Picture supply: Getty Pictures

I feel these FTSE 100 and FTSE 250 shares may very well be price a really shut look proper now. Right here’s why.

In restoration

Berkeley Group (LSE:BKG) shares have dropped by nearly a 3rd over the previous yr. This displays two substantial threats to the UK’s housing market restoration: rising inflation with its impression on Financial institution of England rate of interest coverage; and the potential of a protracted financial downturn.

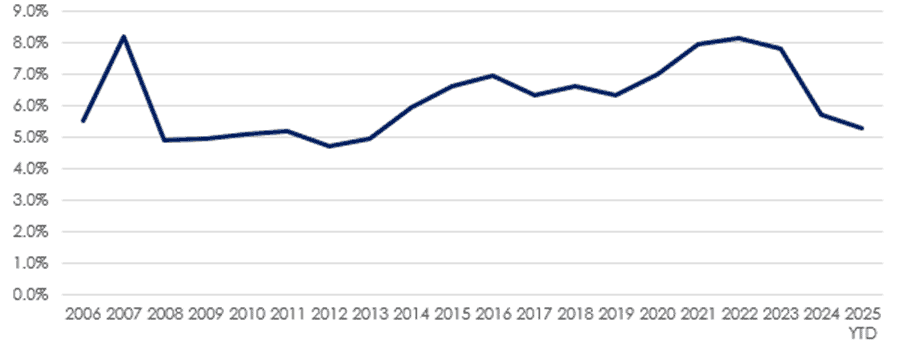

I feel London-focused Berkeley’s worth decline could signify a sexy dip-buying alternative, although. Migration out of London continues to sluggish quickly, and reached its lowest degree since 2013 within the first seven months of the yr:

Supply: Hamptons

Supply: Hamptons

Londoners bought simply 5.3% of properties outdoors the capital within the interval, in keeping with property agent Hamptons. Curiously, this was additionally under the 5.9% common between 2010 and 2020.

There’s little question weaker dwelling worth development in London is encouraging individuals to remain put. That’s a danger. However different components, like a larger enchantment for metropolis dwelling and the decline of working from dwelling are additionally boosting demand. Because of this, some analysts anticipate property worth development in London to outpace that of the broader UK over the subsequent few years.

I imagine Berkeley is properly positioned to seize this chance. The FTSE 100 firm has a powerful stability sheet, underpinning its plans to make £2.5bn of land acquisitions over the subsequent 10 years. I additionally like its determination to enter the red-hot rental sector by constructing and renting out 4,000 properties to tenants within the coming decade.

Newest financials final week confirmed that its regular rebound stays intact, with 85% of pre-tax income already secured for this monetary yr (ending April 2026). Whereas dangers stay, I feel it’s an ideal restoration share to contemplate.

Bursting increased

In contrast to with Berkeley, shares in valuable steel miner Endeavour Mining (LSE:EDV) have taken off over the previous yr, rising greater than three-quarters in worth.

Costs have been pushed by a powerful and sustained improve in gold costs. Bullion is up greater than 40% in worth over the past yr, reaching file peaks above $3,600 per ounce on a variety of macroeconomic and geopolitical components.

And I really feel the yellow steel can proceed rising given rising pressure over world inflation, Western nations’ debt ranges, and financial and political circumstances within the US. Sustained weak point within the US greenback can also be boosting investor demand for safe-haven gold.

Gold isn’t simply receiving help from retail traders both, with central financial institution gold demand additionally rising sharply. These establishments now maintain extra bullion of their reserves than US Treasuries for the primary time since 1996, a pattern pushed by mounting considerations over US debt ranges.

I feel Endeavour’s a sexy option to capitalise on gold’s bull run. The unpredictable nature of metals mining means it’s a higher-risk method of investing within the commodity. Nonetheless, buying gold shares also can result in income — and thus share worth positive aspects — that develop quicker than the steel worth.

Due to buoyant bullion costs and elevated manufacturing, Endeavour’s EBITDA greater than trebled between January and June, to $1.1bn.

With the enterprise additionally providing a wholesome 2.8% dividend yield, I feel it may very well be an ideal gold inventory to contemplate. Keep in mind that proudly owning bodily bullion or a price-tracking gold fund doesn’t present an revenue.