During the last 10 calendar years, the FTSE 100 index has returned just a little beneath 9% a 12 months when dividends are included. That’s not a nasty return.

Nonetheless, traders might have carried out much better with an funding belief that’s a constituent of the index. During the last decade, this explicit product has returned about 25% per 12 months.

Picture supply: Getty Photographs

A superb long-term funding

The one I’m referring to is the Polar Capital Expertise Belief (LSE: PCT). It is a tech stock-focused product run by London-based funding supervisor agency Polar Capital.

A decade in the past, it was buying and selling for round 55p. At present nonetheless, it has a share value of round 503p.

Meaning anybody who purchased 10 years in the past and held for the long run has made round 9 occasions their cash. That’s a completely sensible return – it might have turned a £5,000 funding into round £45,000.

Price a glance in 2026?

Is that this belief value contemplating at the moment? I believe so.

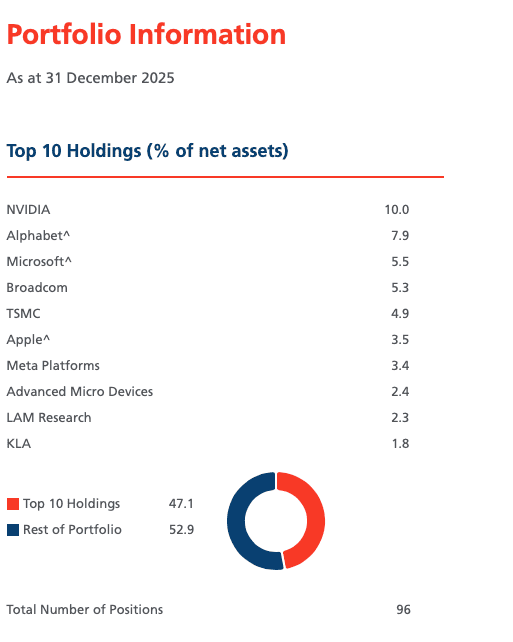

The desk beneath reveals the highest 10 holdings on the finish of 2025. What I like about that record is that there’s lots of publicity to chip (Nvidia, Broadcom, AMD, TSMC) and chip manufacturing gear shares (Lam Analysis, KLA).

I reckon these shares will do properly within the years forward. They need to profit as corporations like Amazon, Alphabet, and Meta spend closely on AI infrastructure and the world turns into extra digital.

Supply: Polar Capital

Supply: Polar Capital

Digging deeper into the holdings, there have been some actually fascinating names within the portfolio on the finish of October (the most recent full portfolio holdings knowledge obtainable). Some examples right here embrace taser maker Axon Enterprise, AI powerhouse Palantir, knowledge centre cooling specialist Vertiv, and fast-growing funding platform Robinhood Markets.

After all, there’s an opportunity that these names have been bought for the reason that finish of October. Nevertheless it reveals you the varieties of modern corporations within the portfolio.

One different factor to love about this belief is that it presently trades at a near-10% low cost to its internet asset worth (NAV). In different phrases, anybody shopping for now’s gaining access to a basket of high-quality tech shares at a big low cost.

Dangers and charges

After all, there are many dangers to contemplate with this product. One is the sector focus.

Whereas the portfolio is properly diversified at inventory degree, it’s not very diversified at sector degree (though there are just a few shares within the portfolio that aren’t pure tech shares). So, if the tech sector was to have a meltdown (and even simply go nowhere), this belief would most definitely underperform.

The numerous publicity to chips is one other danger to contemplate. This space of know-how has traditionally been unstable.

By way of charges, ongoing expenses are 0.77%. That’s comparatively excessive.

There are another merchandise on this house which have decrease charges. An instance right here is the iShares S&P 500 Info Expertise Sector UCITS ETF (its charges are simply 0.15%).

General although, I see fairly a little bit of attraction on this product. I consider it’s value contemplating for a diversified portfolio.