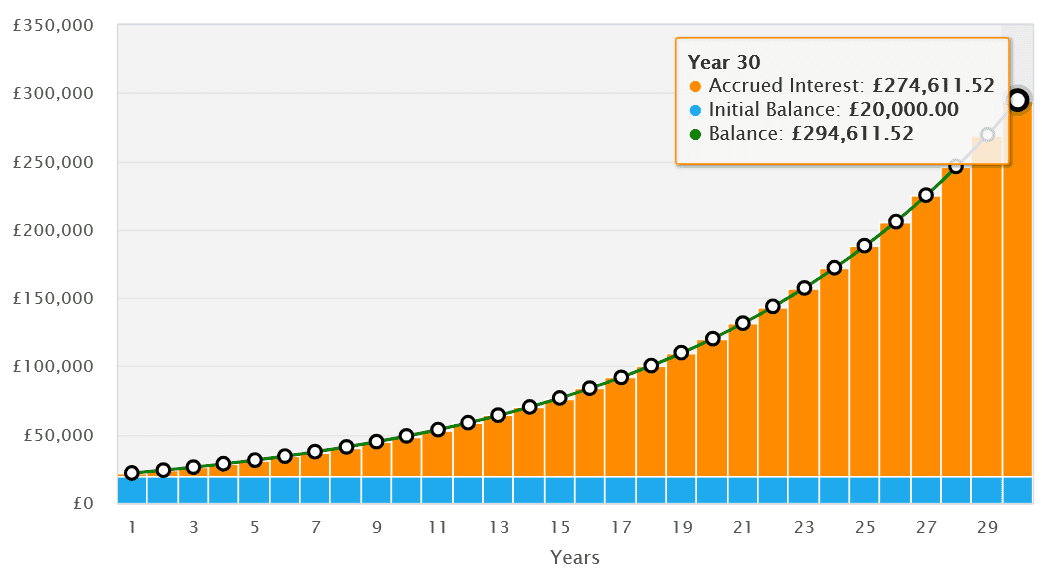

A £20,000 lump sum funding may not appear a lot. However left to compound at an annual charge of 9%, a modest nest egg like this might finally flip into virtually £300,000 after 30 years.

Supply: thecalculatorsite.com

Supply: thecalculatorsite.com

3. Construct a diversified ISA

ISA buyers have 1000’s of shares, funding trusts, and funds from throughout the globe they will purchase to focus on sturdy returns. It will possibly pay to take full benefit of this.

Having a diversified portfolio supplies publicity to a variety of development and revenue alternatives. It additionally helps people cut back danger. I personally like the thought of getting an ISA of at the very least 20-25 shares whose operations span industries and areas.

This may be completed by shopping for particular person shares, although trusts like Alliance Witan (LSE:ALW) can be used to successfully diversify.

This FTSE 100-listed funding belief depends on a staff of 11 fund managers to pick a most of 20 shares. This supplies a variety of views that attracts on many years of investing experience.

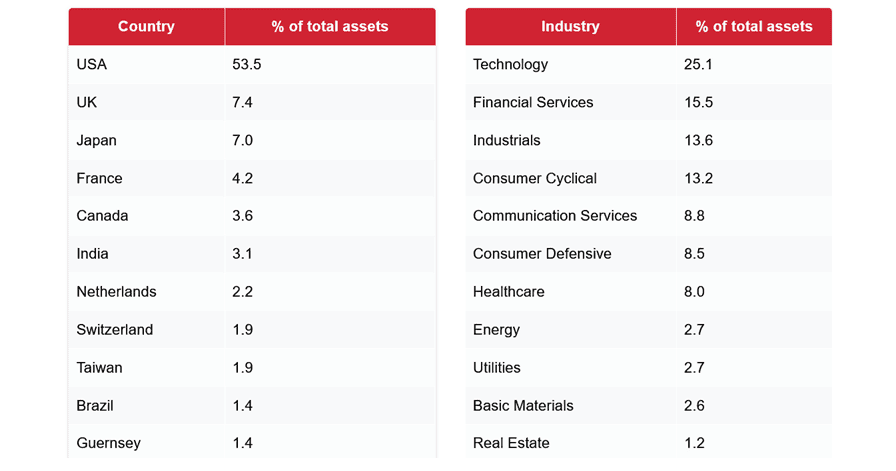

At present, Alliance Witan holds shares in 223 completely different corporations spanning a variety of sectors and protecting all 4 corners of the globe:

Supply: The Affiliation of Funding Firms (AIC)

Supply: The Affiliation of Funding Firms (AIC)

Its portfolio is filled with multinational corporations, providing additional energy. And lots of of those are tech giants like Microsoft and Nvidia, which — though leaving the belief susceptible to financial slowdowns — opens the door to important long-term returns because the digital economic system explodes.

Alliance Witan has delivered a median annual return of 11.6% since 2015. If this continues, which in fact shouldn’t be assured, it may go a protracted option to serving to an ISA investor generate substantial wealth.