Picture supply: Getty Pictures

In case you’re trying to make use of an ISA to generate a second earnings, understanding how your financial savings develop over time is essential.

Tiered contributions

To succeed in a £250,000 ISA, step one is understanding how a lot you must contribute every year. Contributions sometimes enhance progressively over time, reflecting practical financial savings behaviour. The desk under illustrates how you might attain your goal underneath completely different return assumptions over a 20-year interval.

Annual ReturnComplete ContributionsCommon Annual

Contributions6%£143,750£7,1887%£130,000£6,5008%£117,500£5,875

What that £250,000 may imply to your earnings

Hitting a £250,000 ISA whole is a vital milestone, nevertheless it’s solely the place to begin. What actually issues is how a lot reliable second earnings that pot can generate in retirement.

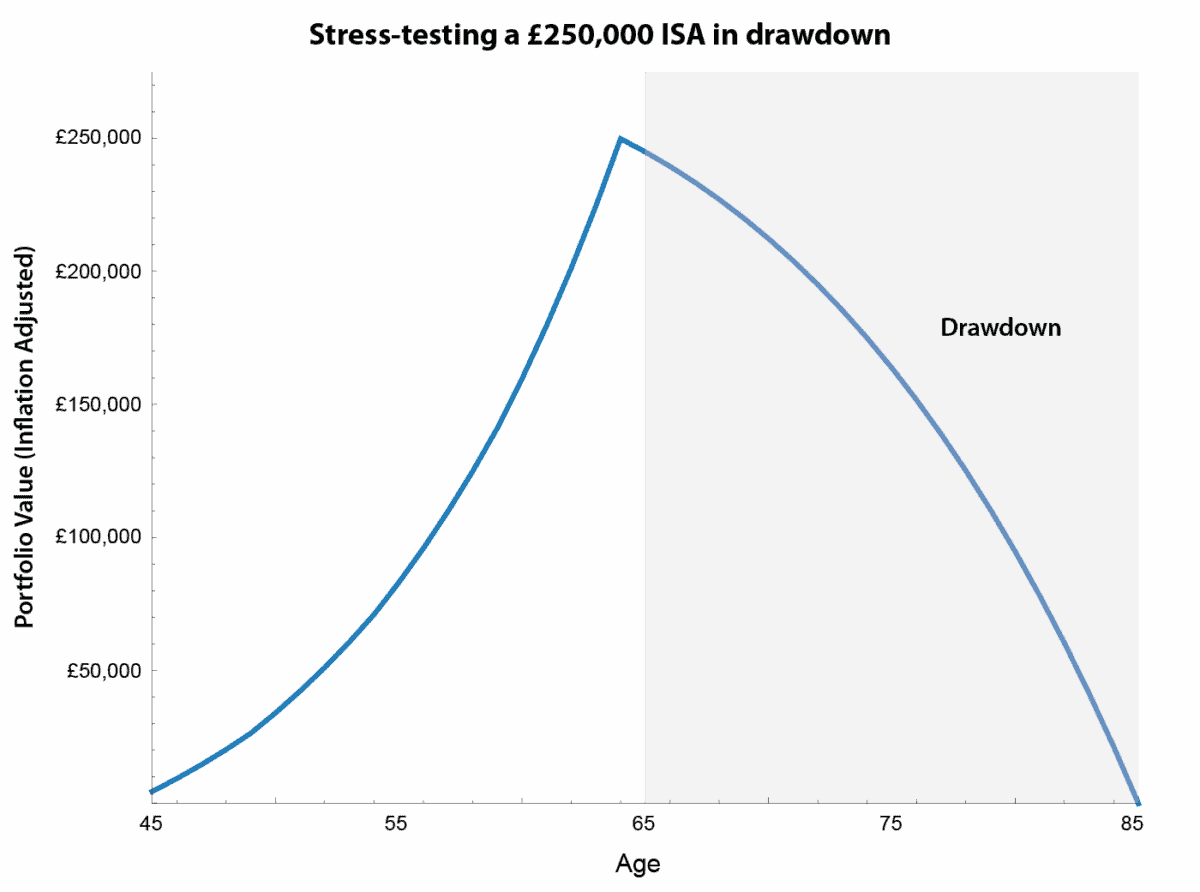

Assuming the ISA strikes into drawdown and is invested extra cautiously, I’ve modelled long-term returns at 4% a 12 months. The chart under exhibits what occurs when the portfolio is intentionally run right down to zero at age 85.

Chart generated by creator

Beneath these assumptions, the ISA can ship an annual earnings of simply over £10,000 – or round £833 a month. All figures are inflation-adjusted, in order that earnings retains its actual spending energy all through retirement.

Most traders, nonetheless, received’t need to spend their last pound. Constructing in a wise security margin of 10% to guard towards market shocks, longer life expectancy or to depart an inheritance nonetheless helps a £750 month-to-month earnings – with round £57,000 left within the ISA pot at age 85.

Development catalyst

To realize the upper return assumptions used within the contribution part, long-term traders want publicity to companies with restoration and re-rating potential. One FTSE 250 inventory I believe suits that invoice is asset administration big Aberdeen (LSE: ABDN).

Regardless of a powerful rebound over the previous 12 months, the shares stay round two-thirds under their 2015 highs. That displays well-documented challenges dealing with conventional energetic asset managers, significantly sustained outflows from the group’s Adviser division.

Nonetheless, the market could also be overlooking how a lot has already modified beneath the floor – and why the risk-reward steadiness now seems extra enticing for affected person traders.

Diversified enterprise

The group’s interactive investor — or ii — platform has turn out to be a real progress engine. Buyer numbers, buying and selling exercise and property underneath administration proceed to rise, pushed by demand for self-directed investing and SIPPs.

With its flat-fee pricing mannequin and rising model recognition, ii is steadily rising as a reputable challenger within the direct-to-consumer market. Crucially, this enterprise advantages from working leverage – incremental progress ought to more and more feed by to earnings.

The long-running drag from the Adviser division can be easing. Web outflows have fallen sharply 12 months on 12 months, helped by extra aggressive pricing and sustained funding in service high quality. Whereas this enterprise could not return to robust progress within the quick time period, stabilisation alone may materially enhance group money technology.

Even so, dangers stay. A renewed market sell-off may immediate unbiased monetary advisers to maneuver shoppers out of Aberdeen’s funds, and additional outflows may delay any re-rating. Shares are finest held as a part of a diversified ISA in the course of the progress part, quite than relied on for earnings alone.

Backside line

From an accumulation perspective, Aberdeen illustrates how a restoration story with built-in yield can work in follow. The shares presently yield round 7%, which may very well be reinvested to boost long-term progress – displaying how contemplating an ISA holding like this might contribute to a gentle second earnings over time.