Picture supply: Getty Photographs

On the lookout for the most effective UK shares to consider shopping for and holding for the long-term in a Shares and Shares ISA? Listed here are two I feel might supercharge a well-balanced portfolio over the subsequent 10 years.

Copper big

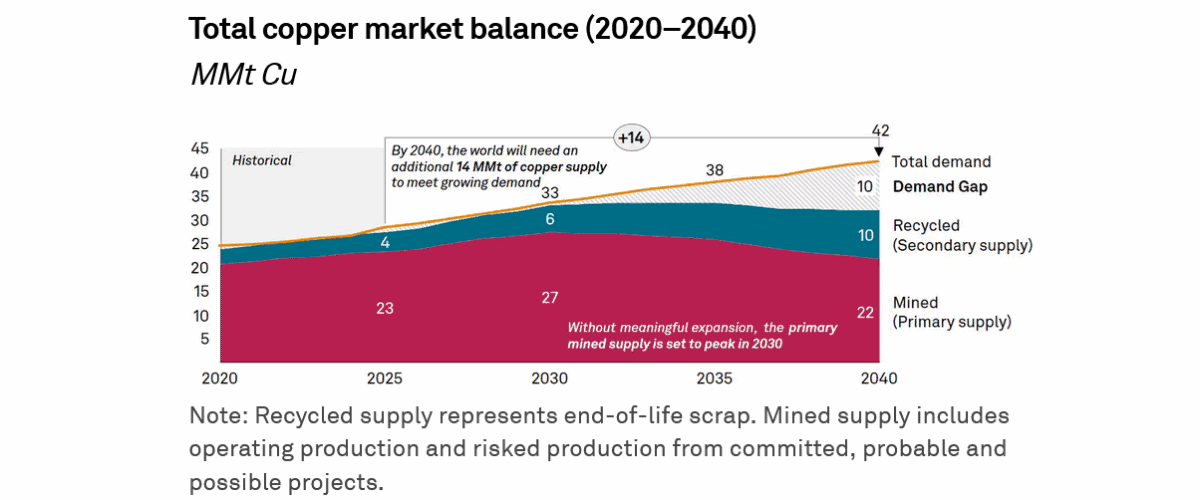

There appears to be little doubt about it. A large provide deficit in copper is looming that would supercharge costs of the crimson metallic over the subsequent decade — it not too long ago hit new peaks above $13,000 a tonne.

Supply: S&P International

Supply: S&P International

Investing in copper shares might be a good way for buyers to monetise this. As one of many world’s greatest copper miners, in addition to a significant dealer of the commercial metallic, I really feel Glencore (LSE:GLEN) might be an awesome inventory to contemplate.

Holding copper shares over an exchange-traded fund (ETFs) that tracks metallic costs is a riskier technique. Nonetheless, the FTSE 100 firm’s monumental scale can scale back the affect of operational points at anyone or two belongings considerably.

It has eight crimson metallic initiatives spanning North America, South America and Africa. That is along with its dozens of different belongings spanning different high-demand metals and minerals. Be conscious, although, that Glencore’s share worth might endure short-term volatility within the occasion of an financial downturn.

Nonetheless, at present costs I feel the miner deserves critical consideration. Its price-to-earnings progress (PEG) ratio for 2026 sits at a bargain-basement 0.1. Any studying beneath 1 suggests beautiful worth.

One other ISA contender

International energy era is tipped to blow up over the subsequent decade. A rising inhabitants, mixed with hovering power demand from sectors like knowledge centres and electrical automobiles, is about to push power demand via the roof.

Greencoat UK Wind (LSE:UKW) is one star inventory to contemplate for this upswing. Because the title signifies, it operates within the renewable power sector which is about for robust progress because the transition from fossil fuels accelerates.

Circumstances are particularly beneficial within the UK the place the FTSE 250 firm operates. Final week the federal government dished out offshore wind farm contracts for 8.4GW of latest capability, a record-breaking public sale placing it nearer to its objective of producing 95% of the nation’s power from inexperienced sources.

Given their important operations, renewable power shares can get pleasure from robust and dependable money flows they’ll then distribute in dividends. This isn’t all the time the case, although: throughout unfavourable climate situations, energy era can fall off a cliff.

Nonetheless, Greencoat UK’s broad portfolio helps shield (if admittedly not eradicate) this risk. The 49 belongings on its books span all 4 corners of Britain, which reduces the affect of calm situations in a single or two areas on general efficiency.

At this time, the corporate trades at a 30% low cost to its internet asset worth (NAV) per share. This displays the affect of upper rates of interest lately which have eaten into income.

With the Financial institution of England steadily reducing charges although, I count on Greencoat UK’s share worth to rebound sooner slightly than later.