Picture supply: Getty Photos

The FTSE 100 main index of shares has risen a powerful 12% since 1 January. However such wholesome beneficial properties haven’t been common, and a few top-quality UK shares have dropped sharply for a wide range of elements.

I feel these unloved FTSE 100 shares might now show nice dip buys for long-term traders to contemplate. Right here’s why.

Glencore

Glencore‘s (LSE:GLEN) share price has recovered ground in recent months, but remains down 6% since the start of 2025. Commodities prices (like copper) have picked up but risks remain as China’s manufacturing sector splutters.

Certainly, newest buying managers index (PMI) knowledge confirmed manufacturing facility exercise nonetheless shrinking in September. It marks probably the most protracted hunch since 2019.

Particularly worrying for Glencore are the troubles in China’s metal business. Robust steelmaking coal costs are important to the miner‘s backside line. Adjusted EBITDA slumped 14% within the first half as weak spot endured.

Nonetheless, Metropolis analysts are assured Glencore’s shares will rebound over the subsequent 12 months. Worsening provide shortages in key markets are serving to offset weak demand and driving industrial metals increased.

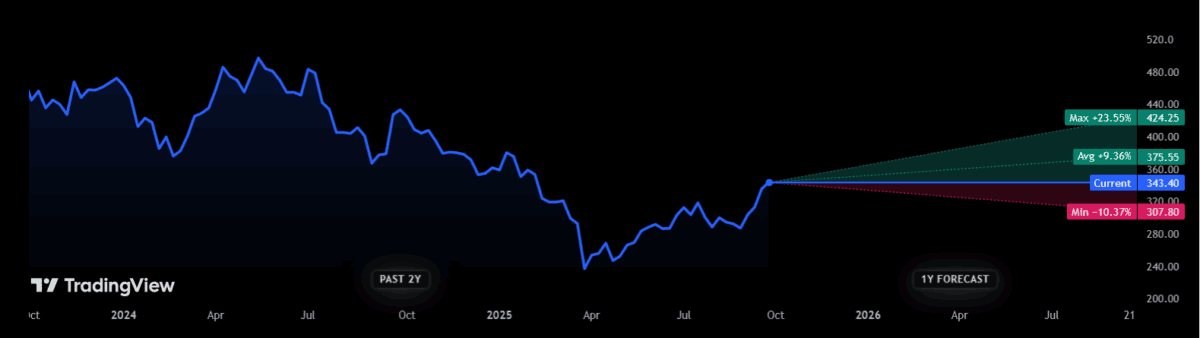

With these troubles turning into extra widespread, dealer consensus suggests Glencore will rise 9% in worth between now and subsequent October, to 375.6p per share. Analysts are additionally hopeful additional rate of interest cuts from international central banks will revive commodities consumption.

Supply: TradingView

Supply: TradingView

Over the long run, Glencore has important alternatives to develop income due to the rising inexperienced and digital economies. Metals like copper, nickel, aluminium and cobalt play important roles in industries like electrical autos (EVs), renewable vitality, client electronics and knowledge centres.

The FTSE 100 firm additionally has a sprawling advertising and marketing division to assist it capitalise on these tendencies. Pleasingly, this unit additionally reduces Glencore’s reliance on its mining operations to drive earnings.

Barratt Redrow

Barratt Redrow (LSE:BTRW) shares have retraced 11% for the reason that begin of 2025 amid rising worries over the housing sector.

Returning inflationary pressures, and the impression on Financial institution of England rate of interest coverage, has seen the business restoration moderating in current months. So has enduring weak spot within the home financial system and a downturn within the jobs market.

Hypothesis {that a} new property tax could substitute Stamp Responsibility can be hampering dwelling gross sales. Newest HMRC knowledge confirmed residential property transactions dipped 2% month on month in August.

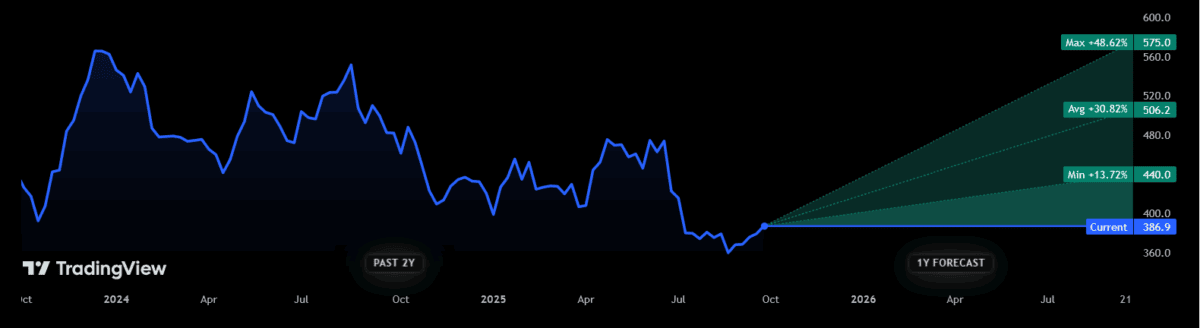

But Metropolis analysts are unanimous of their perception Barratt Redrow’s shares will stage a spectacular restoration. The common value goal amongst them is 506.2p, representing a 31% premium from right now’s ranges.

Supply: TradingView

Supply: TradingView

Regardless of the present gloom amongst traders, there are causes to be optimistic for Britain’s largest housebuilder. Non-public reservations charges are bettering properly — up 16.4% within the first half, at 0.64 per week. Additionally it is benefitting from accelerating value advantages following final yr’s mega-merger, serving to the enlarged enterprise higher climate present robust situations.

I feel Barratt shares might recuperate as optimism builds over its long-term earnings image. Demand for properties appears to be like set to develop strongly because the home inhabitants booms. Authorities plans to ease planning restrictions ought to make it simpler for housebuilders like this to capitalise on this beneficial backdrop.

For affected person traders, I feel choosing up high quality FTSE 100 shares Glencore and Barratt is value severe thought.