Picture supply: Getty Pictures

When coupled with the State Pension, £15,000 passive earnings – or about £1,250 a month – could make an actual distinction in retirement. However being ready to withdraw that quantity yearly for the remainder of one’s life is a distinct problem.

Crunching the numbers

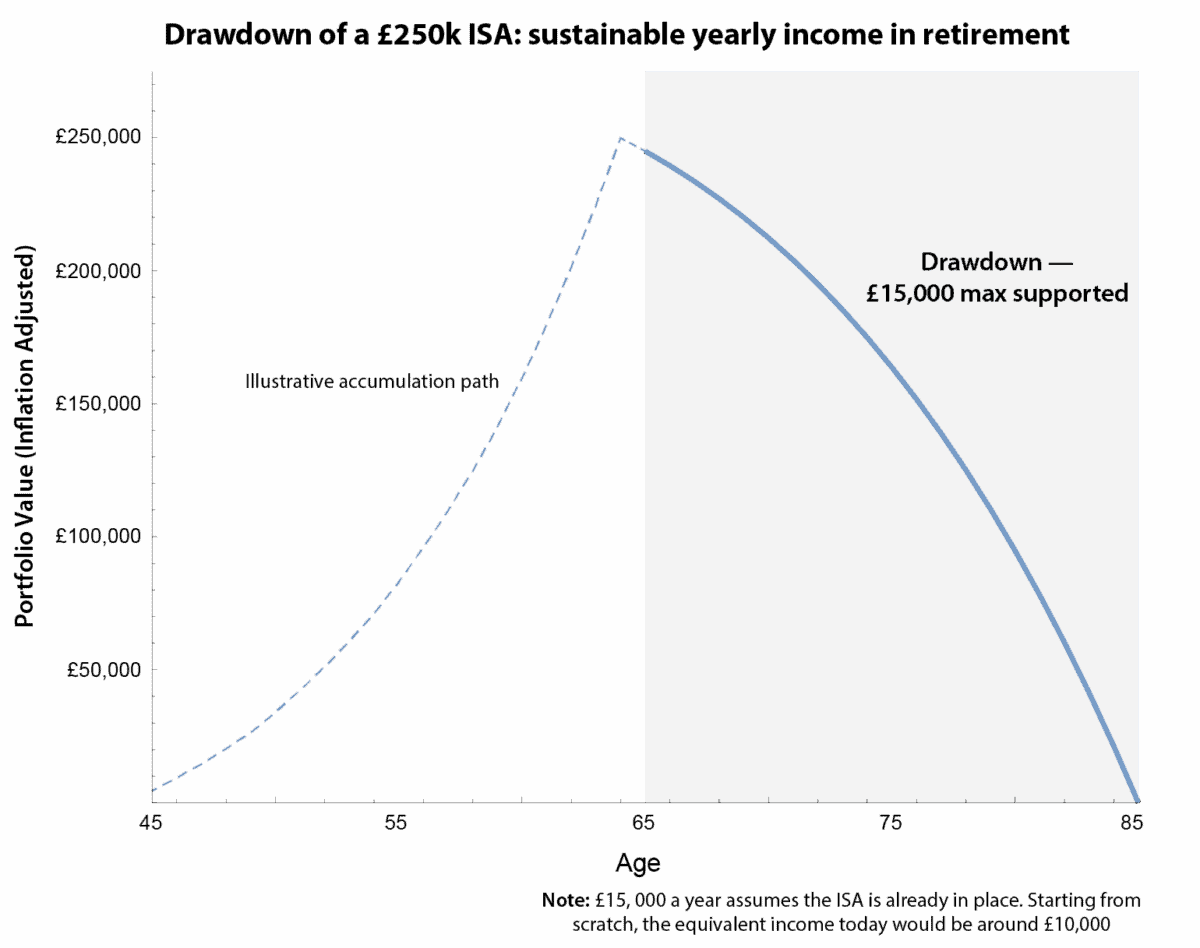

My calculations present {that a} £250,000 ISA immediately is the minimal portfolio wanted to maintain this stage of earnings. This assumes the portfolio grows at 4% in retirement and inflation sits at 2%. That’s cash you may rely on to cowl spending, journey, or just take pleasure in retirement with confidence.

For these ranging from scratch, the earnings you may safely withdraw immediately is nearer to £10,000 a 12 months in immediately’s phrases. The reason being easy: it’s all about when the capital is in place. Extra money upfront means extra earnings instantly; constructing it step by step over 20 years means you additionally have to account for inflation alongside the best way.

The chart illustrates this clearly. It exhibits the one sustainable withdrawal line for a £250,000 ISA stability. Crucially, this line doesn’t change whether or not the pot is already in place otherwise you’re nonetheless constructing it. What modifications is how that earnings interprets into immediately’s spending energy.

Chart generated by writer

Sustainable withdrawals

The chart additionally tells an vital story: there’s no room for overconfidence. Withdraw an excessive amount of, or assume the portfolio will develop sooner than is real looking, and the cash might run out earlier than anticipated.

That’s the key lesson: the road provides a baseline for planning. From there, you may alter withdrawals to go well with completely different phases of retirement, deal with market ups and downs, or depart a small cushion for longevity or inheritance functions.

With cautious planning, the ISA gives versatile, reliable earnings, letting you take pleasure in retirement by yourself phrases with out complicated calculations or dangerous assumptions.

Excessive-income inventory

In case you’re excited about producing passive earnings out of your ISA, Authorized & Basic (LSE: LGEN) is price a glance. The sustainability of its 8.2% dividend yield stays continuously in focus, however I believe many buyers miss a a lot greater level.

What makes the insurer stand out is the predictability of its money circulation. The enterprise takes in long-dated pension and annuity liabilities, invests them conservatively, and steadily returns capital to shareholders by way of dividends. Which means the earnings is supported by underlying money technology quite than short-term market strikes.

For buyers constructing a £250,000 ISA, reinvested dividends maximises compounding benefits. For these already in drawdown, those self same dividends scale back the necessity to promote shares, smoothing withdrawals by way of unstable markets. In different phrases, the insurer’s dividends can complement the sustainable withdrawals you propose out of your ISA.

There are dangers. Ought to excessive ranges of inflation grow to be the norm, that would put important strain on the worth of its £86bn bond portfolio, thereby threatening future dividend funds.

Backside line

Authorized & Basic’s share value has struggled for momentum over the previous couple of years. However regardless of this it continues to reward buyers with marketing-leading returns. With an adjusted price-to-earnings (P/E) ratio of simply 13, I’m very snug holding it in in my Shares and Shares ISA. Certainly, I not too long ago topped up my holdings.