Picture supply: Getty Photographs

On the subject of shopping for shares, I purpose to attempt to strike a stability. My portfolio comprises some comparatively small, speculative names, however I additionally prefer to personal shares in huge established firms.

These usually are likely to have sturdy aggressive positions with economies of scale or entrenched buyer relationships. However this doesn’t at all times include a correspondingly excessive share worth.

Dimension issues

There are plenty of benefits to proudly owning shares in companies which were round a very long time. Some of the apparent is that they usually profit from sturdy reputations.

Take Authorized & Common for example. The primary factor anybody shopping for life insurance coverage desires to know is that the corporate’s going to have the ability to pay out in the event that they ever have to make a declare.

One other huge distinction is dividends. Smaller companies usually look to make use of their money for progress, however many change to returning money to shareholders as they develop into bigger over time.

This isn’t for everybody – some individuals may choose higher progress potential and there’s nothing in any respect improper with that. However for revenue traders, huge firms may be engaging.

Goal Healthcare REIT

Goal Healthcare REIT‘s (LSE:THRL) a FTSE 250 stock that I’ve had my eye on for a short time. I feel it’s in a very fascinating sector with plenty of long-term potential.

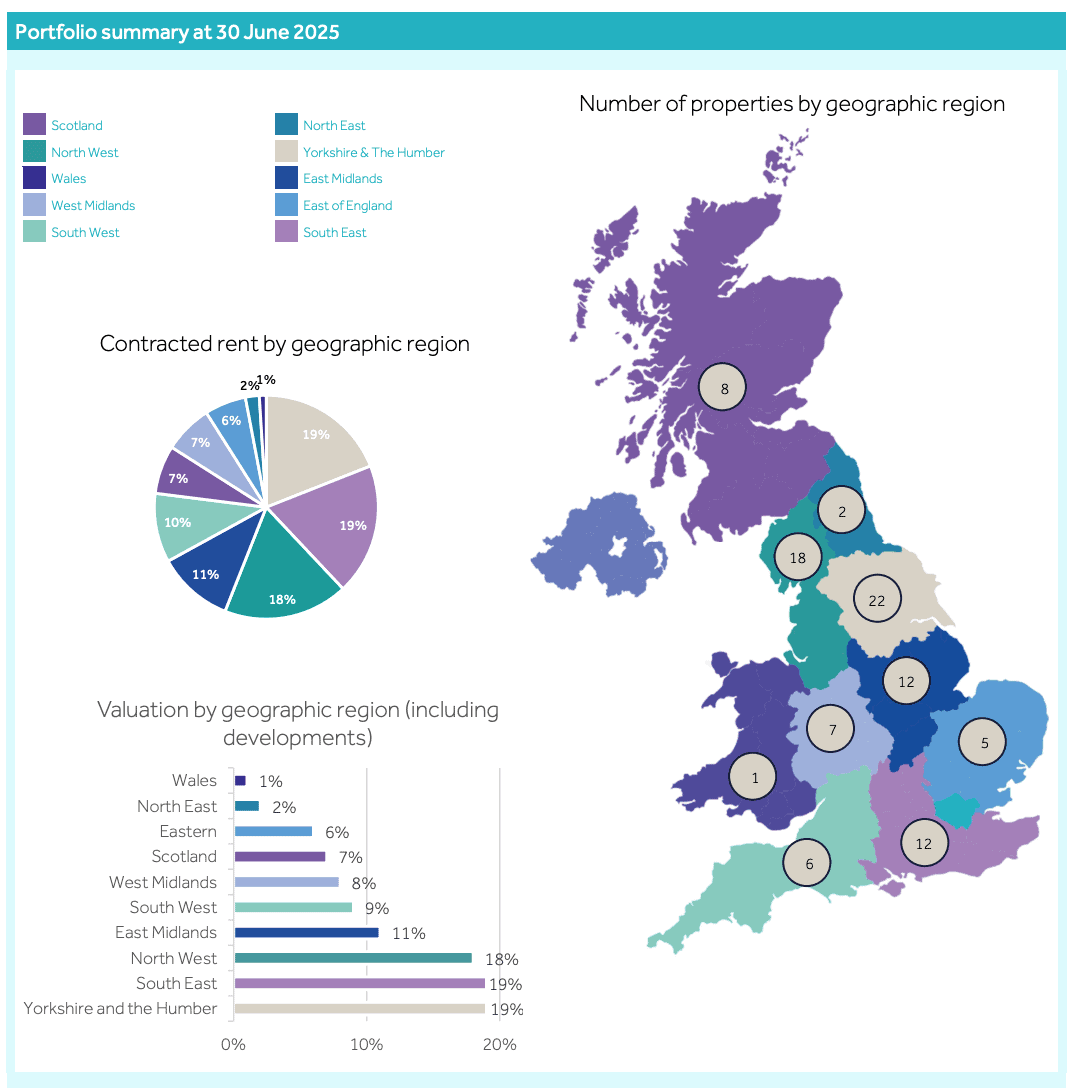

The corporate’s an actual property funding belief (REIT) with a portfolio of 93 care properties. And an ageing UK inhabitants ought to imply there’s loads of demand for its properties in future.

Supply: Goal Healthcare REIT Q2 Investor Presentation

It’s value noting that the care home based business isn’t essentially the most simple. Rules hold altering and this has the potential to create future prices, which might weigh on returns.

A share worth of 97p although, implies a dividend yield of 6%. And with inflation-linked rents defending this from increased prices, this can be a inventory that may very well be an ideal addition to my portfolio subsequent month.

Please notice that tax therapy relies on the person circumstances of every shopper and could also be topic to vary in future. The content material on this article is supplied for data functions solely. It isn’t meant to be, neither does it represent, any type of tax recommendation.

Vodafone

After climbing virtually 25% to date this yr, Vodafone (LSE:VOD) shares at the moment are priced at round 89p. And the enterprise is perhaps in a a lot stronger place than it was in January.

The corporate’s merger with Three UK in Could may very well be the beginning of one thing thrilling. The deal each boosts the agency’s scale and reduces the variety of opponents out there.

All of that is very optimistic. But it surely’s nonetheless fairly early to inform whether or not the transfer goes to be successful and there’s quite a bit to be executed by way of integration and capital investments.

That’s not likely what I search for in a giant firm – I choose established corporations with clear strengths, slightly than transformation potential. So I’m going to go on this one for now.

Blue-chip bargains?

I’m at all times enthusiastic about proudly owning shares in companies which have developed sturdy reputations over time and I just like the look of Goal Healthcare REIT very a lot. Since Care REIT was acquired again in Could it’s the one care dwelling inventory accessible on the UK market.

The inventory may simply provide me some useful publicity to a market that’s prone to develop. And for lower than £1, I can’t consider too many issues I need to purchase extra.

![Simply launched: the three greatest growth-focused shares to contemplate shopping for in November [PREMIUM PICKS] Simply launched: the three greatest growth-focused shares to contemplate shopping for in November [PREMIUM PICKS]](https://i0.wp.com/www.fool.co.uk/wp-content/uploads/2022/10/Three.jpg?w=330&resize=330,220&ssl=1)